New Poll: Most Canadians support, with qualifications, carbon pricing.

April 6, 2016

Most Canadians believe the climate is changing and are open to using carbon pricing to reduce emissions. When it comes to the uses of carbon revenues, preferences are for recycling in ways that will most directly shift emissions outcomes.

Abacus Data conducted a nationwide survey on behalf of Canada’s Ecofiscal Commission to measure public opinion on climate change, carbon pricing, and revenue recycling options. Our survey was conducted online with 2,200 adult Canadians from September 25 to 29, 2015. A random sample of panelists was invited to complete the survey from a large representative panel of over 500,000 Canadians.

VIEWS ON CLIMATE CHANGE AND GOVERNMENT ACTION

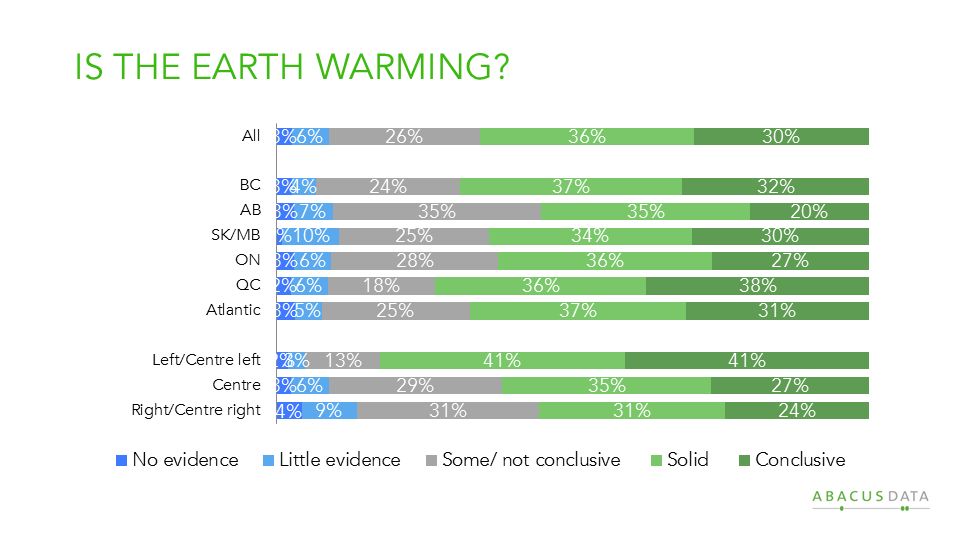

Most (66%) believe that there is solid or conclusive evidence that the average temperature on earth has been getting warmer over the past few decades. Few believe there is no or little evidence (9%). Another 26% believe there is some evidence of warming but it is not conclusive.

Views are fairly consistent across the country with Albertans less likely and Quebecers more likely to believe there is solid or conclusive evidence of rising temperatures. Those on the left are more sure than those on the right.

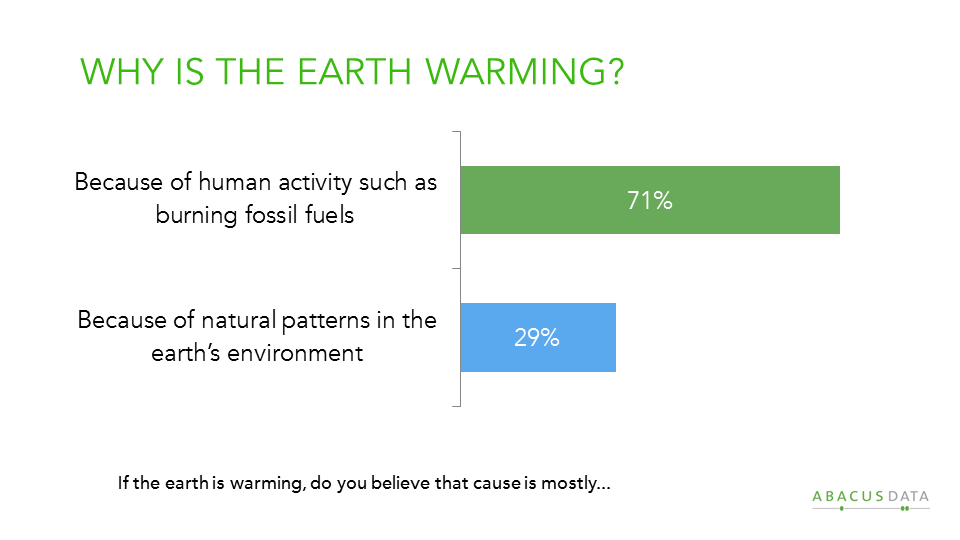

When asked if the earth is warming whether human activity or natural patterns were responsible, the majority 71% believe it is caused by human activity such as burning fossil fuels.

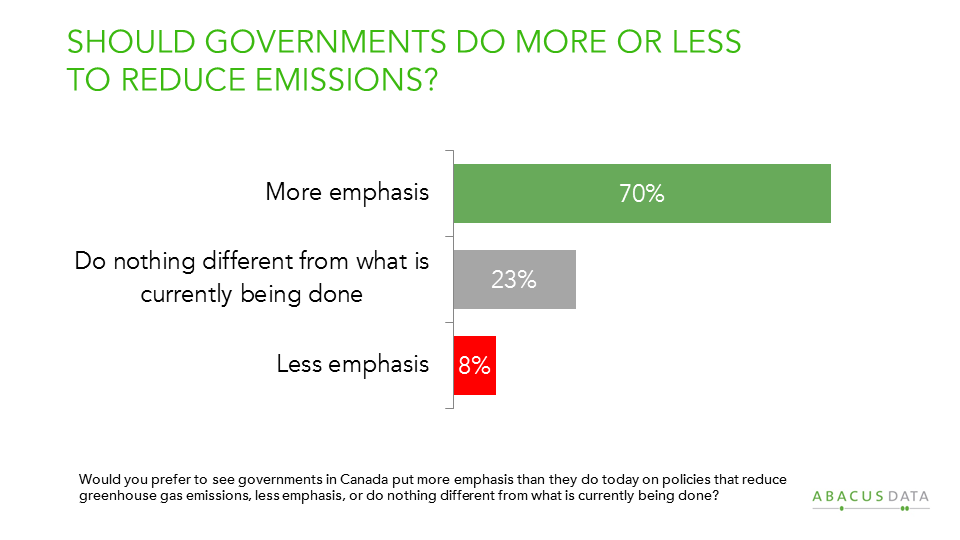

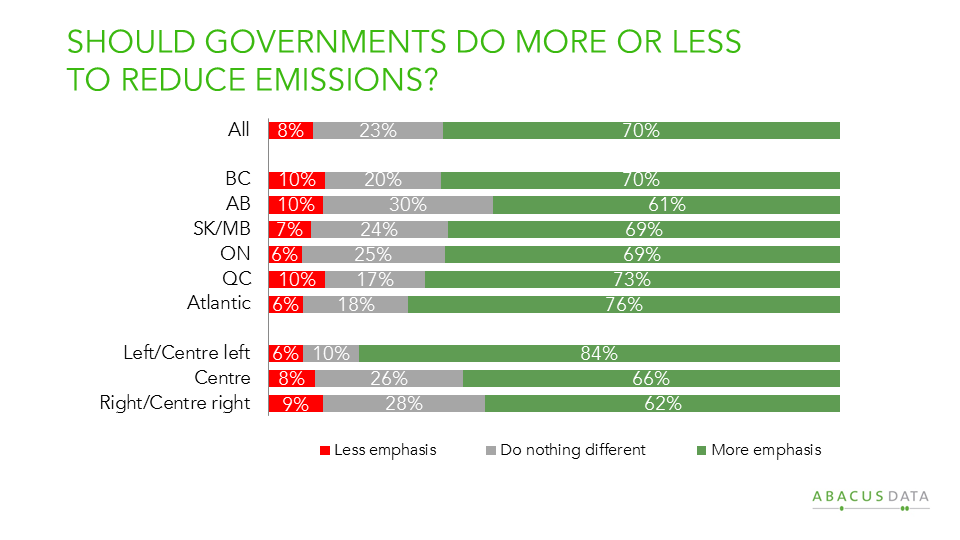

Canadians would like to see governments in Canada put more emphasis (at the time of the survey in September 2015) on policies that reduce greenhouse gas emissions.

Overall 70% would like to see more emphasis on reducing emissions while 8% believe there should be less emphasis. Another 23% are satisfied with the amount of effort currently being done now.

Opinion on government action on cutting greenhouse gases is fairly consistent across Canada with at least six in ten respondents in all regions of the country favouring more action (61% in Alberta). There is also a generational consensus with at least two thirds in all age groups favouring more emphasis on reducing emissions.

CARBON PRICING: FAMILIARITY AND REACTION

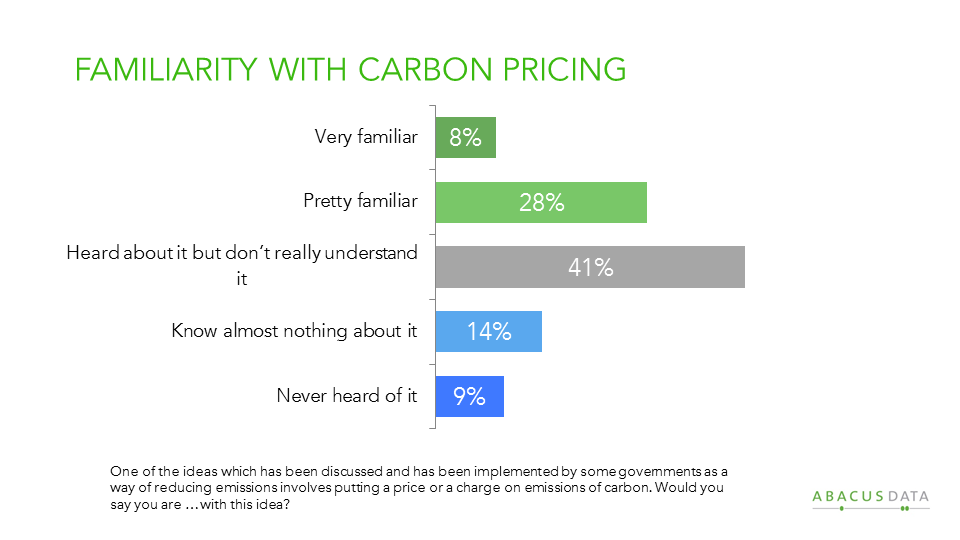

While the topic of carbon pricing has been a part of the policy discussion for a long time, it remains the case that many Canadians are not that familiar the idea.

Just over a third feel familiar with the idea but the plurality (41%) said they “have heard about it but don’t really understand it.

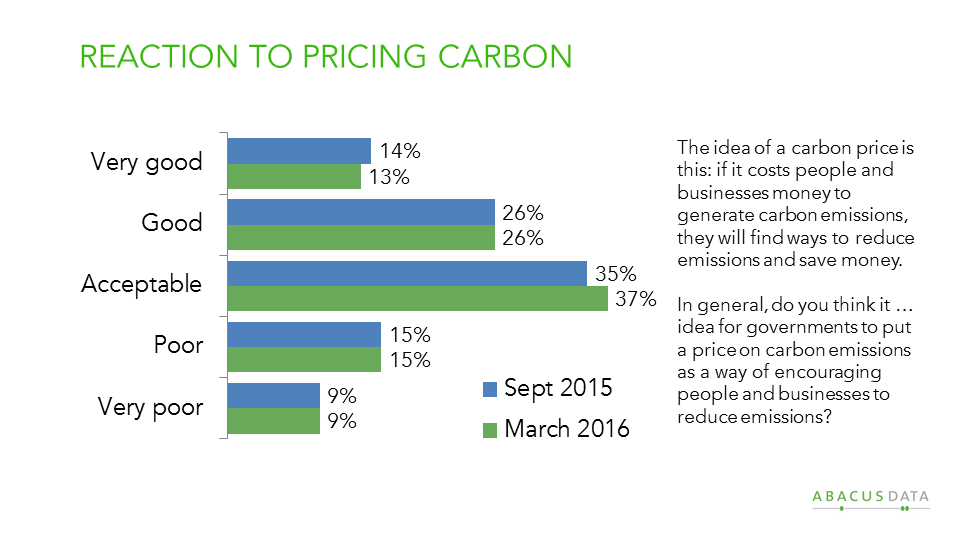

We provided respondents with a brief description of carbon pricing and the logic behind the policy, and then asked people for their reactions.

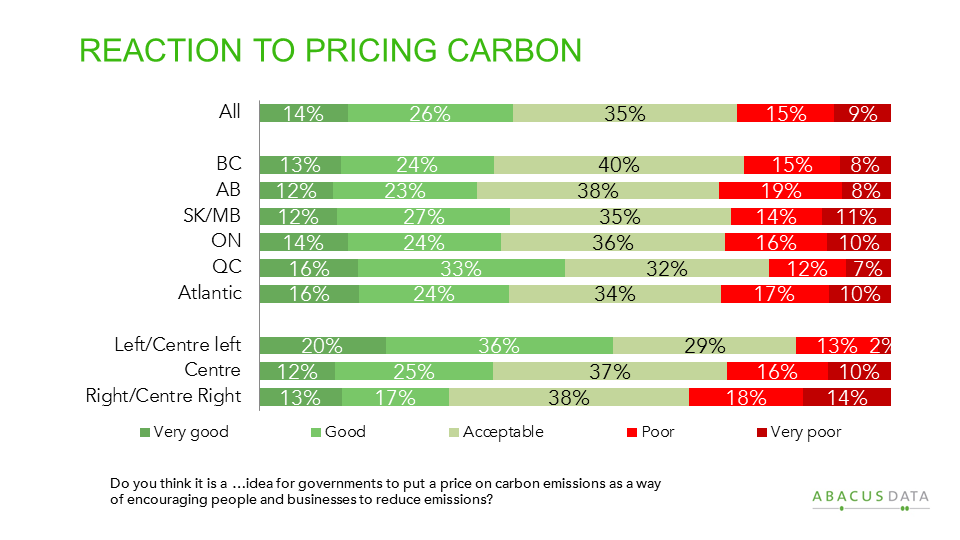

Three quarters of respondents (75%) believed it was at least an acceptable idea with 40% saying they thought it was a good idea. Only 24% said it was a poor or very poor idea.

Reactions varied slightly by regions with Quebecers being most enthusiastic. Notably, 63% of Albertans consider the idea acceptable or good. Those on the left of the spectrum were more likely to embrace the policy, but only 32% on the right reject it.

USES OF REVENUE FROM CARBON PRICING

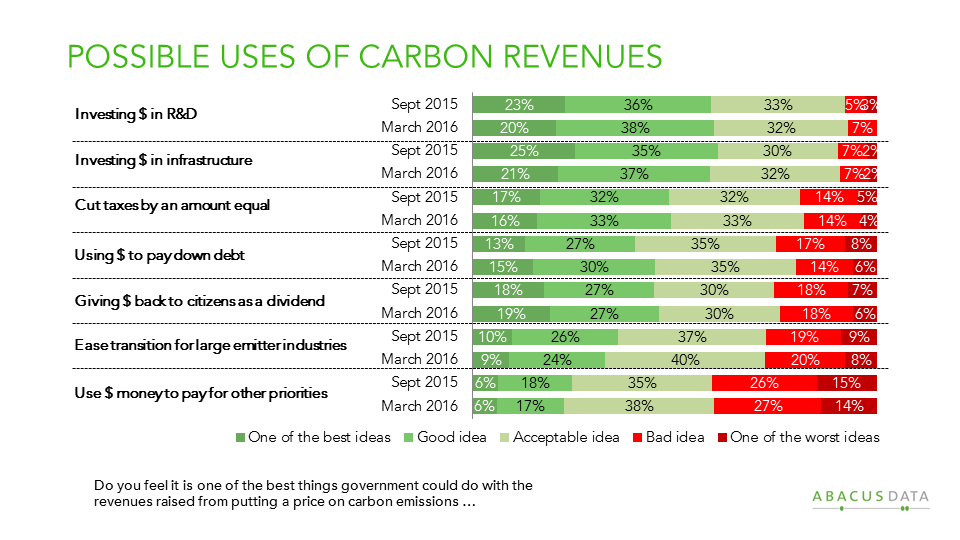

The primary objective of this study was to explore public attitudes towards the different ways revenue raised from pricing carbon could be used. Respondents were to react to 7 approaches:

• Investing in research and development and clean technologies.

• Investing in infrastructure like public transit, rail networks, the electricity grid, roads and bridges.

• Providing financial support to ease the transition for industries that are the largest emitters of greenhouse gases.

• Cutting taxes by an amount equal to the amount raised

• Giving the money back to citizens in the form of a dividend.

• Using the money to pay down government debt.

• Using the money to pay for other government priorities.

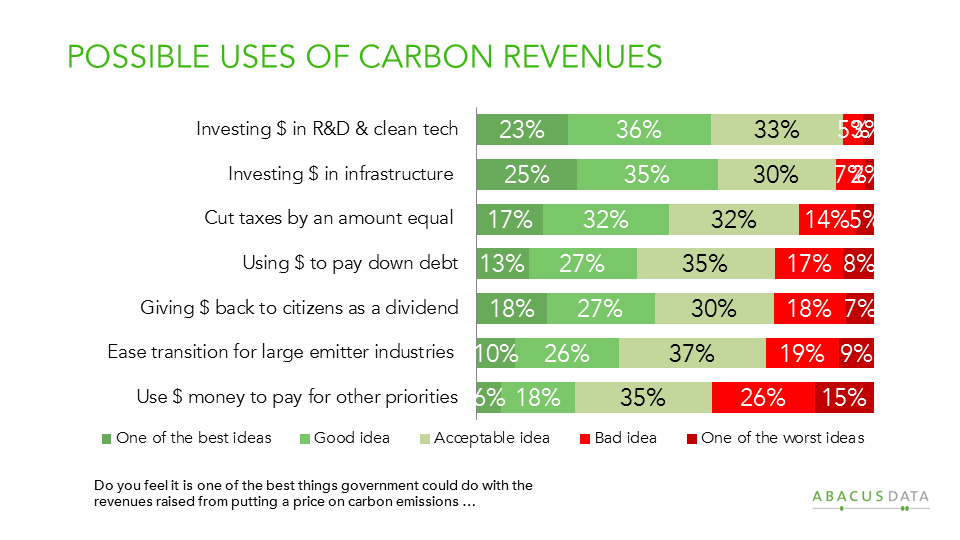

A majority of respondents said that all of these were at least acceptable ideas. However, some ideas generated more enthusiasm than others.

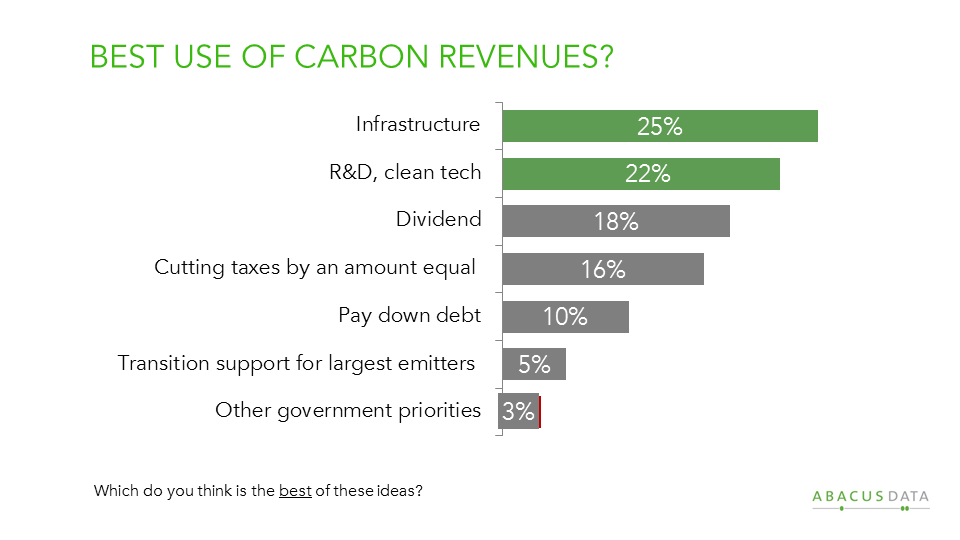

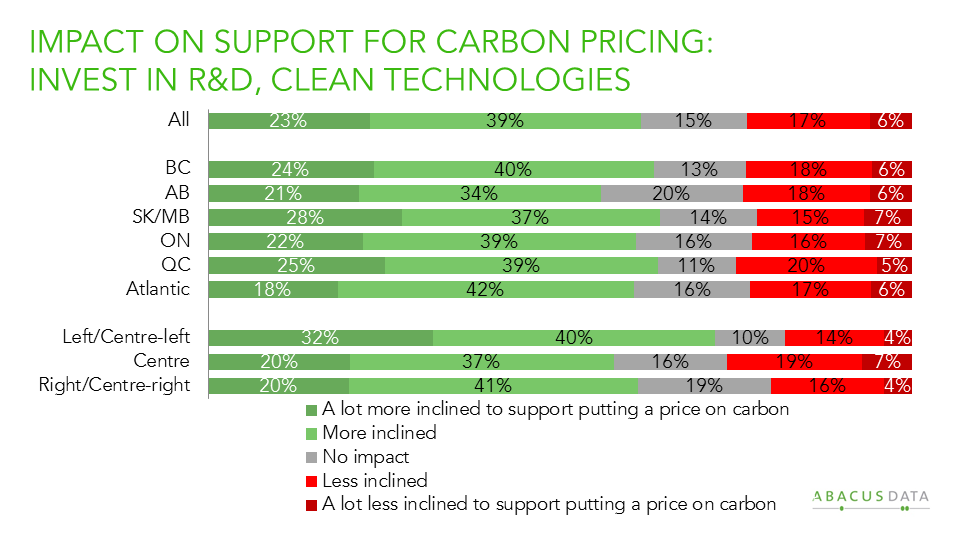

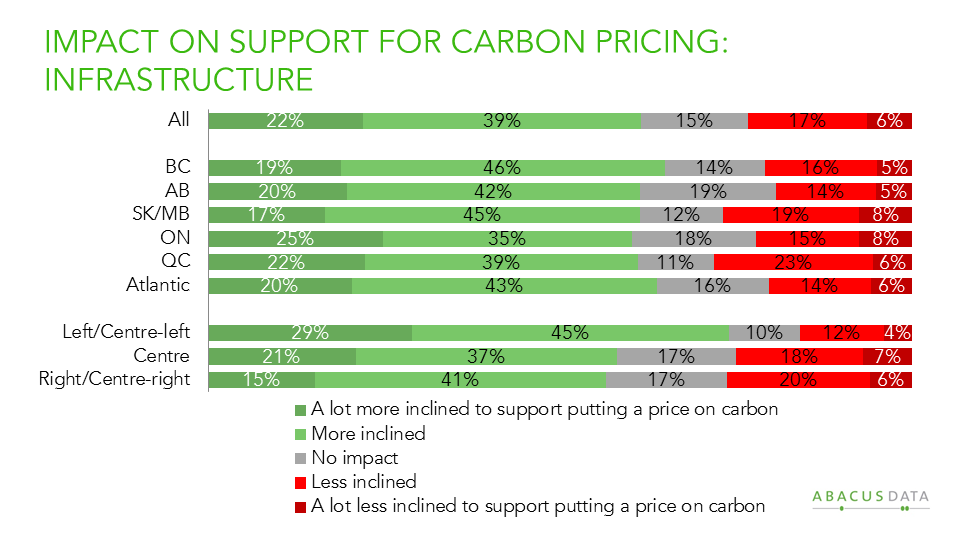

Investing in research and development in clean technology and in infrastructure like transit, rail, power grids, roads and bridges, were met with the strongest support, (roughly 90% acceptable or better) and very little resistance.

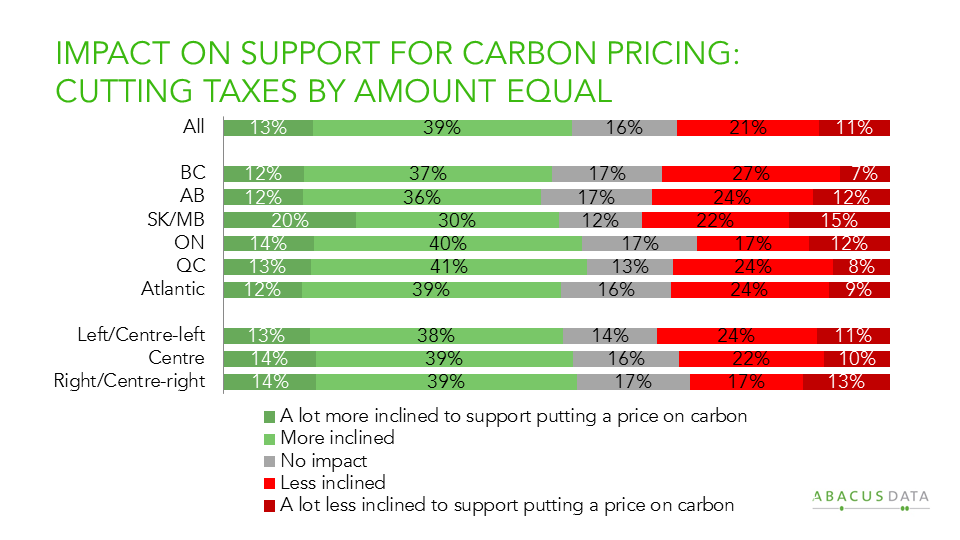

A large majority (81%) react positively to the idea of cutting taxes by an amount equal to amount raised

Fewer, but still substantial majorities consider acceptable the idea of using the money to pay down public debt, giving the money back to citizens in the form of a dividend or providing funding to help ease transition for large emitting industries. There was little resistance to each of these ideas.

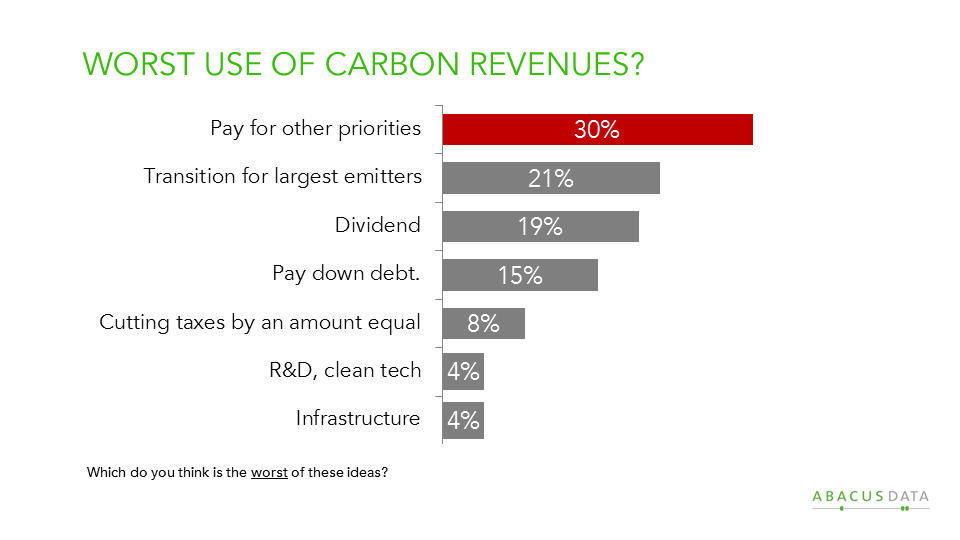

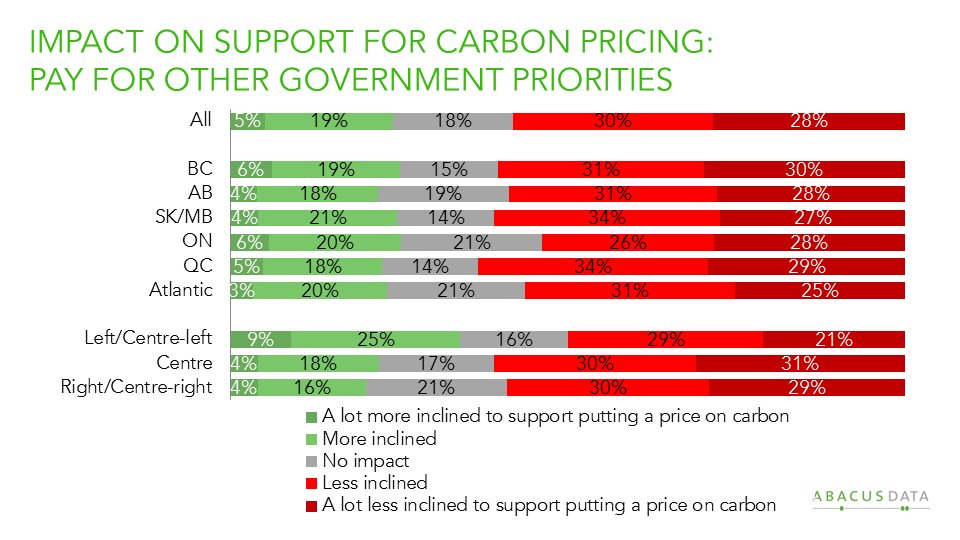

More hesitation was found for the idea that the revenue from carbon pricing be used to pay for other government priorities. Fully 41% believe it was a bad idea or one of the worst ideas.

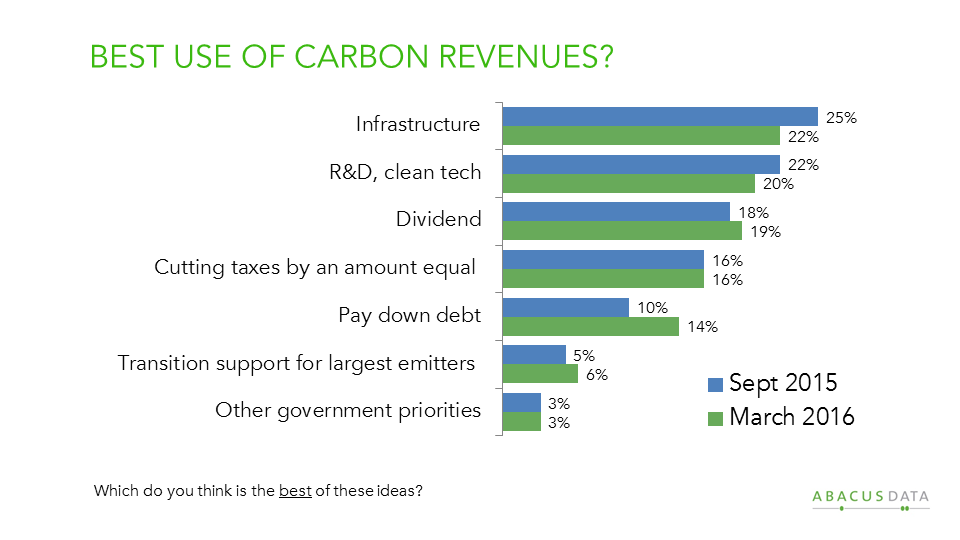

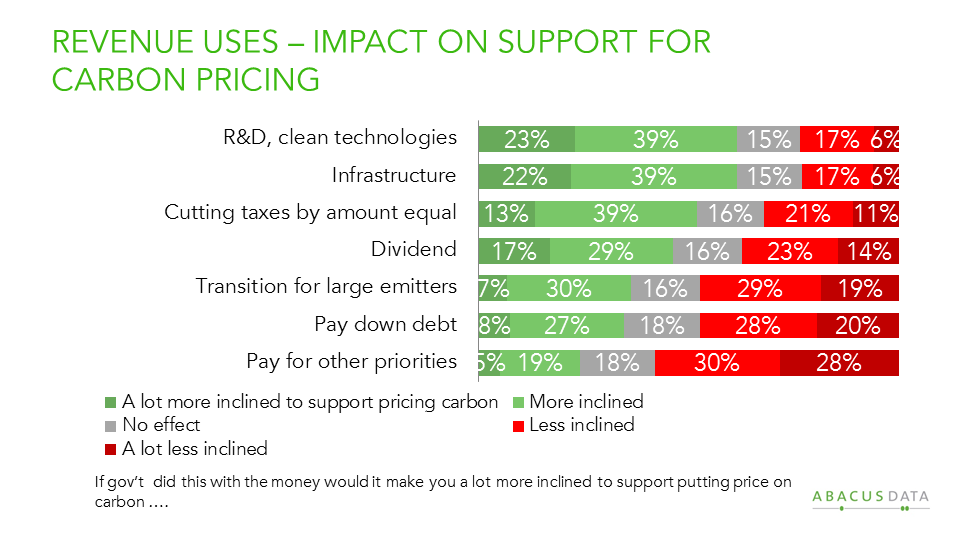

We also asked whether each alternative would make people more inclined or less inclined to support pricing carbon. Six in ten would be more inclined to support carbon pricing if the revenue was used to invest in research and development in clean technologies (62%) or in infrastructure (61%).

Cutting taxes by an amount equal to that raised by the carbon price also grows support with 52% saying they would be more inclined to support carbon pricing in that scenario.

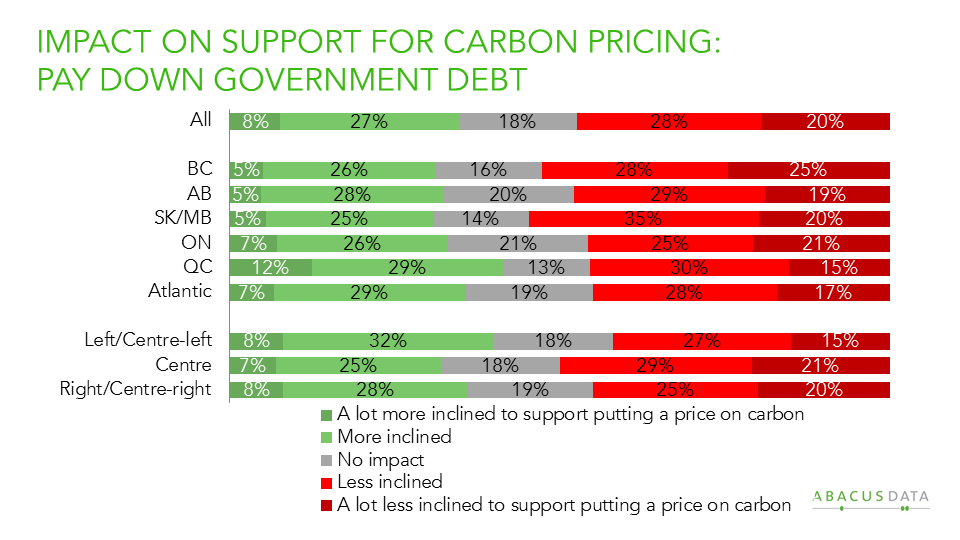

The other options had more limited or mixed impacts on views about carbon pricing.

There was not a lot of variation across regional or ideological groups. However, a few are worth noting:

• Cutting taxes by an equivalent amount found similar levels of support in all regions and across the political spectrum.

• Albertans were more hesitant about using carbon revenue to offer a dividend to residents, or to ease transition for heavy emitting sectors.

• Infrastructure was a particularly strong draw for those on the left.

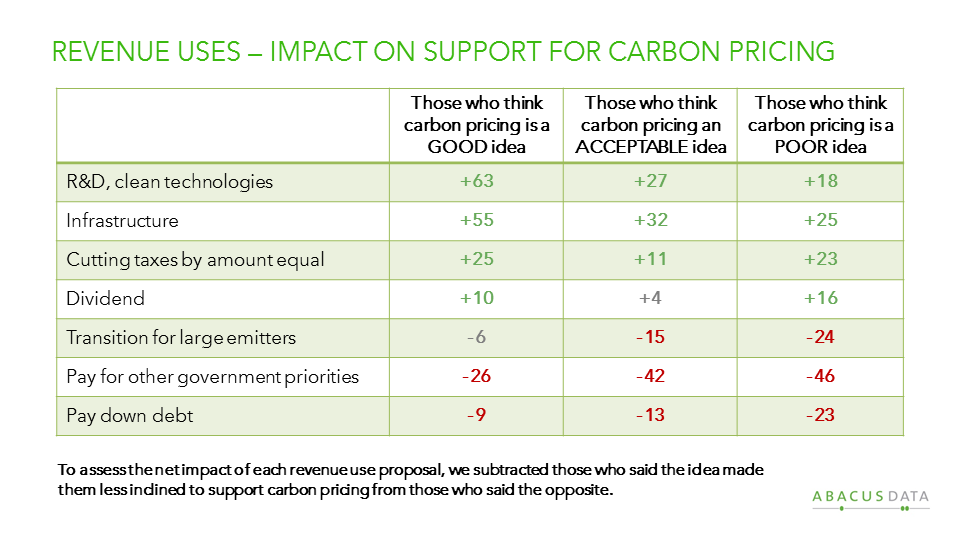

We examined the impact of each of these ideas for use of the revenue by those who initially said they liked, found acceptable, or disliked the idea of carbon pricing.

The results reveal that 3 of the 7 approaches tested have particularly good potential to strengthen support for the policy idea. The three are: investing in R&D, clean technologies, infrastructure and ensuring that the carbon tax revenue is returned in the form of equivalent tax cuts.

CONCLUSIONS

Many Canadians want to see governments take more steps to reduce carbon emissions and the tendency is to think that carbon pricing can be a useful part of the policy mix.

At the same time, it is clear that many people are only lightly familiar with the way carbon pricing would affect them and the economy and their views on this policy option should be understood as soft and somewhat qualified.

People express some clear inclinations when it comes to the treatment of carbon revenues: they are more enthusiastic about investments in new infrastructure and clean technologies and less comfortable with the idea that monies raised would simply flow to general government revenues without any prescribed uses, or linkage to the emissions reduction intent.

Ideas like tax neutrality and revenue recycling helps build support for carbon pricing, an effect which is evident in all parts of the country and across the left, centre and right of the political spectrum.

METHODOLOGY

The survey was conducted online with 2,200 adult Canadians from September 25 to 29, 2015. A random sample of panelists was invited to complete the survey from a large representative panel of over 500,000 Canadians.

The Marketing Research and Intelligence Association policy limits statements about margins of sampling error for most online surveys. The margin of error for a comparable probability-based random sample of the same size is +/- 2.1%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

ABACUS DATA

We offer global research capacity with a strong focus on customer service, attention to detail and value added insight. Our team combines the experience of our Chairman Bruce Anderson, one of Canada’s leading research executives for two decades, with the energy, creativity and research expertise of CEO David Coletto, PhD.

APPENDIX

To assess the impact of the passage of time and events that occurred from September 2015 to today, we asked a number of the same questions on the March 2016 edition of our national omnibus survey.

The survey interviewed a nationally representative sample of 1,500 Canadian adults from March 16 to 18, 2016 from a large representative panel of over 500,000 Canadians.

Overall, the responses to the questions we re-asked in March 2016 were very similar and mostly within the expected margin of error of the two surveys.

The charts below compare results from the two periods: