I shop, therefore I am: Can Augmented Reality Save Canadian Stores?

January 24, 2019

Over a third of Canadians have already used Augmented Reality (AR) and most are interested in seeing the technology in retail spaces.

Those under 45 are especially enticed by the idea of AR being integrated into their retail experience (75%).

Like many new technologies, AR use in retail will probably be driven by curiosity and novelty at first, but there is a signaling from consumers that AR could enhance the shopping experience.

Augmented Reality has the potential to be a one-two punch for retailers: First, by drawing consumers back into their physical stores through the novelty of AR, then enticing them to open their wallets through the enhanced user experience AR provides.

AR isn’t confined to retail disruption either. See the pdf at the bottom of this page for a short story-deck with some exciting stats and potential applications for different industries, including retail, museums and tourism, and entertainment facilities.

This article only scratches the surface of our study. For a comprehensive deck with an in-depth breakdown of all our findings please email Maciej Czop, Senior Research and Communications Consultant at Abacus Data.

The Evolution of Shopping

Remember, in the infancy of the World Wide Web, when only lunatics gave out their credit card numbers over the internet? These days, that fear is a vague memory and it’s fading quicker than shipping times for Prime Delivery.

Online retail has exploded in the past decade with the advent of trusted online payment systems, cheap or even free shipping, intuitive user interfaces, and a massive shift in consumer culture that makes it feel like we’ve been buying clearance-sale socks through our smartphones while lounging in bed since the dawn of the modern age.

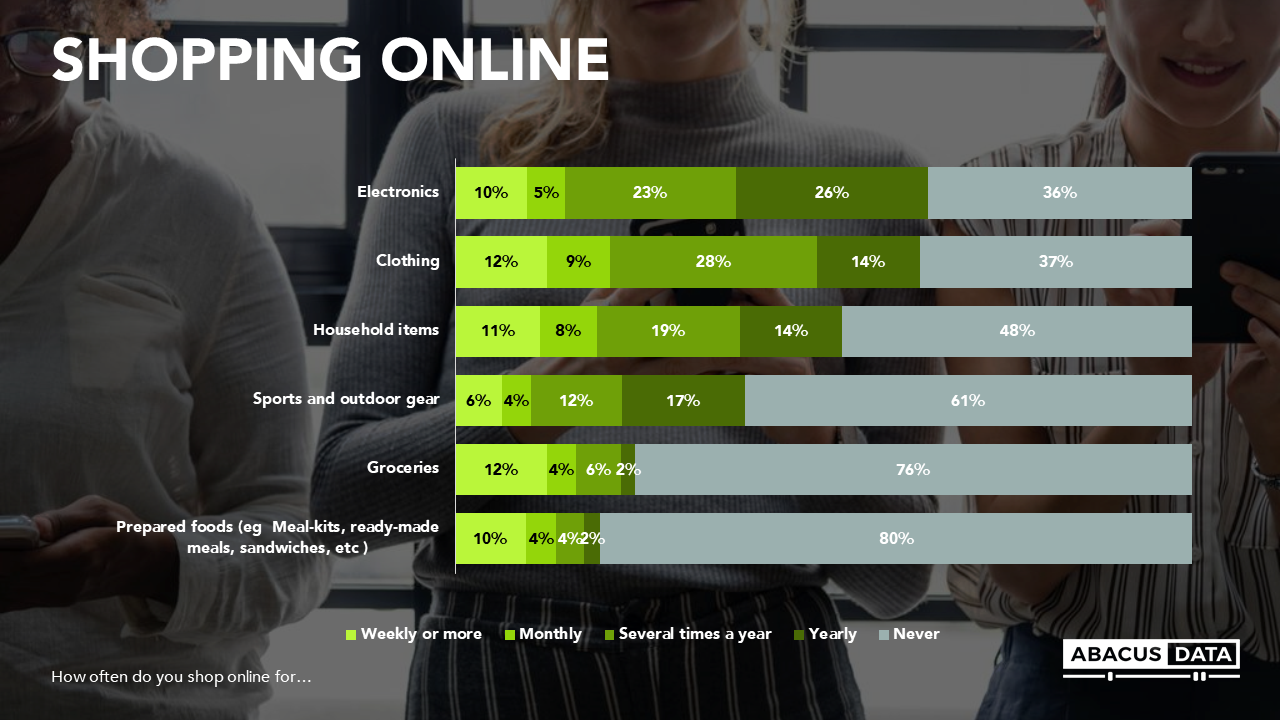

The obvious online purchases, like electronics and clothing, are leading this digital transition with almost 2/3’s of Canadians telling us that they shop for these online at least once a year. Traditionally less digital-friendly purchases are gaining traction as well. Just over half (52%) of Canadians bought household items like dish soap and laundry detergent online and about a quarter (24%) purchased groceries online in the past year.

With consumers moving significant portions of their spending online, and many retail trends pointing to strong and consistent growth in the digital space, where does this leave the brick-and-mortar shop? Some of the more intrepid and creative retailers are exploring how Augmented Reality (AR) could entice consumers back into their physical stores.

What is Augmented Reality (AR)?

Let’s start with the fundamentals. Augmented Reality is an enhanced environment as viewed through a screen or other display, produced by overlaying computer-generated images, sounds, etc. on the real-world. AR is half-way to virtual reality, but instead of a completely digital world, AR enhances the physical space around us. Think of the much-hyped Google glasses and you’ll get the idea, but AR can be as simple as interacting with a physical object/space through your smartphone, or a kiosk screen, or as complex as a Pokémon franchise revival.

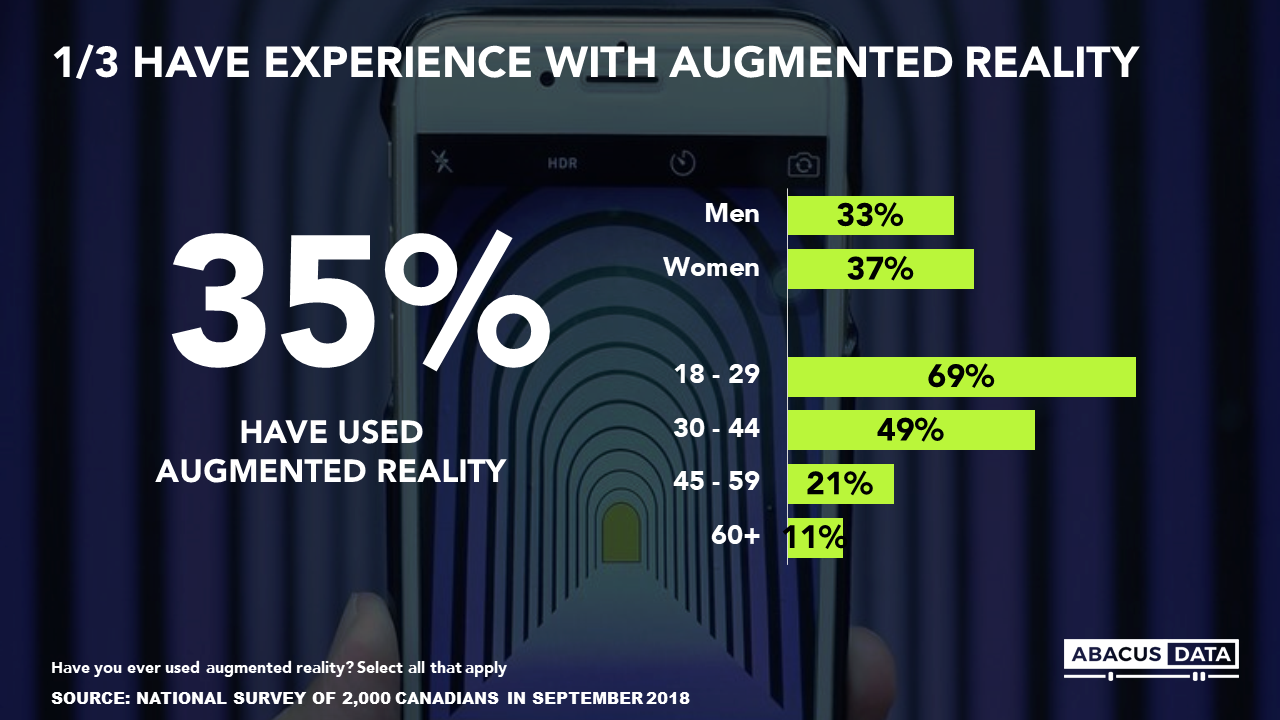

A surprising number of Canadians are already using AR. Just over a third (35%) of all Canadians have used augmented reality, and this number rockets to half (49%) of 30-44 year-olds and almost 7 in 10 (69%) 18-29 year-olds.

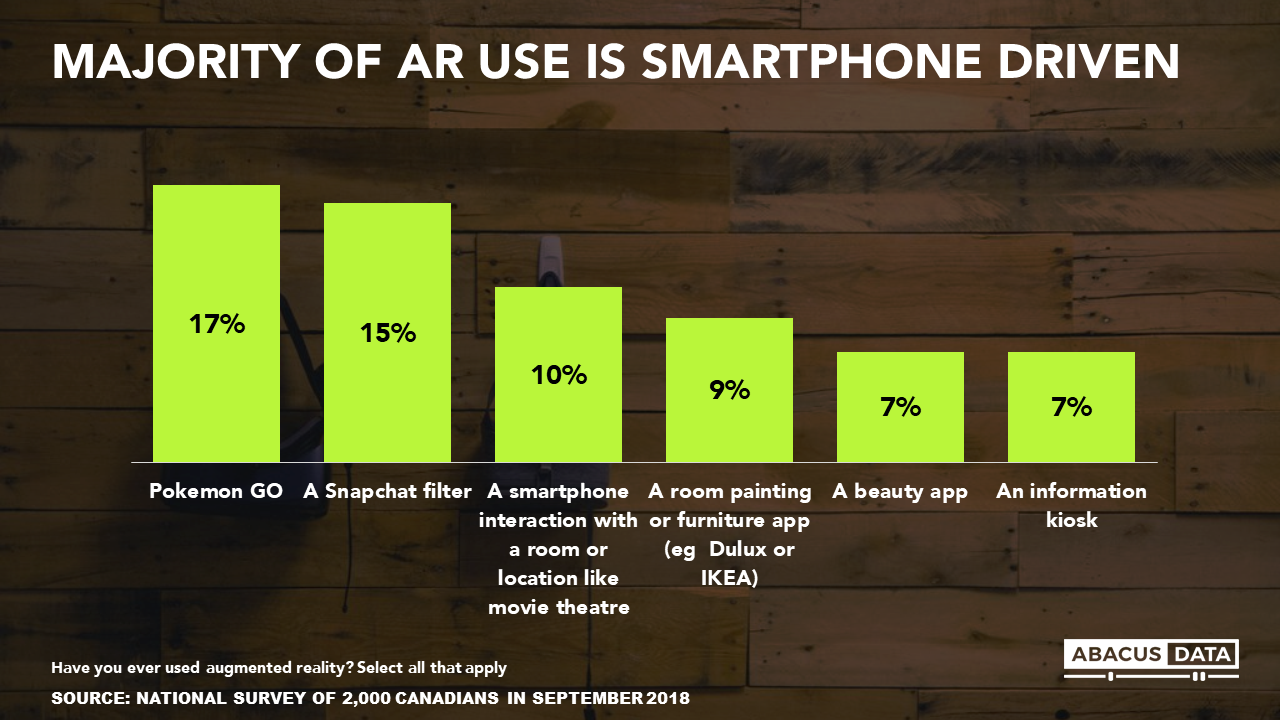

Smartphone games and social media apps are leading augmented reality use: 17% of Canadians have used AR through Pokémon GO and 15% through a Snapchat filter. But AR’s appeal doesn’t end with trivial distractions on phones, and this is where retailers’ ears will perk up: 1 in 10 Canadians have used a smartphone to interact with a room or used an AR app to try different paint colours or furniture arrangements, while 7% have used beauty apps to try make-up on a simulation of their face and the same number have used AR at information kiosks.

AR’s Potential in Retail

Looking beyond the way AR is currently being used, we also wanted to measure AR’s potential as it pertains to the retail space in Canada.

What we found was very promising for AR innovators and enthusiasts: Most Canadians (59%) are willing to try AR in a retail space and this climbs to a large majority of 18-29 year-olds (82%) with 30-44 year-olds not far behind (70%).

Canadians think clothing and entertainment are the most popular potential uses for retail AR. Those willing to try AR say they are most interested in trying-on clothing without having to use a change room (26%) and using it for fun at an arcade or theatre (25%).

However, consumers are also interested in how AR can help them make purchases, such as providing more information and demonstrations for electronics (18%), for beauty and cosmetics to see what you look like without physical application (10%), and grocery shopping to get more information about products such as nutrition and how foods fit into personal meal plans (8%).

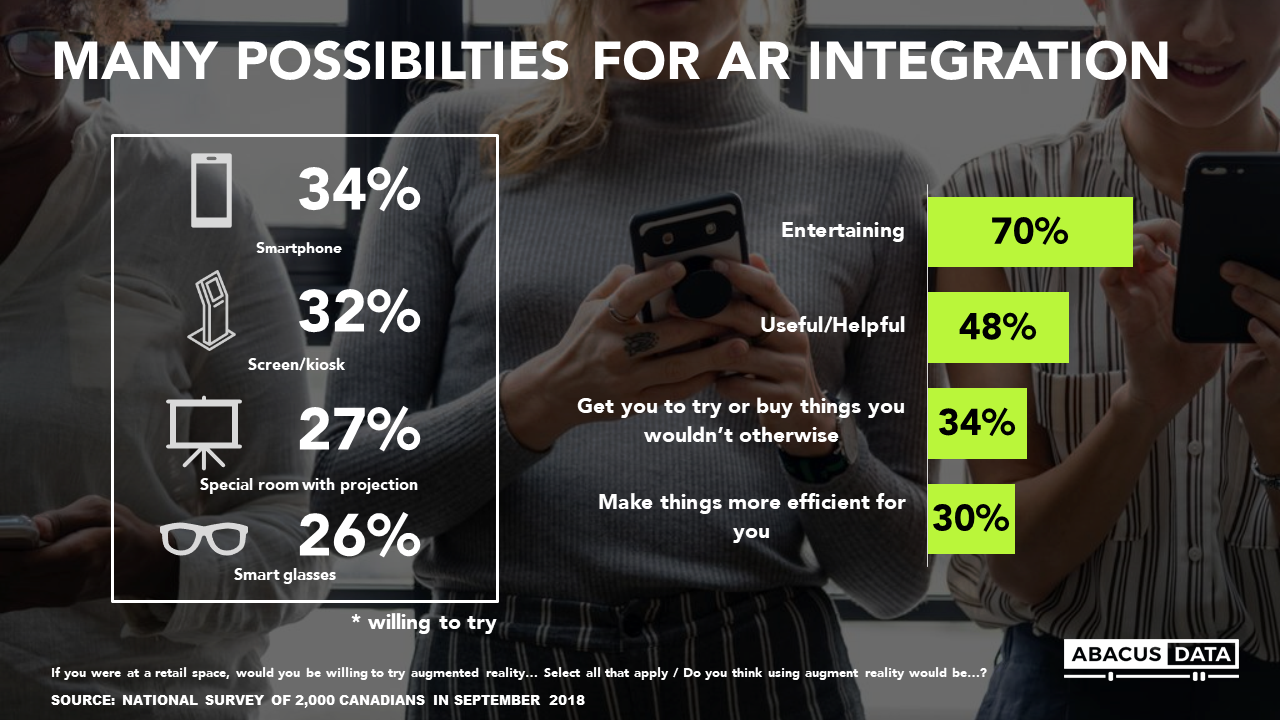

The main driver of potential retail AR use seems to be the “novelty” factor: 7 in 10 said using AR would be entertaining. Retailers would be wise to make sure whatever implementation of AR they attempt is easy, intuitive and fun for consumers to use.

Many Canadians are anticipating more serious benefits from AR as well. Almost half (48%) said AR would be useful/helpful, over a third (34%) said it would get them to try or buy things they wouldn’t otherwise, while 3 in 10 believe it would make shopping more efficient.

No Perceptual Barriers to AR and lots of Consumer Interest

The big story is that many Canadians are interested in seeing AR in retail spaces, especially those under 45. Like many new technologies, AR use in retail will probably be driven by curiosity and novelty at first, but there is a signaling from consumers that AR could enhance the shopping experience. Augmented Reality has the potential to be a one-two punch for retailers: First, by drawing consumers back into their physical stores through the novelty of AR, then enticing them to open their wallets through the enhanced user experience AR provides.

Physical retail may never match the convenience of online shopping, but these new augmentation technologies can give consumers something experiential, useful and valuable that draws them back to brick and mortar stores. At the very least, Canadians don’t seem to be opposed to or disinterested in retail AR, but there is also evidence that a significant portion of Canadians explicitly desire it as part of their purchase decision making due to its perceived benefits.

Big Opportunities for Retailers who get AR “Right”

Perhaps the most interesting facet of AR is that Canadians already conveniently carry a powerful piece of AR tech around with them wherever they go: the smartphone. This is a major advantage in the consumer culture arms race and a significant opportunity. Now it’s up to attentive retailers to make retail AR easy and enticing, and give consumers a reason to take their phones out of their pockets.

In an age of big-budget, at-your-fingertips TV shows a la Netflix, Amazon prime, etc., expectations for great story telling and sumptuous aesthetics have never been higher – if you want consumer attention then the production value of AR better be of high quality and unique creativity or retailers risk leaving even the most interested users unimpressed. A neat example of a creative approach to AR is a recent trend seen on some wine labels to tell a story to potential customers.

Our research shows that shoppers expect to be entertained as well as informed, and a short AR interaction that tells a brand/product story can enhance what might otherwise be a mundane experience and keep customers coming back for more – IF the effort is thoughtful, fun, attractive and polished.

AR isn’t confined to retail disruption either. Here is a short story-deck with some exciting stats and potential applications for different industries, including retail, museums and tourism, and entertainment facilities.

This article only scratches the surface of our study. For a comprehensive deck with an in-depth breakdown of all our findings please email Maciej Czop, Senior Research and Communications Consultant at Abacus Data.

Methodology

The survey was conducted online with 2,000 Canadian residents aged 18 and over from September 15th to 20th, 2018. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The Marketing Research and Intelligence Association policy limits statements about margins of sampling error for most online surveys. The margin of error for a comparable probability-based random sample of the same size is +/- 2.19%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.