Housing affordability is the top issue for Millennials who are looking to achieve the dream of homeownership

October 1, 2018

On behalf of The Canadian Real Estate Association (CREA), we conducted a national survey of 2,500 Canadian millennials (those aged 18 to 38) earlier this spring (April 18 to May 9). The survey explored attitudes and perceptions around housing with Canada’s largest generation.

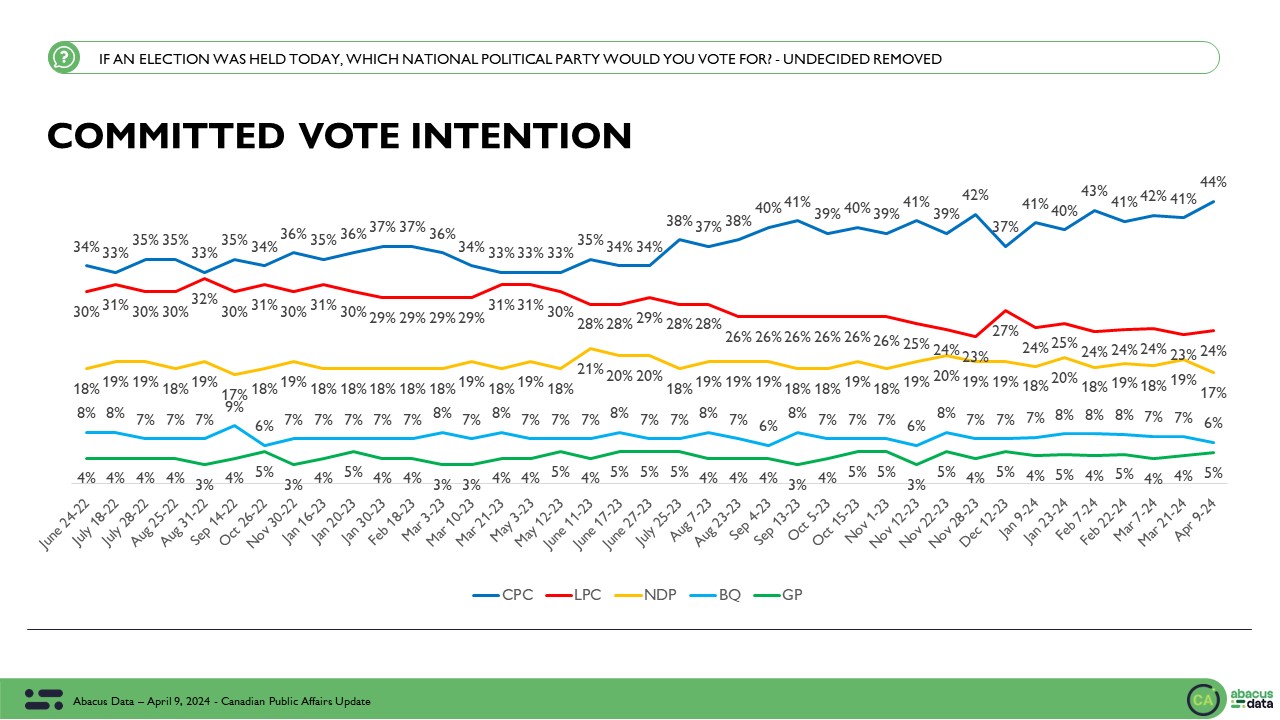

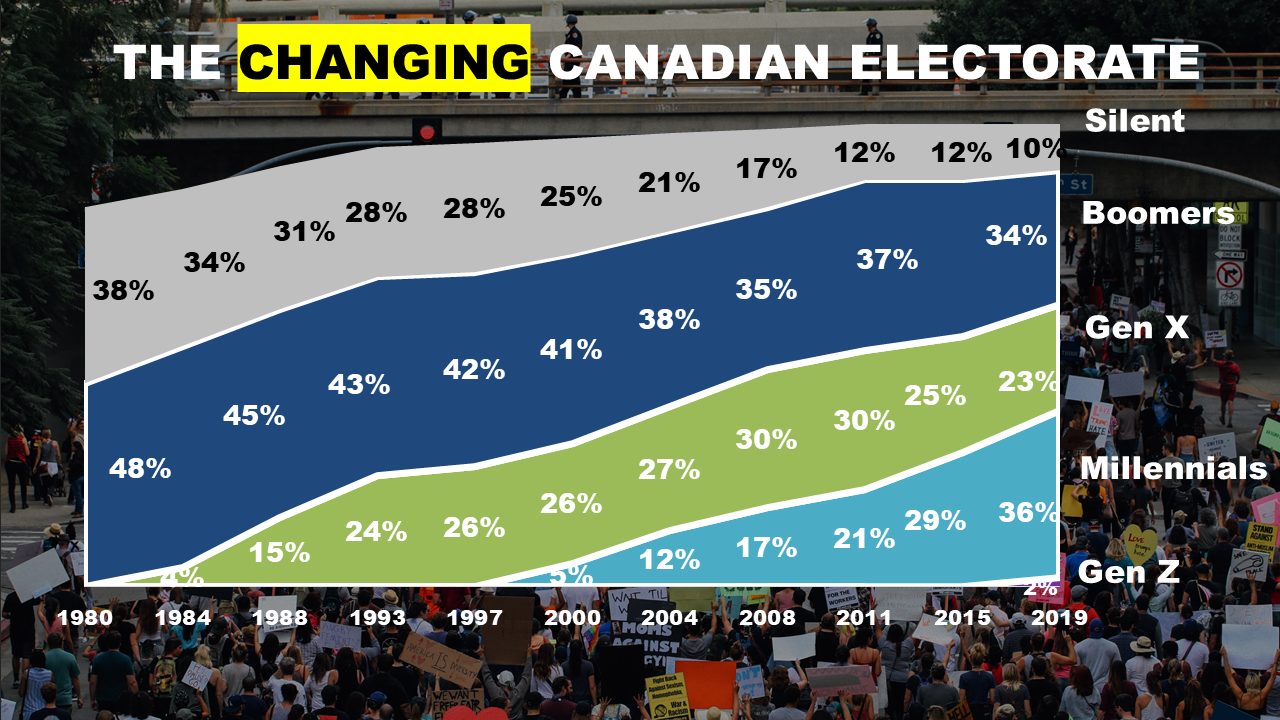

Come the time of the next federal election in 2019, millennials will make up the largest group of eligible voters and Elections Canada estimates voter turnout among young voters increased by about 15 percentage points from 2011 to 2015. Given the size of the generation, if they vote collectively and turnout, they can have a major impact on the outcome of the next election.

Here are the highlights from the research:

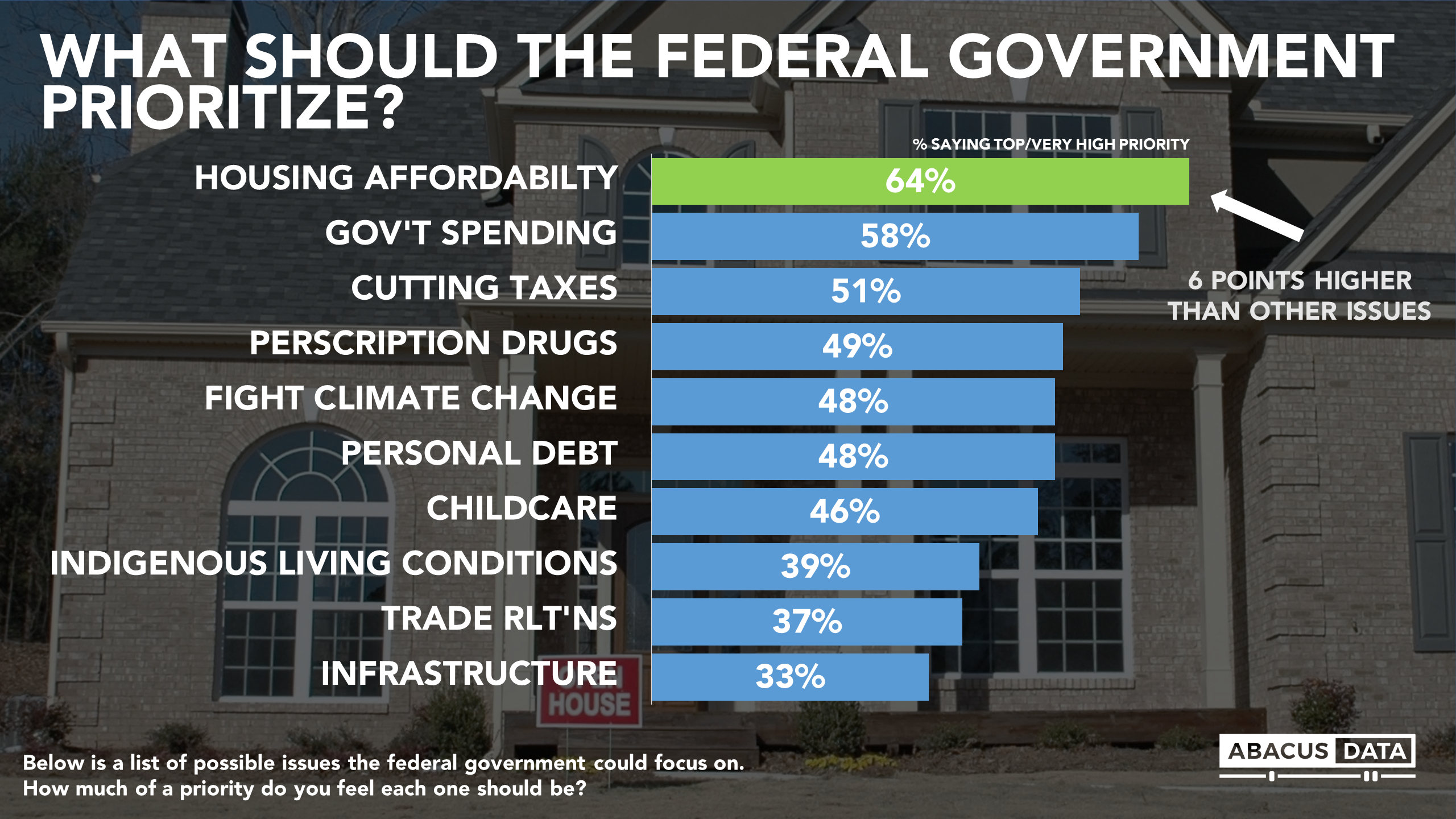

MORE MILLENNIALS BELIEVE THAT THE FEDERAL GOVERNMENT SHOULD MAKE HOUSING AFFORDABILITY A TOP OR VERY HIGH PRIORITY THAN OTHER ISSUES.

Over 6 in 10 millennials rated housing affordability as a top or very high priority. It’s the top issue of those we tested and six points higher than government spending, cutting taxes, prescription drug prices, and fighting climate change.

And concern about housing affordability is not confined to the Greater Toronto Area or the lower mainland of British Columbia. Majorities in every province, except for Quebec, rated affordable housing as a top or very high priority for the federal government to focus on.

THE DREAM OF HOMEOWNERSHIP IS ALIVE AND WELL WITH MILLENNIALS.

The concern about housing affordability among millennials comes from their strong desire to own their own home. Among those who do not own a home yet, 86% said they want to own a home someday and over two-thirds of this group are passionate about owning a home. For many millennials, homeownership and home improvement are topics they obsess over. Watching HGTV or browsing REALTOR.ca listings is a common practice for many young Canadians. The data confirms this.

MOST MILLENNIALS FEEL IT HAS BECOME MORE DIFFICULT TO BUY A RESIDENTIAL PROPERTY IN THE PAST YEAR.

But the dream to own is up against growing anxiety about their ability to get into the housing market. Most millennials say that it has become more difficult to buy a residential property in the past year, including 63% of those who don’t currently own but want to.

And again, these feelings are not isolated to those living around Toronto, Vancouver, or Montreal – although perceptions are more acute in those regions. In urban, suburban, and rural communities across the country, a majority or a large plurality of millennials say it has become more difficult to buy a home in the past year.

When asked what affects affordability millennials are more likely to cite saving enough for a down payment (47%), the cost of carrying the home with monthly mortgage payments (44%), or specifically mortgage interest rates (38%). Fewer, but still a sizeable minority, feel that low supply or foreign buyers are a very big factor impact housing affordability in Canada.

MILLENNIALS FEEL THAT SOME POLICY CHANGES ARE HAVING A NEGATIVE IMPACT ON HOUSING AFFORDABILITY.

When we asked what impact three policy changes have had on housing affordability, most feel that interest rate increases and government decisions that make it more difficult for people to get a mortgage have had a negative impact on housing affordability. One in three feels the same way about the new government rule that imposed new restrictions on when it will insure some properties worth more than $1 million.

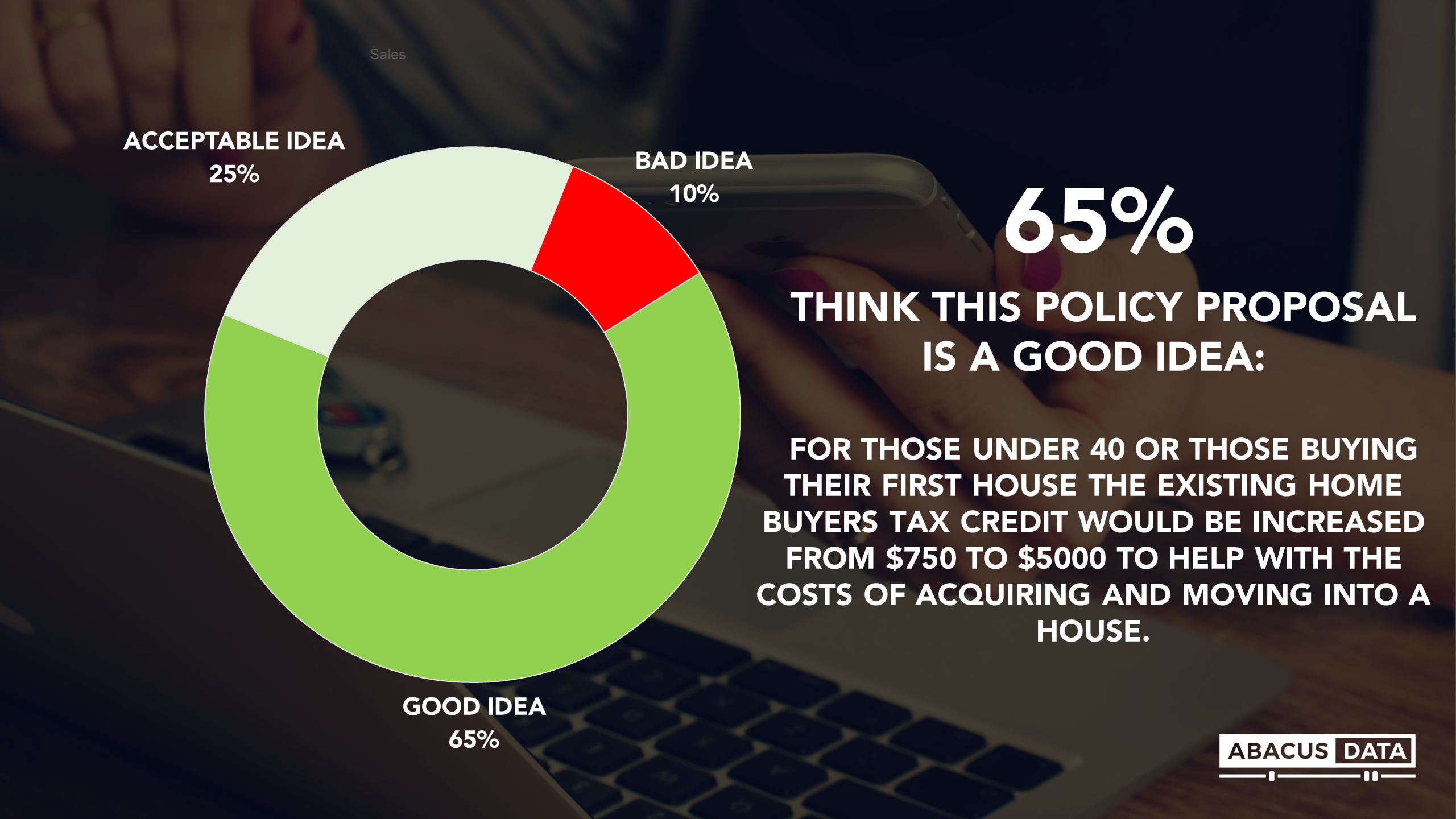

INCREASING THE FIRST TIME HOME BUYERS TAX CREDIT IS HIGHLY APPEALING TO MILLENNIALS.

One policy opinion being recommended by the Canadian Real Estate Association is highly appealing to millennials. We presented a proposal that would increase the existing First Time Home Buyers Tax Credit from $750 to $5000 for those under 40. Overall, 65% felt it was a good idea and another 23% thought it was an acceptable idea. Few felt that it was a bad idea.

THE UPSHOT

Over the past few years, I’ve noticed that housing affordability has been rising as a top concern for Canada’s millennial generation. This survey adds further evidence as young Canadians are increasingly concerned about their ability to afford a place to live and the dream of homeownership is slipping away from them.

Most want to own a home and many are passionate about the topic. It monopolizes conversations not just around Toronto and Vancouver, but in communities across the country as millennials feel that it is becoming more difficult to buy a home. Many feel that decisions being made by the federal government are having a negative impact, and there’s a clear desire for policy solutions to make the dream easier to achieve.

Housing is an issue that could activate millennials to engage in politics and turnout to vote in the next election. There’s a clear opportunity for political leaders to empathize with young Canadians, lead on the issue, and offer solutions to a challenge that most feel hopeless to solve.

METHODOLOGY

The survey was conducted online with 2,500 Canadians aged 18 to 38 (Millennials) from April 18 to May 9, 2018. A random sample of panelists was invited to complete the 20-minute survey from several online panels of Canadians.

The data were weighted according to census data to ensure that the sample matched Canada’s millennial population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.