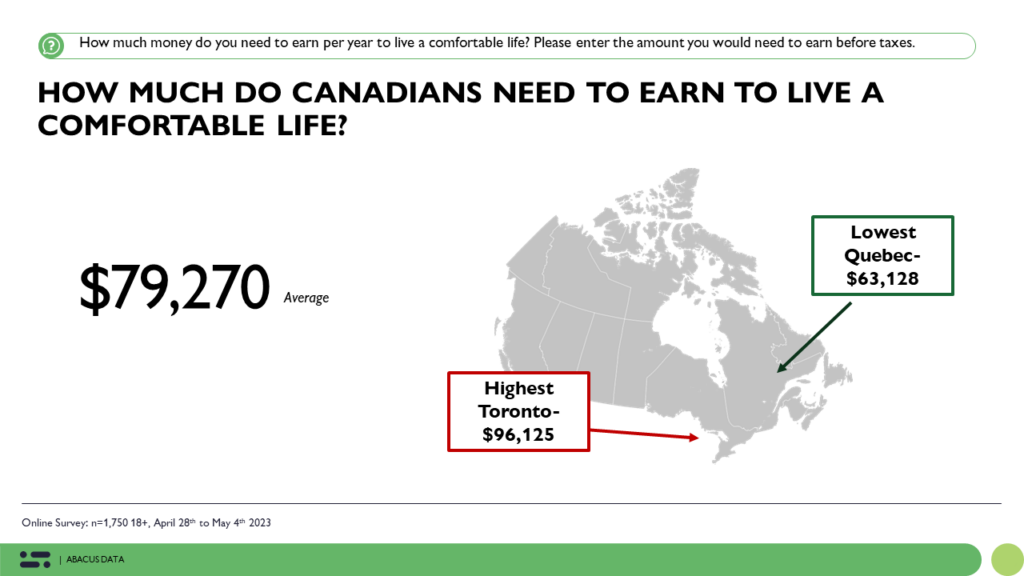

How Much Money Do You Need to Earn to Live Comfortably?

May 25, 2023

The last year has shown that living costs can be high and unpredictable. The cost of food and other home goods has meant living a comfortable life day-to-day is more pricey for everyone. And the rapid rise in house prices, not yet matched by wage increases, have meant other living costs have put comfort out of reach for more folks. With this, we were curious. How much income do people believe they need to live comfortably? And how does it differ by age.

To begin, on average Canadians say they need to earn $79,280 (before taxes) annually to live a comfortable life. It is higher for those with a partner ($85,445) and lower for those without ($72,919). It is lowest in Quebec, and highest in Toronto. And those who have children, say they need to earn about $30,000 more than those without.

Those with a household income lower than $75,000 say they’d need to earn more than they do now to live a comfortable life- but a relatively modest increase. Those with a higher household income, $75,000 and up, say the are comfortable making what they do now, and some would even be comfortable with less.

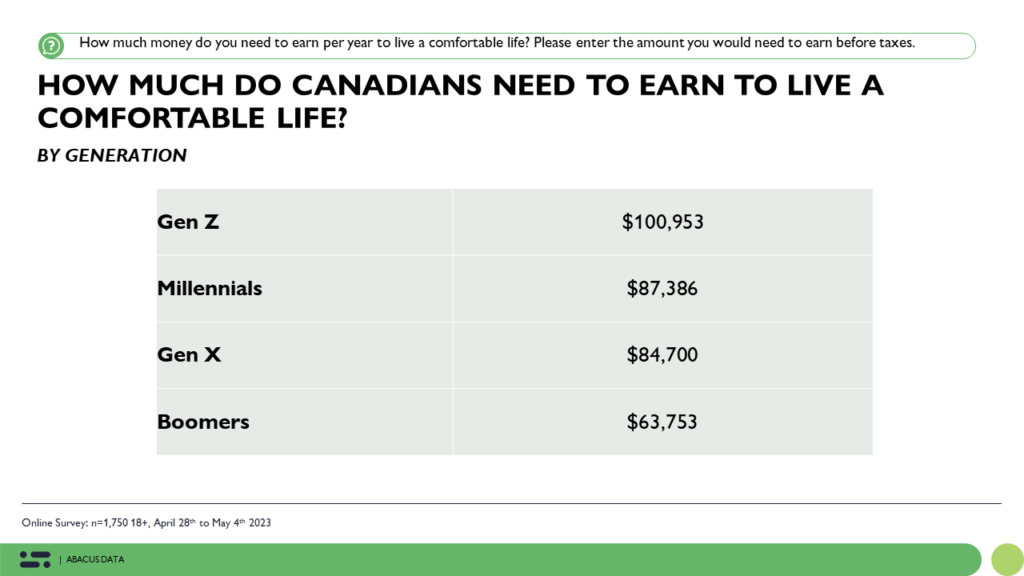

One of the greatest variations however is by generation. Gen Z say they need to make over $100,000 a year to live a comfortable life, more than any other generation, including millennials. This is also considerably higher than the current average income for this cohort, which hovers around $45,000.

The generational breakdown is as follows: Gen Z say they need to make $100,953, Millennials say $87,386, Gen X say $84,700 and Boomers say they need to earn $63,753 before taxes to live a comfortable life.

One likely driver of this discrepancy is that a greater proportion of young people (Gen Z in particular) that are striving for a comfortable life, rather than living one. Younger generations need to check off some large boxes before they feel comfortable. For Gen Z this is looks like saving for a downpayment or starting to tackle student loans, and for Millennials this is likely a mortgage or other debt. For Boomers, who have bought and paid off the major purchases in their life, their earnings to live comfortably are much lower.

Another likely influence is where these generations live, or hope to live (Gen Z and young millennials prefer cities and urban cores).

THE UPSHOT

Perceptions of financial comfort varies based on a number of factors. It’s influenced by where you live, if you have a partner and if you have dependents to support. But above all else, it’s influenced by your age whether or not you’ve made it through many of the major life purchases that are considered life milestones.

As more Gen Z’s become more situated in the workforce, their perceptions of ideal income may shift, but the important take away is the discrepancy between the actual income of young people in Canada, and what they think they need to live comfortably. This gap signals financial concern for young people (something that’s been on the rise for everyone, but particularly these generational cohorts since the pandemic), and if it sticks around (or worse yet, increases) will have real consequences on everything from consumer behaviour to votes.

METHODOLOGY

The survey was conducted with 1,750 Canadian adults and 1,750 Ontario adults from April 28 to May 4, 2023

A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.343%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.