Food Fight: Hoarding, Stockpiling and Panic Buying

October 22, 2020

Remember just a few short months ago when the biggest news story of the pandemic was how much we were all hoarding toilet paper? Lots has changed since then, including countless news stories of much greater consequence, but have our hoarding behaviours changed? And what are the drivers behind them?

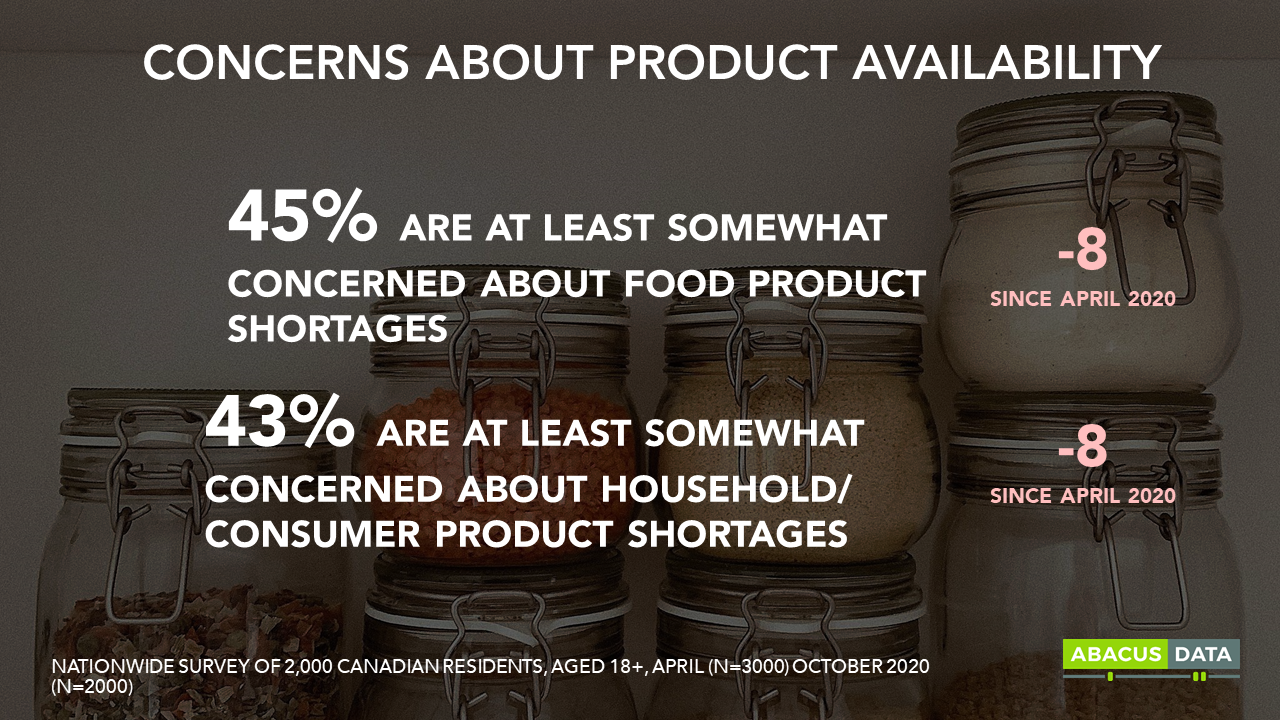

1.Generally, we are a bit less concerned about shortages in Wave 2.

After living through a first wave of the coronavirus pandemic, it seems there is less uncertainty about the future, including feelings of uncertainly towards our food system. Our fears about shortages on the shelves have declined, but they haven’t gone away completely. While we may be less concerned, very few of us are confident this won’t be an issue at all. Only 13% have zero concerns about shortages of food or household products.

2. We are still stockpiling, but as as many of us as before. Yet.

It turns out that toilet paper is still a hot commodity, but less so than in March. Many Canadians are still stocking up when we make a trip to the grocery store, but not as many as before. In particular, fewer Canadians are stocking up on canned good, fresh meats and dairy products. Our behaviour may not be considered ‘hoarding’, but still into purchasing extra products ‘just in-case’.

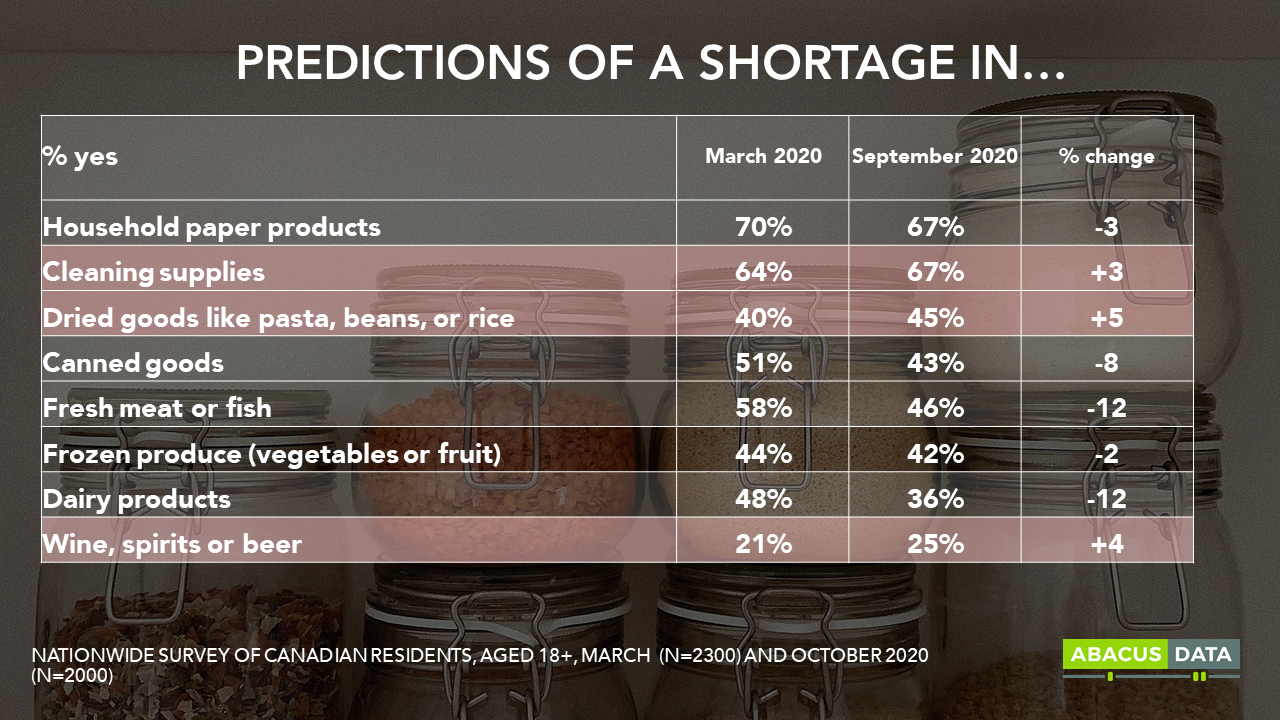

3. But we still predict shortages to happen this wave too.

Our predictions of shortages in certain product categories haven’t changed nearly as much as our tendencies towards stockpiling behaviour. but they aren’t all holding steady either. Two thirds of Canadians predict another shortage in household paper products (read: toilet paper). And we are less concerned about the supply of meat and dairy products, but having growing concerns about dried goods, cleaning supplies and alcoholic beverages. Perhaps we learned at thing or two from the rather unexpected yeast shortage a few short months ago.

4. Concerns about shortages vary across the country.

Quebec aside, concerns about shortages are driven in part by how soon the next lockdown will be. While there is an uptick in concern about a lockdown in Quebec, they are not nearly as concerned about supply issues as other provinces facing lockdowns. Concerns about shortages are highest in Atlantic Canada, where the region has been on lockdown for months, and in Ontario (where 38% predict the province will be on lockdown within the next 14 days).

SO WHAT?

Right now, it looks like our hoarding tendencies aren’t as strong as they were back in March. But there’s still time for that to change.

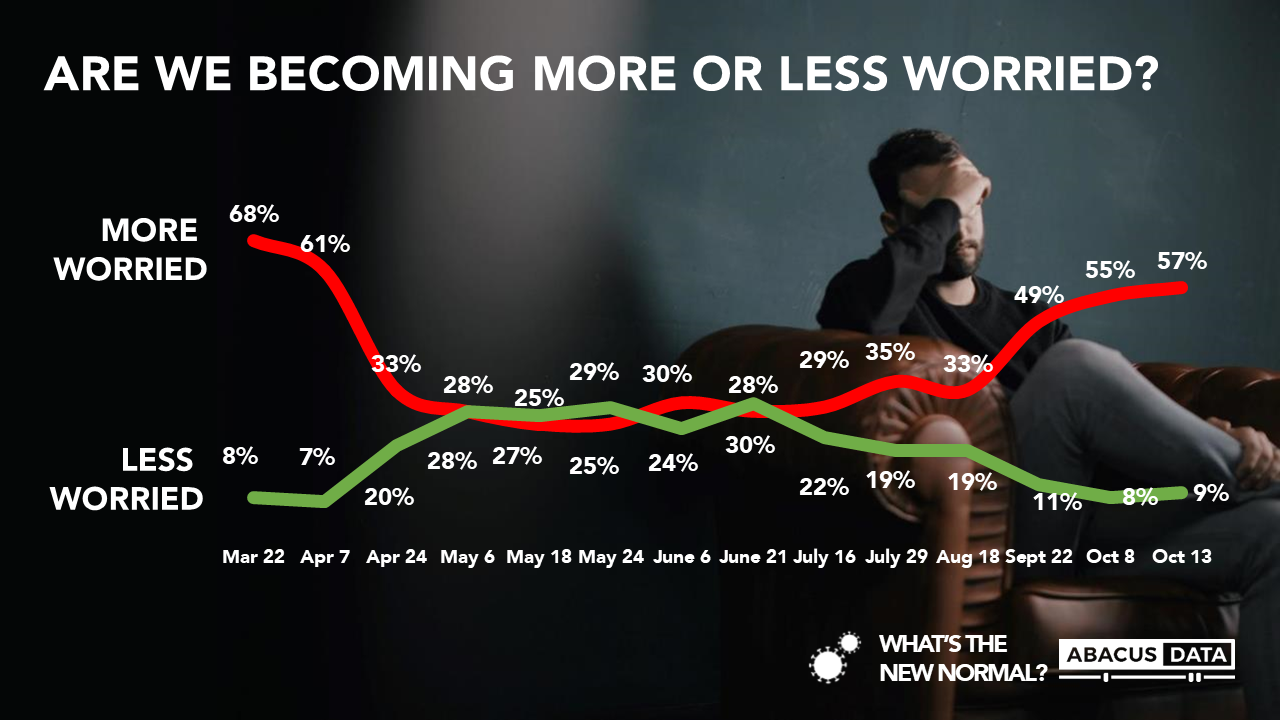

Our tendency to stock up is driven by what we see happening around us. The more likely we are to foresee an imminent lockdown, worry about an increase in cases, predict food shortages, and hear conversations about shortages, the more likely we are to go out and buy canned lentils and paper towels in bulk.

In other words, if we can justify stocking up for a second wave, we will be going out and doing just that. While predictions of shortages have decreased, our peripheral fears of increasing cases, and feeling like the worst is yet to come seem to be back on the rise. This creates a perfect climate for the kind of panic buying we saw earlier this year.

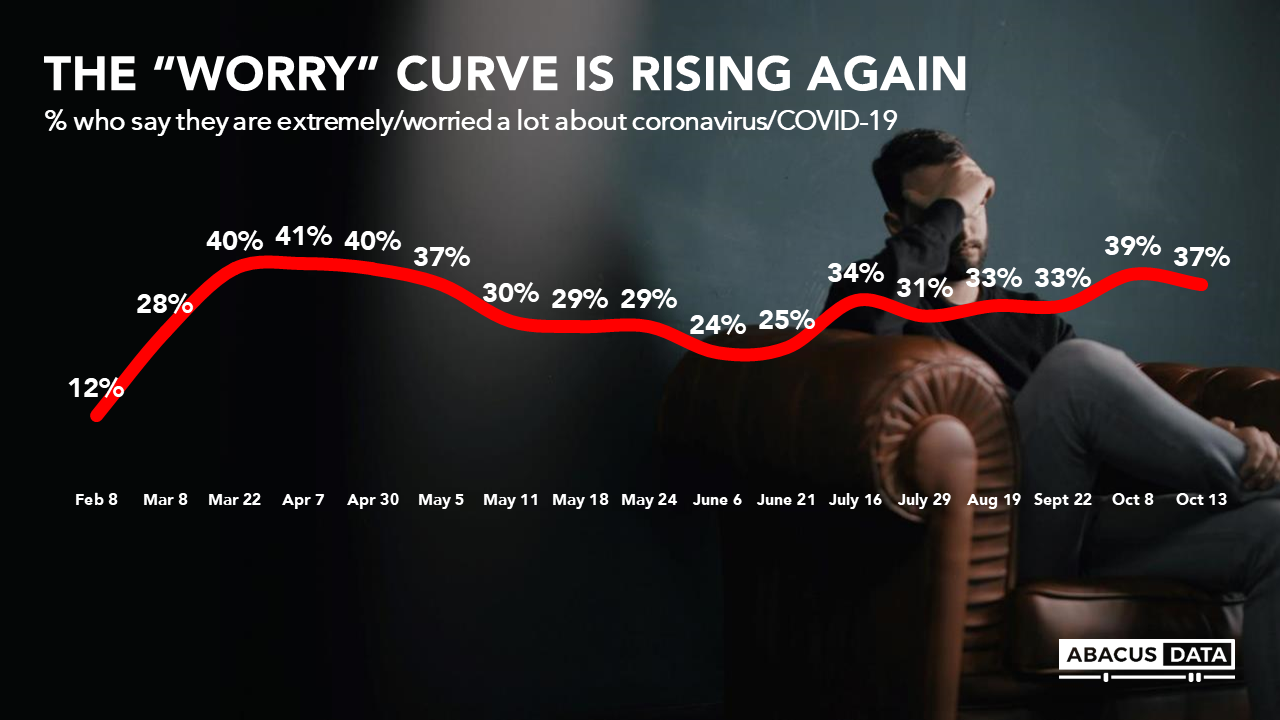

The worry curve, or those who say they are extremely/very worried about coronavirus is one of those measures. We are almost as worried about the pandemic, as we were in March.

Canadians sense this growing fear themselves too. Similar to what we saw in March, the number of Canadians that are increasingly worried about the pandemic, outpaces those who are becoming less worried.

If these fears start to spur concerns about the food system like they did in March, then we will likely be back to long lines at the supermarket, and finding shelves cleared out of flour and macaroni.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

Find out more about what we are doing to help clients respond to the COVID-19 pandemic.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

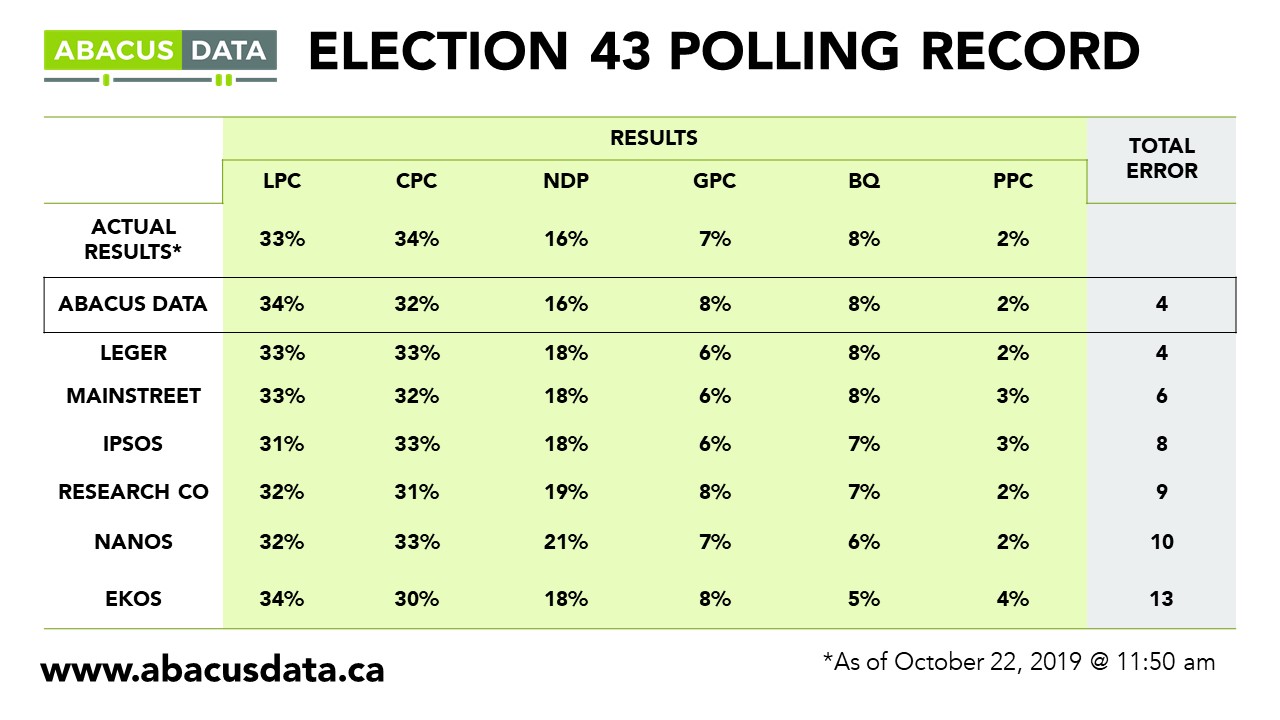

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.

METHODOLOGY

This release uses results from three separate surveys.

The first survey was conducted with 2,300 residents of Canada aged 18 and older from March 19 to 24, 2020. The margin of error for a comparable probability-based random sample of the same size is +/- 2.0% 19 times out of 20.

The second survey was conducted with 3,000 residents of Canada aged 18 and older from April 2 to 7, 2020. The margin of error for a comparable probability-based random sample of the same size is +/- 1.79% 19 times out of 20.

The third survey was conducted with 2,000 residents of Canada aged 18 and older from October 8 to 12, 2020. The margin of error for a comparable probability-based random sample of the same size is +/- 2.17% 19 times out of 20.

All three surveys used a random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The data in each survey were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.