Today’s Menu: Whatever’s Convenient

December 2, 2021

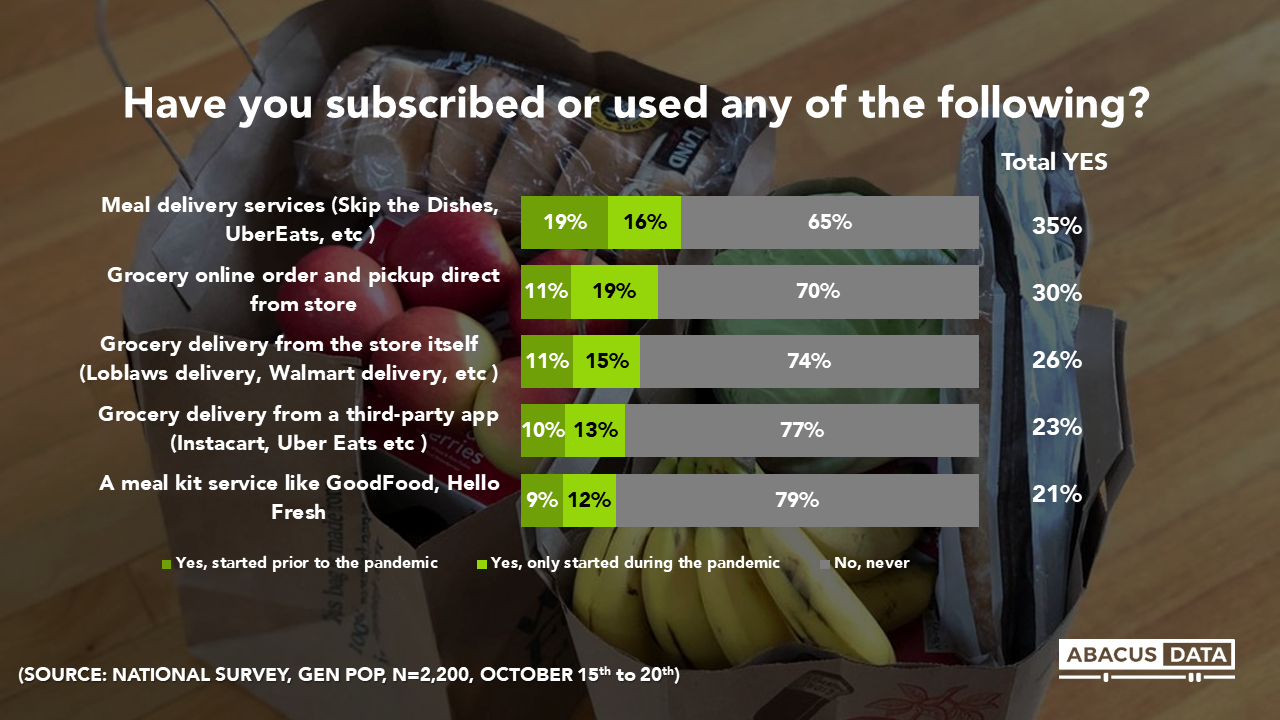

Eighteen months ago when the pandemic hit, many of our normal routines were upended and our food habits were no different. As restaurants closed during lockdowns, we looked for ways to spend as little time in the grocery store aisles as possible.

That got us thinking about alternatives to the old ways of buying foods like meal delivery services, grocery pick-up and meal kit services. As we transitioned from dining room menus to food and meal delivery apps, did we pick up any new habits? And what could this mean for these services in the future?

Back in October we asked a few questions to try and find out.

First, there’s no doubt the pandemic had an impact on our use of these services. Since the start of the pandemic the number of Canadians using meal delivery services, grocery delivery services or meal kit services has doubled. Grocery online order and pickup saw the biggest push because of the pandemic, but was closely followed by meal delivery services and grocery delivery from the store itself.

The situation created by the pandemic helped many of these services grow their customer base, in some cases more than doubling it. For every service tested, aside from meal delivery services, half or more of their customer base only started using their services during the pandemic. Among the 30% that say they’ve used grocery online order and pickup from the store, two-thirds only started during the pandemic. Meal delivery services also saw a rise in popularity, as just under half of the 35% of Canadians who use the service started doing so during the pandemic.

However, Canadians aren’t abandoning the grocery store just yet. Two-thirds of us still visit the grocery store in-person at least once a week, but other grocery and meal delivery services aren’t necessarily used infrequently. 15% of Canadians use meal delivery services like Skip the Dishes, and UberEats at least once a week, while 13% use grocery online order and pickup direct from the store at least weekly.

So, are these services replacing traditional grocery shopping behaviour? Not necessarily. Or at least, not yet.

When it comes to those who use meal kit services, they are actually a lot more likely than the average Canadian to be visiting a grocery store in-person, regardless of when they started using meal kit services (before or during the pandemic). For these folks, it seems like shopping in-person, and selecting their own products is something that’s important, and meal kits are supplementing their regular shopping behavior.

Those who started using grocery delivery and pickup services during the pandemic still shop in-person just as much as the average Canadian. Right now, or at least it seems, there isn’t a service that can fully replace the in-store grocery shopping experience.

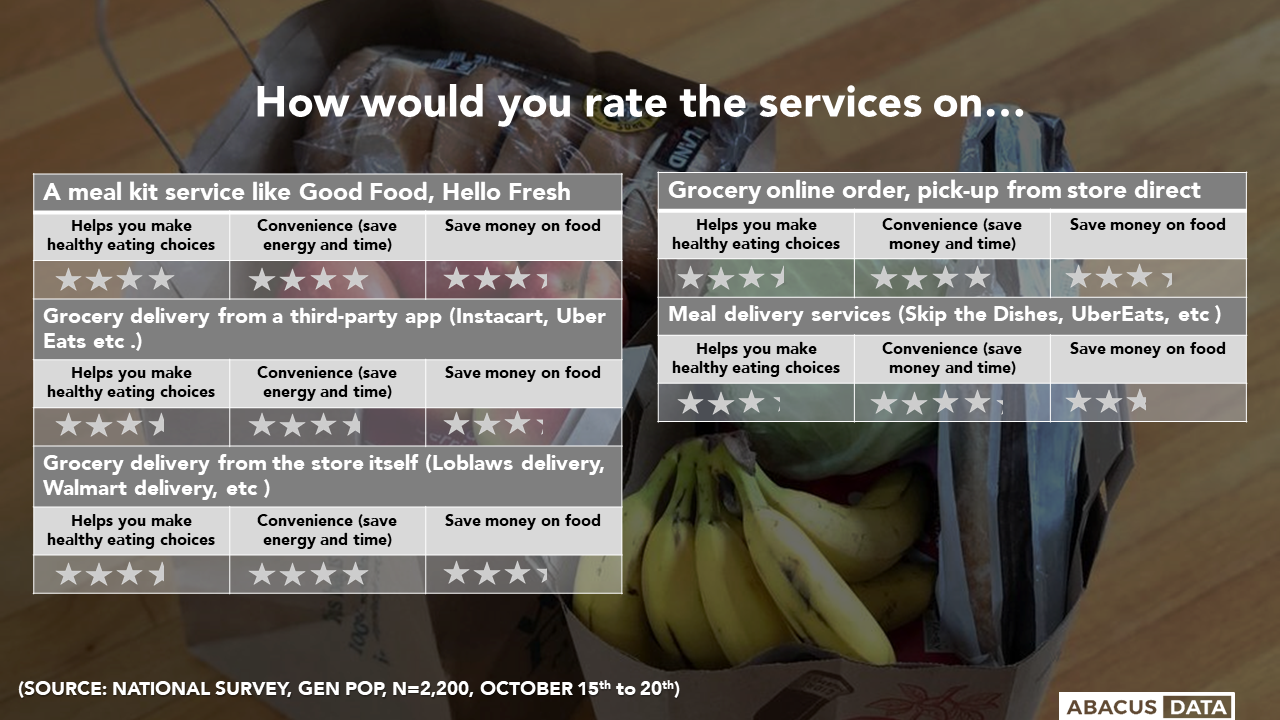

So, if it hasn’t replaced in-store shopping yet, are there any benefits to using these services? We asked those using these services to rate them on 3 factors: their ability to help you make healthy eating choices, convenience (saves energy and time), and saving money on food.

Grocery delivery and pickup does well regarding convenience, with those who use grocery delivery or pick-up direct from the store rating the service a 4 out of 5 stars for convenience. All three services receive a score just over 3 out of 5 on both saving money on food and helping them make healthy eating choices.

However, meal kits do the best on healthy eating choices, with a 4 out of 5 star rating. Meal delivery services do best on convenience, getting just over 4 out of 5 stars. Also worth noting, meal delivery services get the lowest score on saving money on food.

So, will we continue to use these services flourish, even once the pandemic is over? For now, it seems like the usage of these services is on an upward trajectory.

Regardless of whether they’ve used the service or not, 29% of Canadians say they have plans to use grocery delivery services more frequently, 27% have plans to use pre-prepared meal services (restaurant delivery or third-party) more frequently, and 23% plan on using meal kits more often.

Most of this growth will come from those already using the services, especially those who used the services prior to the pandemic. That said, it looks like all three (grocery delivery, meal delivery and meal kits) have a good chance of turning customers who tried their services during the pandemic, into regular users. Half of those who tried grocery delivery or pre-prepared meal services for the first time during the pandemic are interested in using it more. And the future is even brighter for meal kit services- with 71% of their ‘pandemic customers’ planning to use the services more in the future.

UPSHOT

So, while grocery and meal delivery services have yet to upend the in-store shopping experience, it seems like they won’t be going away anytime soon, even once the pandemic is over.

The pandemic has helped many online and digital product offerings, that promote convenience, grow their customer base- and food and meal delivery services are no different. But unlike Zoom for work meetings, or Peloton for spin class, it seems like these services weren’t necessarily a direct replacement for things like restaurants or in-person shopping. Instead, they seemed to have opened up a new kind of offering for food services, one that prioritizes convenience.

This will likely remain the biggest draw to the services, even as dine-in and in-person grocery options become more and more normal. But if use of these services continues to grow (as is projected by Canadians themselves), there’s the possibility that these services will continue to disrupt the food industry even further.

For more insights on the food industry and COVID-19, please reach out to Oksana, Director of Strategy & Insights at: oksana@abacusdata.ca

METHODOLOGY

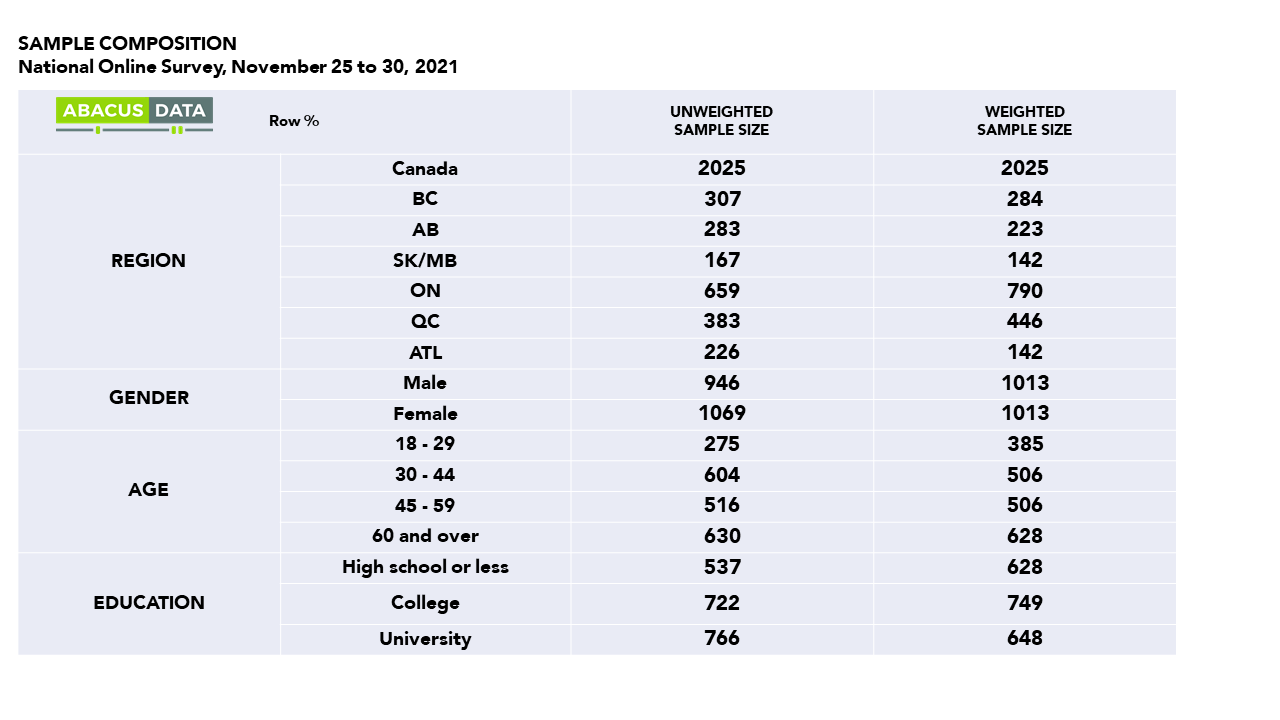

This survey was conducted with 2,200 Canadian adults from October 15th to 20th 2021. The margin of error for a comparable probability-based random sample of the same size is +/- 2.0%, 19 times out of 20.

The survey was conducted using a random sample of panelists invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The data was weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. This poll was conducted and paid for by Abacus Data.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.