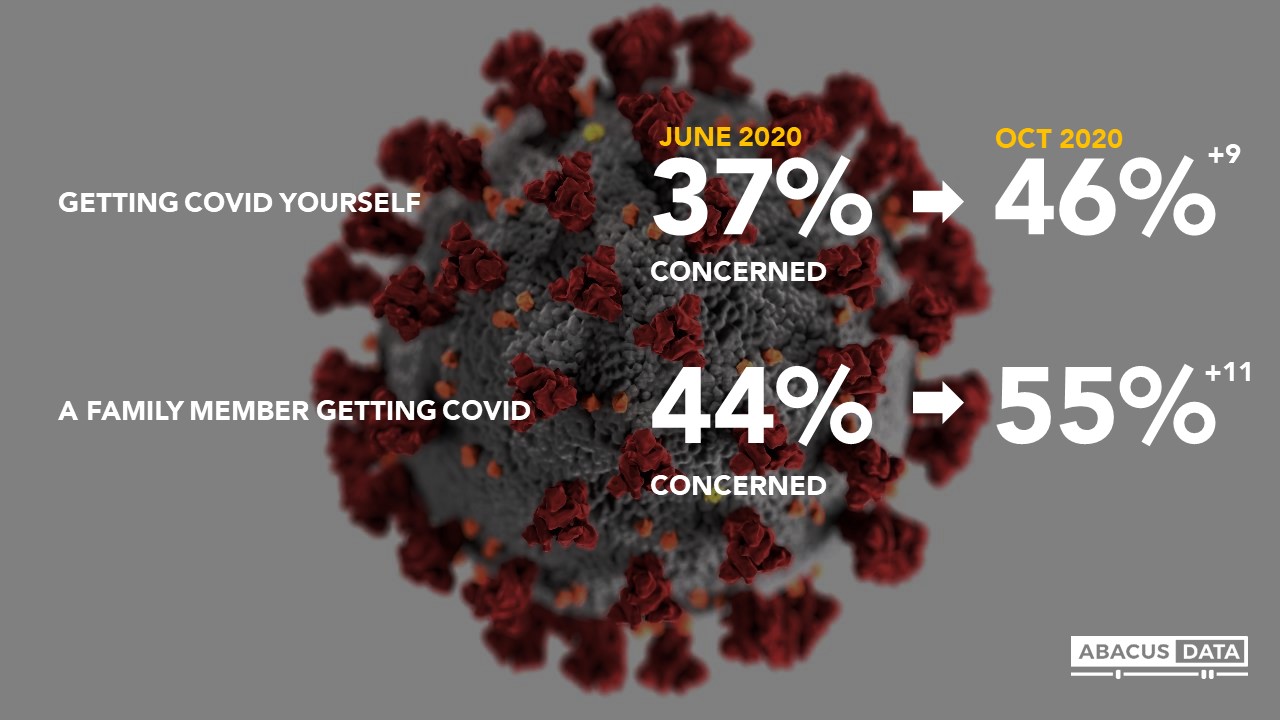

Fall brings rising concern about contracting COVID-19 in Canada

October 29, 2020

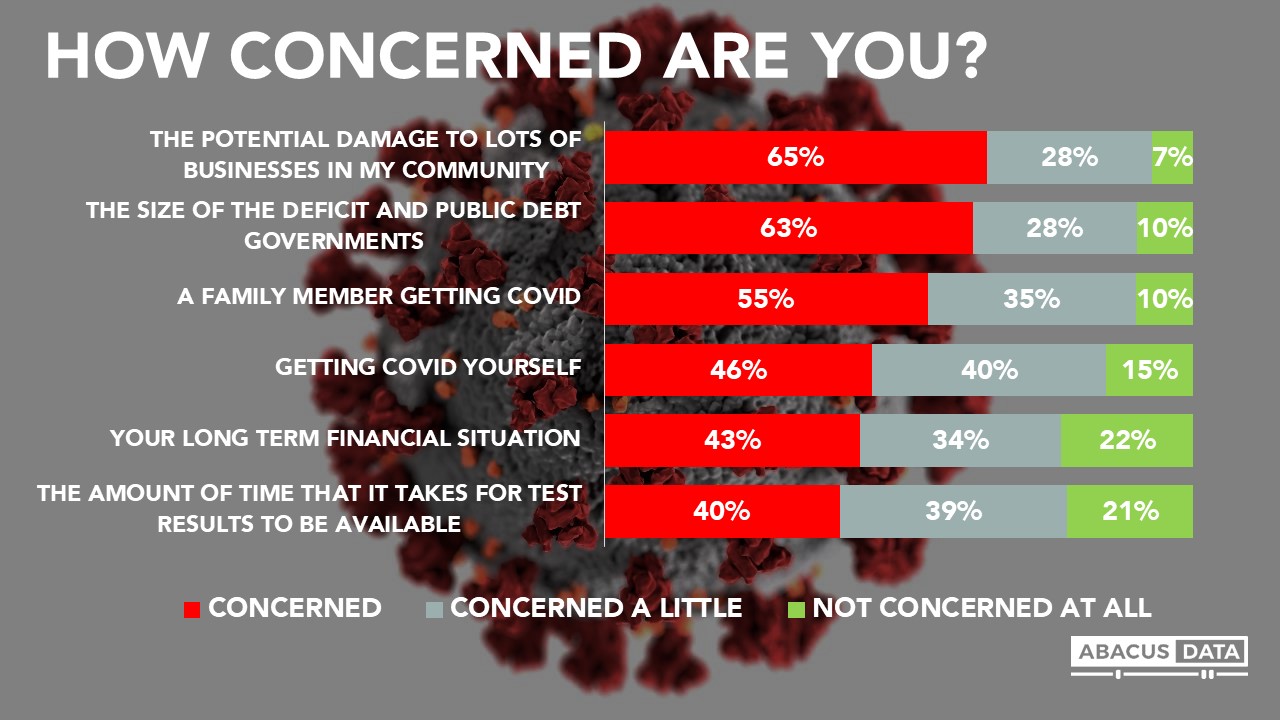

As the world struggles with rising infection rates, Canadians are also showing heightened concern that they or a family member will become infected. Today, 46% are concerned they may contract the disease (up 9 percentage points since June) and 55% are concerned that a family member will (up 11-points since June).

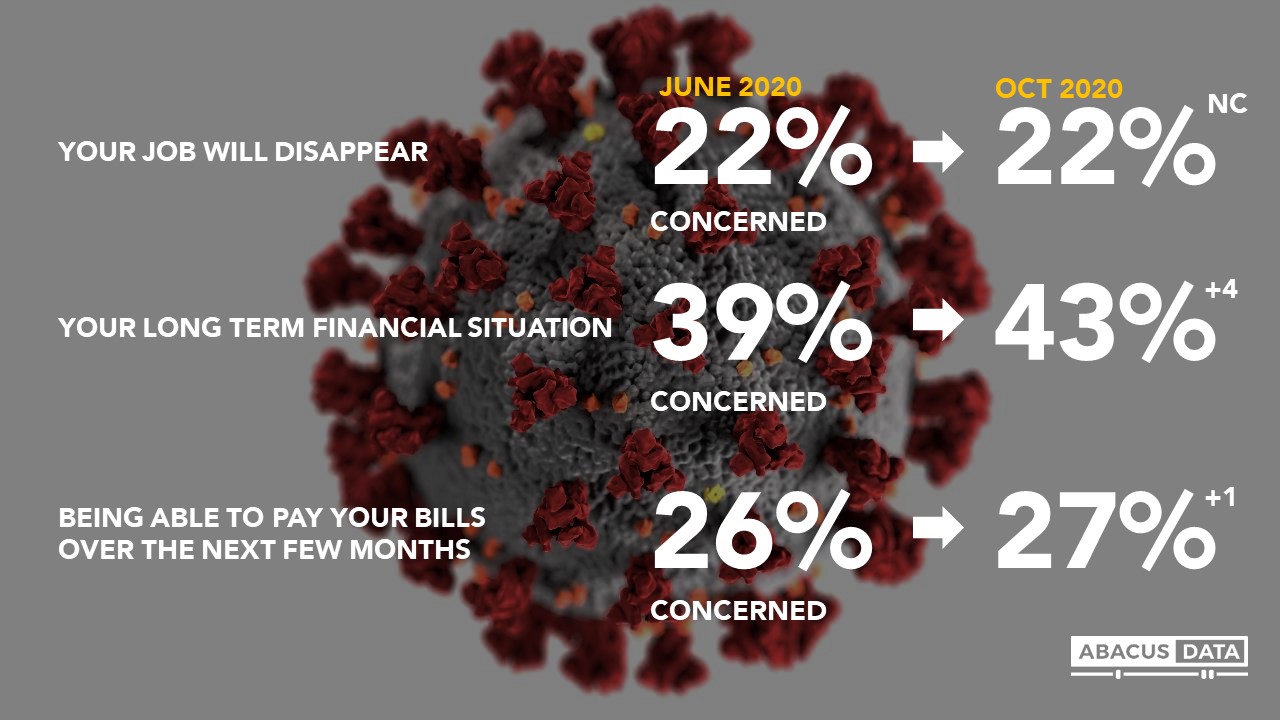

In contrast, anxiety about the personal economic repercussions of the pandemic has remained fairly stable over that period of time. Today, 27% are concerned about their ability to pay bills over the next few months (26% in June), 43% are concerned about their long term financial situation (up 4 points), and 22% are concerned their job might disappear (no change).

Roughly two-thirds are worried about the potential damage to lots of businesses in their community (65%) and are concerned about the size of the deficit and public debt (63%) taken on to help manage the impacts of the pandemic.

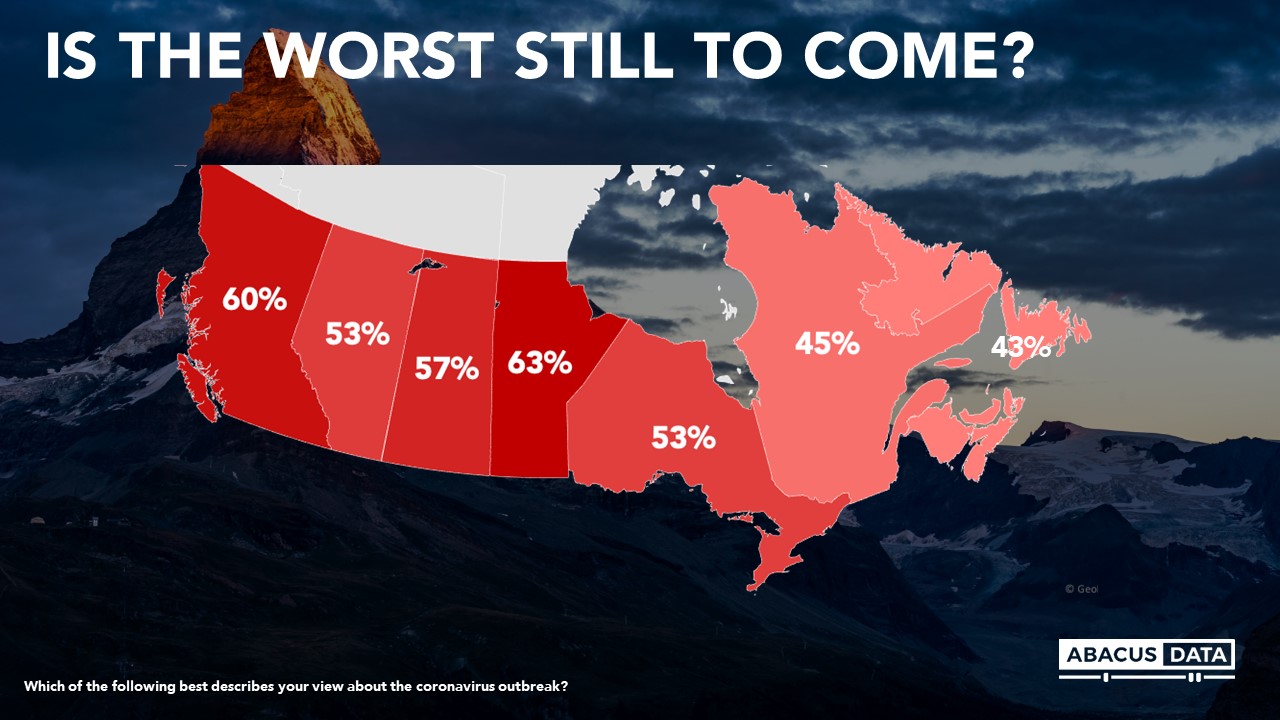

Today, more Canadians believe the worst is yet to come for the pandemic (52%) than at any point from May to mid-September. Those in western Canada are more likely to be pessimistic about the future. Perceptions are still in elevated Quebec and Atlantic Canada, but are lower than the national average.

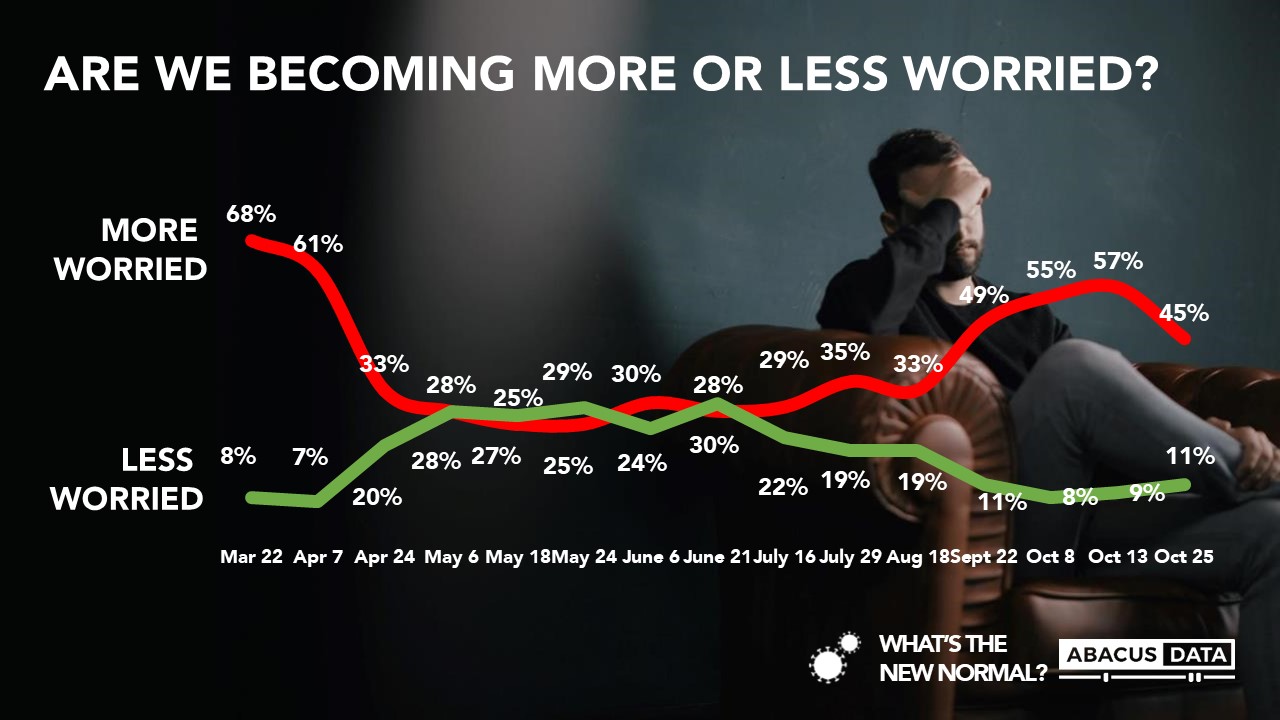

We also track whether Canadians feel they are becoming more or less worried over the past seven days. This week, 45% of Canadians say they have become more worried about the pandemic over the past week while 11% have become less worried. This is down from two weeks ago, but still higher than at any point since early April.

UPSHOT

According to Bruce Anderson: “Most of our public opinion tracking since the pandemic started reveals broad levels of concern, continued desire for governments to prescribe policies that limit the spread, and caution when it comes to resuming normal activities. Even given the months-long impacts and the inevitable fatigue with the pandemic, this stoic and steady mood continues to prevail. While people are worried about business failures, and uncomfortable with record levels of public debt, they continue to want governments to take the steps necessary to ensure public safety and to cushion economic shocks.”

According to David Coletto: “Over the past few weeks, public anxiety about the pandemic has risen to levels not seen since the early days of the outbreak of COVID-19. Our research finds that when these core fears and perceptions rise, other attitudes and behavioural change follows. The risk of panic buying essential products increases as more feel another lockdown might happen. The willingness to take risks decreases meaning fewer trips to shopping centres, grocery stores, or restaurants and a reduction in social interactions.”

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

Find out more about what we are doing to help clients respond to the COVID-19 pandemic.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

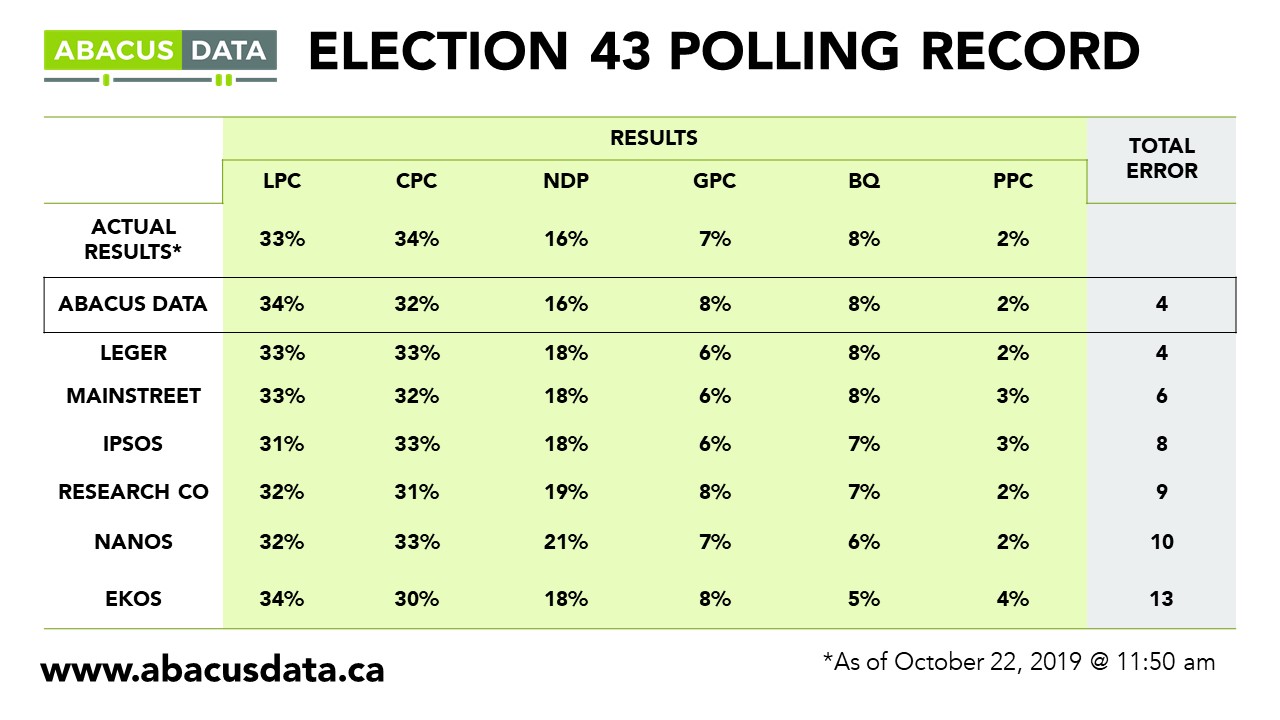

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.

METHODOLOGY

The survey was conducted with 1,500 Canadian adults from October 20 to 25, 2020. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.