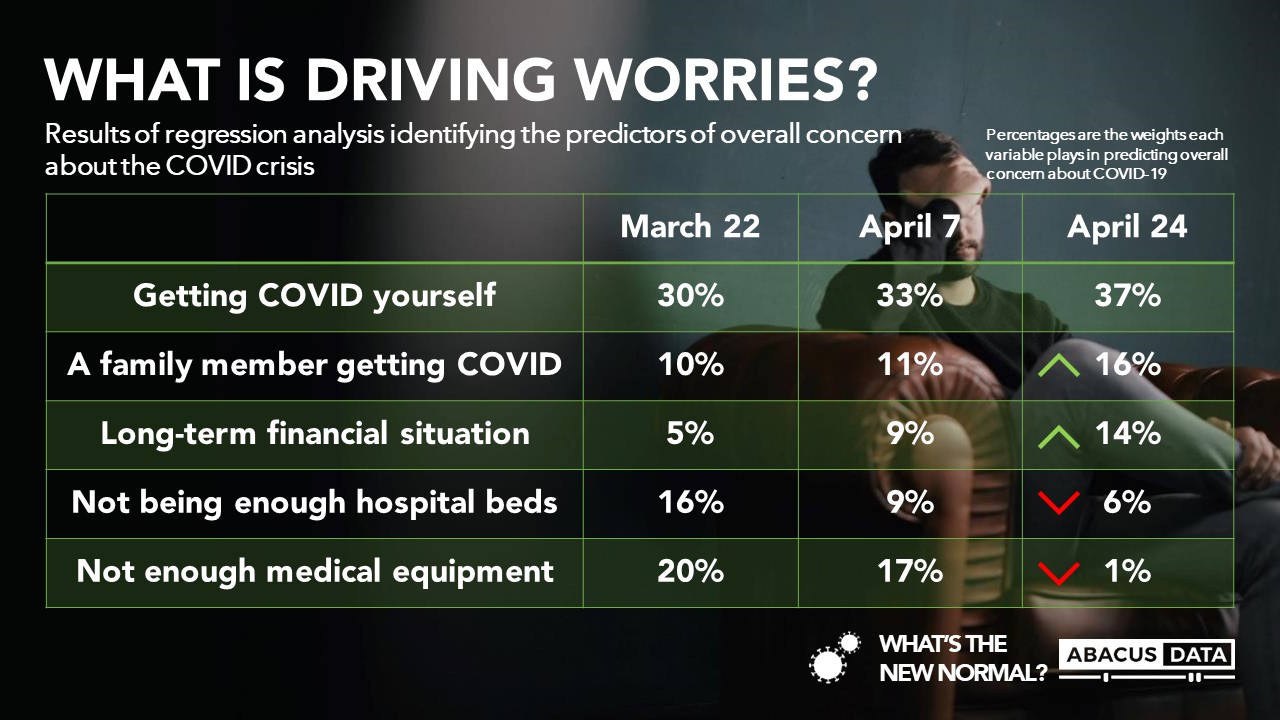

Economic concerns become more significant in driving overall concern about COVID 19

April 28, 2020

Abacus Data Bulletins are short analyses of public opinion data we collect. For more information or media interviews, contact David Coletto.

Our team has been tracking Canadian perceptions and attitudes around the pandemic for over a month now, and data suggest we have entered a new phase of the crisis, at least when it comes to public perceptions.

While many Canadians are still very concerned about the crisis, our analysis suggests that what is driving concern is shifting.

The top drivers for concern about COVID-19 continue to the fear of contracting the virus both personally and among family members. These two factors have had the most significant impact on predicting one’s level of concern from the first wave of our research.

But other factors have shifted.

In the early stages of the pandemic, concern was much more focused on whether our health system could manage the coming wave of patients and whether there would be enough protective equipment for frontline workers. Today, those factors no longer contribute much to what is driving concerns.

Instead, we see economic anxiety as a factor rising. While still well behind concerns about contracting the virus, perceptions about the long-term economic impacts now outpace worries about the health system as main drivers.

This has important implications for policymakers and businesses. First, people won’t be ready to accept big moves to re-open the economy until they feel it is safe to do so. Second, even if people can go shopping, to malls, or restaurants, they may not venture out if they feel there’s a risk that they, or someone they care about, could contract the virus.

In our most recent survey (completed April 24 with 2,600 Canadian adults), we found that 83% of Canadians want policymakers to go slow and err on the side of caution when moving towards re-opening the economy rather than move to re-open it quickly.

These opinions could change as the perceptions about the scale of economic deterioration grow, but given that about 70% of Canadians believe we will experience either a prolonged recession or a depression, suggests those concerns still factor into their views on re-opening the economy.

In short, if public opinion is guiding policy decisions in any way, don’t expect to see governments move quickly to re-open the economy until the public feels more comfortable about their safety.

METHODOLOGY

Our survey was conducted online with 2,481 Canadians aged 18 and over from April 19 to 24, 2020. A random sample of panellists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.1%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

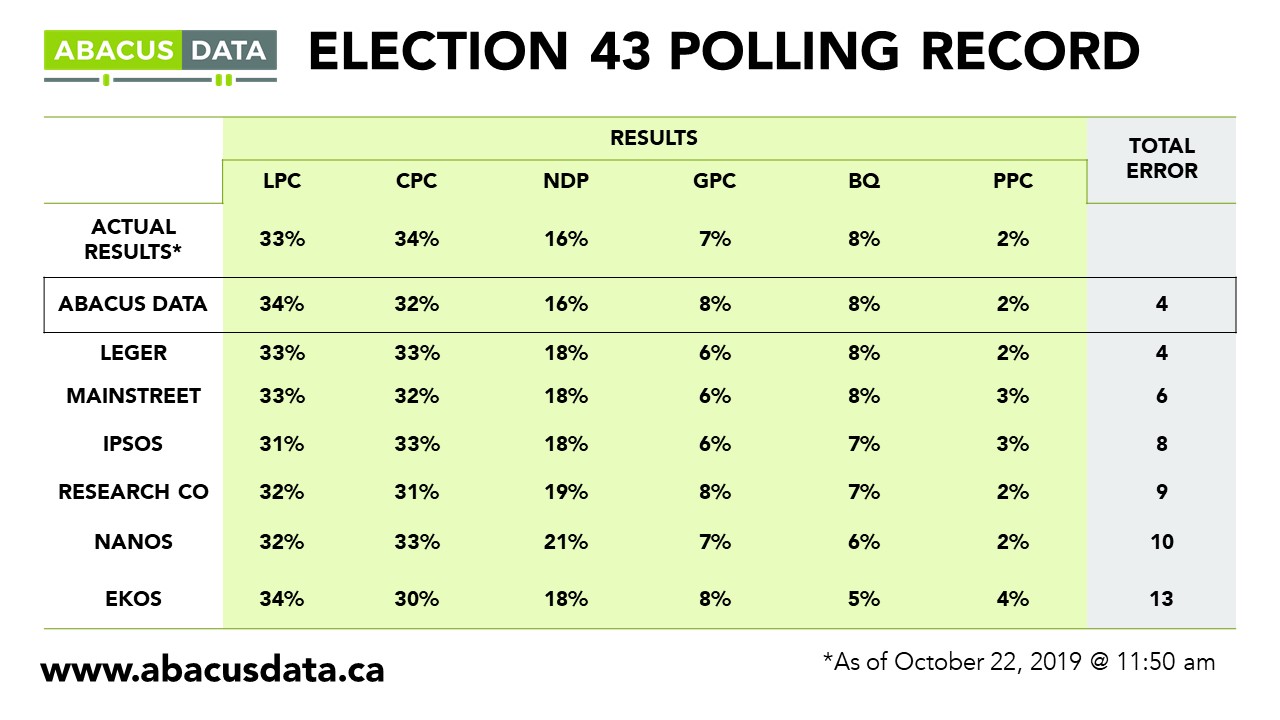

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.