Consumer Spotlight: Streaming Services in Canada

November 28, 2019

With the recent launch of both Disney+ and Apple TV Plus, the streaming wars are heating up. The market is saturated with all your favourite tv shows and movies accessible at the click of your mouse. It begs the question of whether there is enough room in the market or money in our pockets to supplement our forever-rotating list of top fav streaming sites.

In the wake of new industry players, we asked Canadians about what streaming services they subscribe to and how that compares with cable/satellite.

Here is what we found:

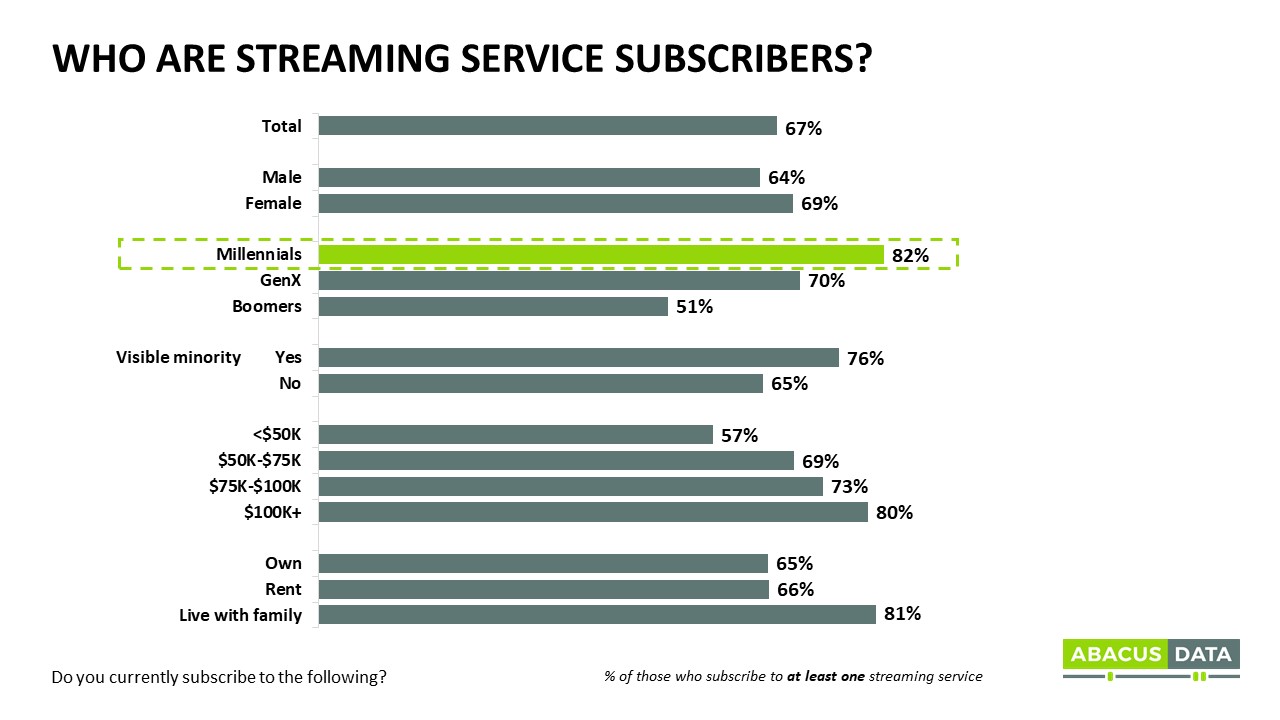

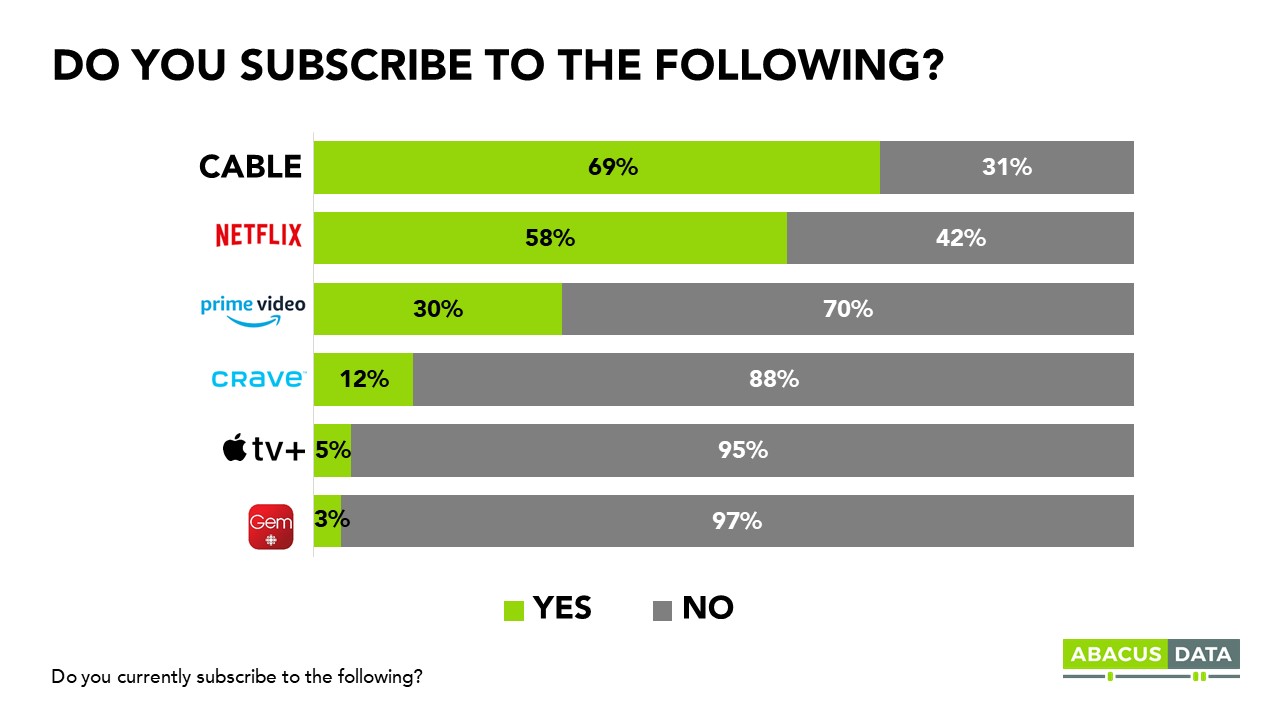

- Almost seven in ten Canadians (67%) reported being subscribed to at least one streaming subscription service.

- Just 12% of respondents are subscribed to only one streaming service.

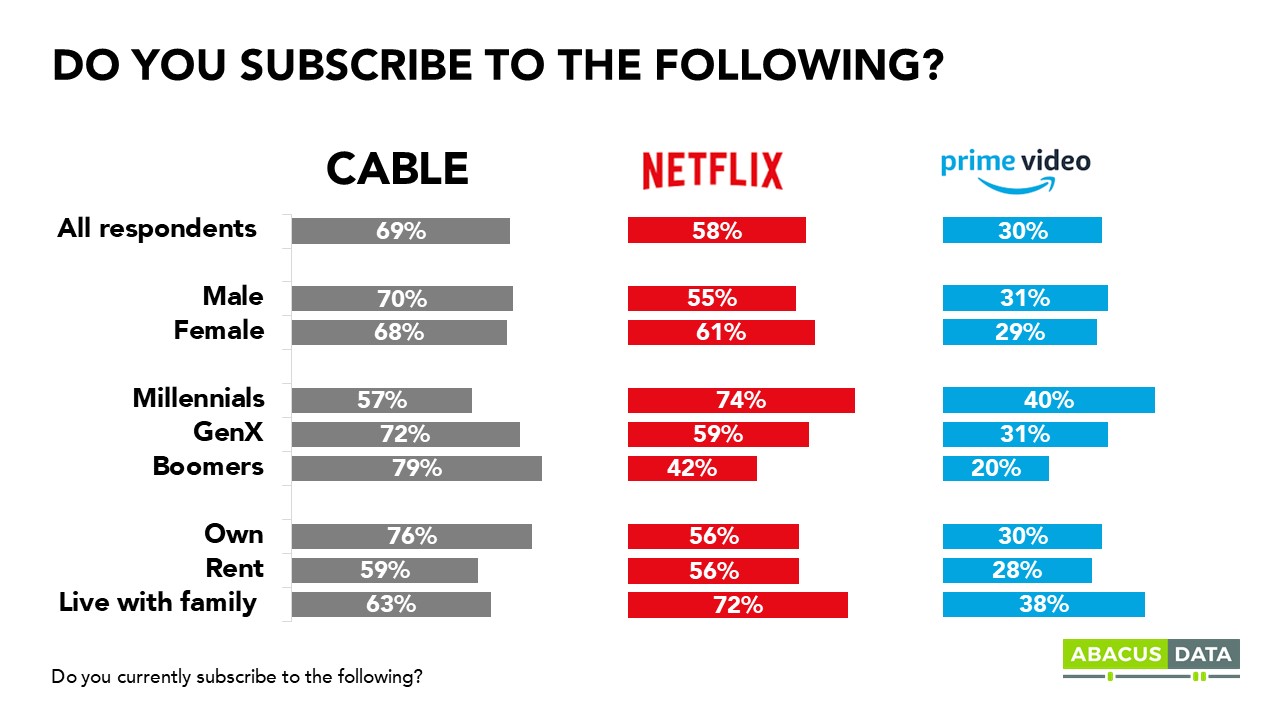

- Seven in 10 Canadians (69%) are currently subscribed to cable or satellite TV. This segment tends to be older (79% Boomers), with the potential to have a higher salary and own their home.

It is more likely that Canadians have a combination of multiple streaming service subscriptions and cable or satellite TV, than one or the other.

Two-thirds (66%) of those who are subscribed to either cable or satellite TV are also subscribed to at least one online streaming subscription service. Only 23% have at least one monthly streaming subscription and no cable or satellite TV.

Among cable and satellite subscribers

- 54% are also subscribed to Netflix.

- 29% have a subscription to Prime Video.

- 25% have only cable/satellite TV and no other subscriptions.

Six in 10 (58%) Canadians reported that they are currently subscribed to Netflix. This group is more likely to be female, suburbanites, higher in education and income, and younger (Millennials & those living with family). One-third (30%) of respondents have subscriptions to Prime Video – with similar demographic tendencies to Netflix.

Netflix and Prime Video appear to be comfortably the market leaders. Netflix is one of the world’s first online streaming subscription services and has over 148 million subscriptions worldwide. Netflix has been inherited through families and has an endless range of movies, TV shows, documentaries, and Netflix original content. Those who subscribe to the hugely popular Amazon Prime are automatically awarded a subscription to Prime Video (subscriptions can also be purchased individually). These two streaming services have accumulated massive bases of subscribers with many years’ head start. They are not likely to be dropping out of the running anytime soon.

Although the streaming market is saturated with subscription services, Canadians are likely to have a rotating lineup of their favourites – heavy competition means it’s more challenging to remain on someone’s roster than to be initially selected.

As is the case with many new/modern services, Millennials are the first to recognize the value of subscription streaming services – they are cost-effective and cheaper than cable or satellite TV, and you don’t have to abide by traditional viewing schedules. Being able to consume content whenever, wherever, and however you want is very Millennial-friendly. Eight in ten (82%) of Millennials subscribe to at least one streaming service: 74% are subscribed to Netflix and 40% are subscribed to Prime Video.

As generations continue to mature, we can expect to see a progressive increase in the number of subscribers to streaming services, which could shift the proportion of tv/cable subscribers and online streaming subscribers – lessening the market share for tv/cable subscribers. The streaming market is becoming saturated and competition more intense. Netflix is the market leader in Canada, but Prime is growing thanks to the other perks of membership.

Disney+ enters the market with a strong catalogue of content and Canada’s largest generation (millennials) well into childbearing years and Baby Boomers increasingly becoming grandparents. With content for young and old, Disney+ has the content, now it needs to compete for that share of time and wallet content producers and distributors are continuing the compete for.

METHODOLOGY

Our survey was conducted online with 3,000 Canadians aged 18 and over from November 12 to 17, 2019. A random sample of panellists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 1.79%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

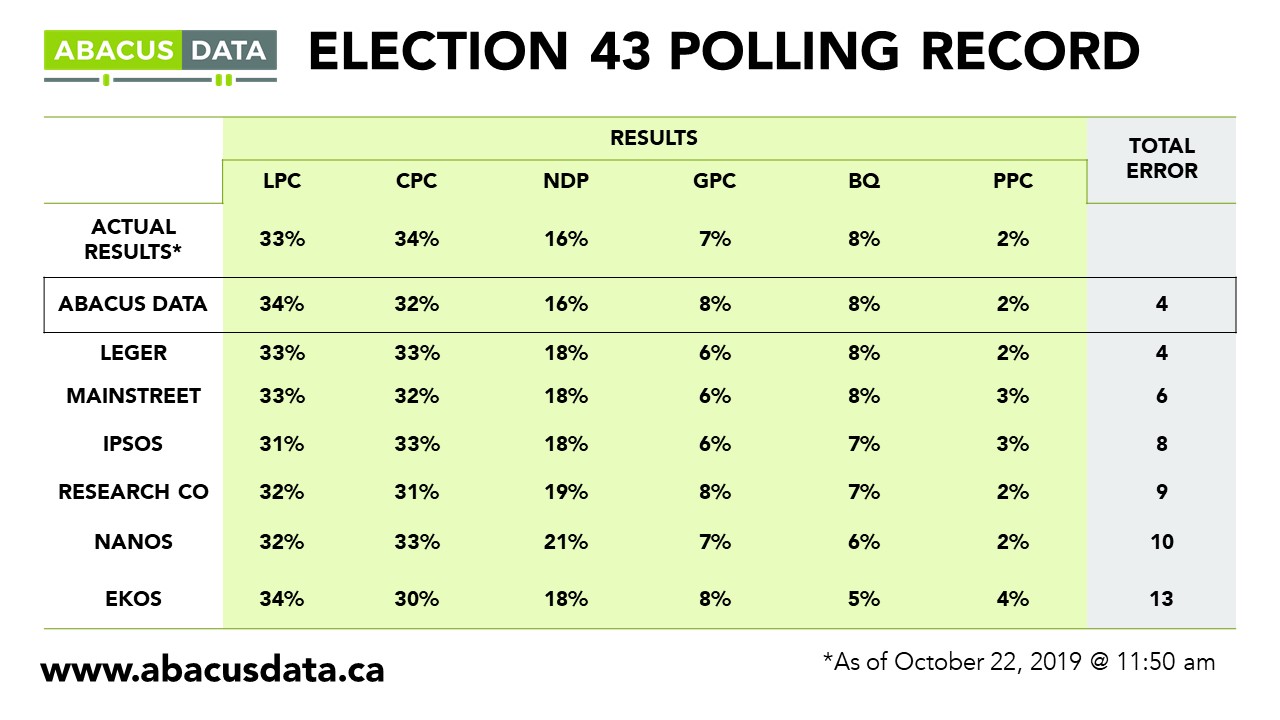

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.