Affordability anxiety continues as income and wealth disparity, made worse by the pandemic, drives priorities for political agenda.

August 13, 2021

Pour l’analyse de la langue française, cliquez ici

For video interviews by Skype or Zoom or audio interviews, please contact David at 613-884-4730 or david@abacusdata.ca

In a survey I did for the Broadbent Institute back in March 2019, I described the mood at the time as affordability anxiety – a feeling that your income is not covering your day-to-day expenses and your ability to cover those expenses will only get harder, not easier.

This year, we asked several of the same questions again in a survey we did for the Broadbent Institute and the Professional Institute of the Public Service of Canada.

Here’s what we found:

1. Affordability anxiety persists. 83% of Canadians worry at least a little about their cost of living, with 39% saying they are pretty or very worried. Overall, this is slightly down from 2019 but remains elevated. Younger Canadians and those in households earning less than $50,000 per year were more likely to feel worried about their cost of living rising.

2. Affordability anxiety crosses the political spectrum but highest among Green, NDP and undecided voters. Worry about a rising cost of living crosses the political spectrum. Those who say they are pretty or very worried about their cost of living rising by current vote:

- Liberal – 33%

- Conservative – 31%

- NDP – 46%

- Green – 51%

- BQ – 41%

- Undecided voters – 49%

3. Cost of living, healthcare, and housing affordability are the top three vote drivers. When asked which three issues are most likely to impact how they vote, cost of living (35%), healthcare (33%) and housing affordability (28%) along with economic growth and job creation were in the top four.

4. The pandemic has hurt the personal finances of 1 in 3 Canadians – or almost 10 million people. 33% of Canadians say the pandemic left their household budget and savings worse off while 14% they are better off financially.

5. Most Canadians believe the cost of things they use day-to-day and the income differences between the richest 1% and your personal salary have gotten worse over the past 2 years. When assessing whether several things have gotten better or worse over the past two years, 64% feel the cost of things they use and consume day to day have gotten worse. Moreover:

- 53% think the income difference between the richest 1% and their salary is worse over the past two years.

- 42% say their ability to save for retirement has gotten worse over the past two years

- 41% say their feelings of stress about money has gotten worse over the past two years.

6. What would help make life more affordable? There’s no silver bullet and reactions depend on someone’s life stage and economic position. But millions of Canadians believe that covering more under public health care, ensuring everyone has a stable job with a decent wage, and taxing wealthier Canadians and large corporations more to pay for better public services for everyone would help.

For others, forcing companies to reduce prices, cutting taxes for middle and working-class Canadians, and making childcare more affordable would help a lot.

Those under 30 are more likely to think the following would help make their life more affordable:

- Making childcare more affordable, raising the minimum wage, reducing tuition fees, creating incentives to encourage employers to raise wages, improving public transit and reducing transit fees, and making it easier for workers to unionize.

Those aged 60 and over are more likely to think the following would help make their life more affordable:

- Covering more services under public healthcare, taxing wealthier Canadians and large corporations more to pay for better public services for everyone, and forcing companies to reduce the prices they charge for things.

UPSHOT

Although the level of affordability anxiety is lower than it was in 2019, it remains widespread, especially for those most hurt financially by the pandemic and is a top vote driver for over 1 in 3 Canadians – higher than any other issue.

Millions of Canadians worry about being able to afford their lives as pressure from rising costs and stagnant wages increase anxiety.

People believe the pandemic has made things worse. Not only do those most impacted by the pandemic feel even more anxious about affordability, but many feel the pandemic has increased inequality between the richest and everyone else.

The connection between affordability anxiety and perceptions of increasing income and wealth inequality is clear. Concerns about wages and income, job security, and rising prices are colliding with growing uncertainty about the sustainability of public services with a large deficit and more debt along with an uncertain economic recovery.

As we approach a federal election campaign and party leaders and candidates debate how best to deal with the federal deficit and affordability issues – these results clearly indicate that most Canadians will react negatively to ideas that they feel will make their lives more expensive. In contrast, as we have seen in the previous research we released, there’s broad appetite for asking those with the most to pay a bit more.

Protecting public services and keeping costs down for middle- and lower-income Canadians while asking those with the most to pay more to cover the cost of the pandemic and the recovery is a cross-partisan, broadly supported approach.

METHODOLOGY

Our survey was conducted online with 1,500 Canadians aged 18 and over from July 13 to 19, 2021. A random sample of panellists was invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

Find out more about what we are doing to help clients respond to the COVID-19 pandemic.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail and exceptional value.

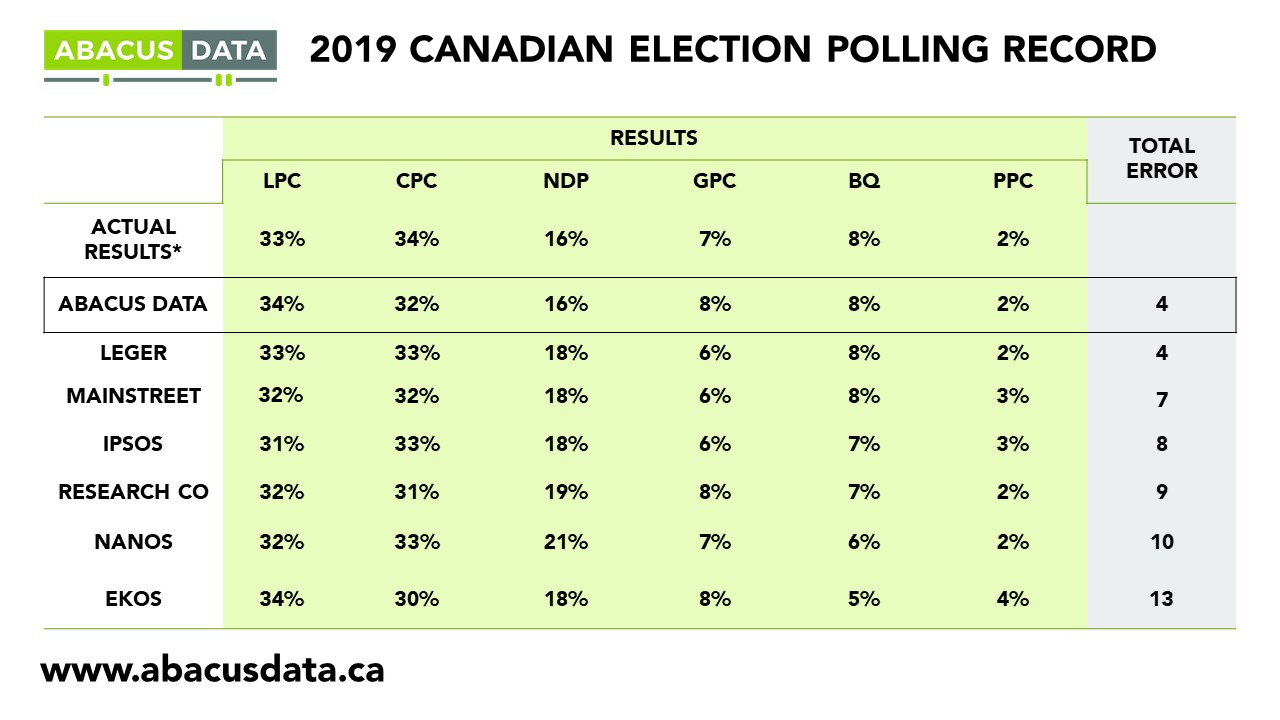

We were one of the most accurate pollsters conducting research during the 2019 Canadian Election.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.