Understanding Canadian Perceptions of the Climate Action Incentive Payment and the Carbon Tax: An In-Depth Poll Analysis

In a recent Abacus Data survey, conducted from January 18 to 23, 2024, interviewing 2,199 Canadian adults, offers crucial insights into the public’s perception of the federal government’s national price on pollution, or carbon tax, and specifically the Climate Action Incentive Payment (CAIP). Results of this poll were reported in the Toronto Star yesterday and were asked on our regular national omnibus surveys.

Here are what I think the key takeaways are:

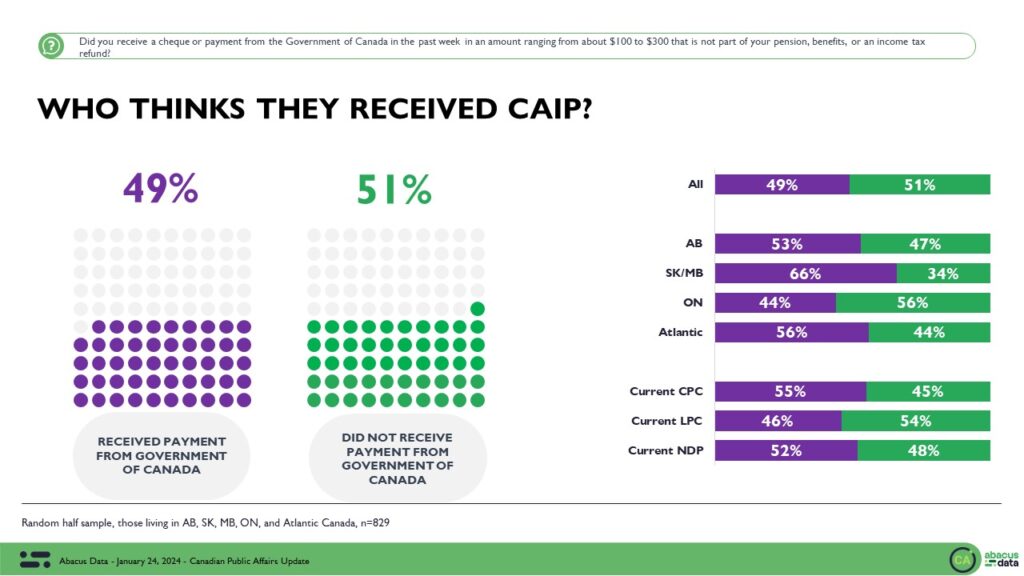

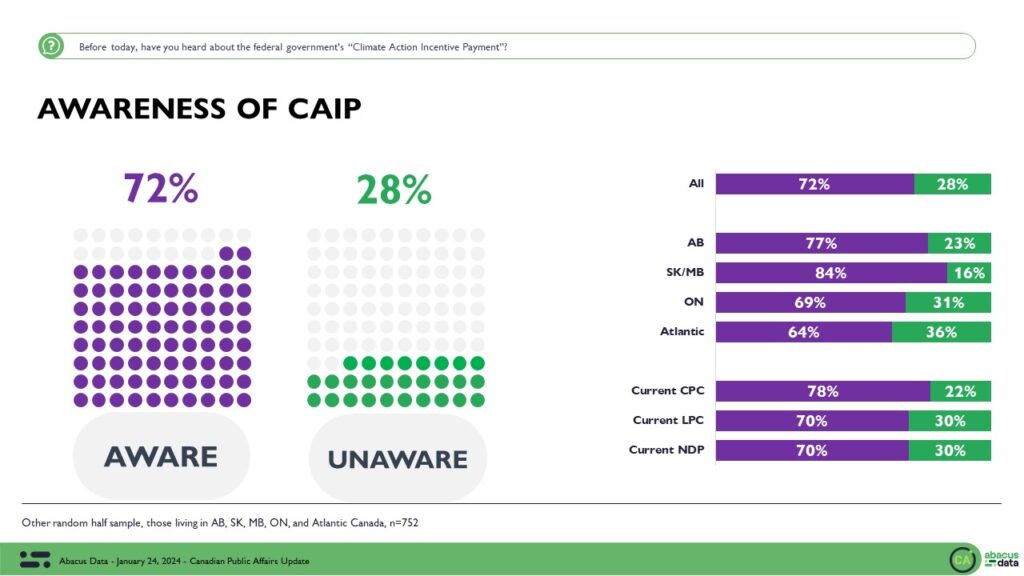

1. Limited Awareness and Belief in Receiving CAIP.

The survey reveals a significant gap in the awareness and belief among Canadians eligible for the CAIP. Only about half of eligible Canadians believe they received a payment. Among those who acknowledge receiving it, 86% associate it with the carbon tax. However, this still represents a minority of the eligible population. This gap highlights a major communication challenge for the federal government and advocates of carbon pricing. The lack of understanding about CAIP’s purpose exacerbates this issue, with only 48% correctly identifying its link to carbon pricing.

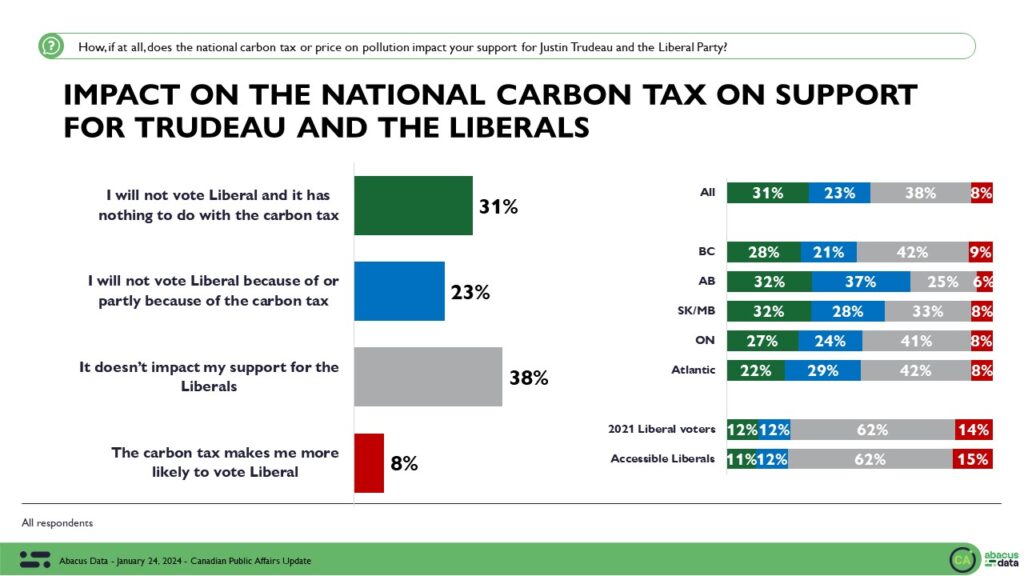

2. Carbon Pricing may be a Decisive Factor in the next Federal Election

The price on pollution or carbon tax, while not overwhelmingly unpopular, faces enough opposition to influence election outcomes significantly. Notably, 12% of 2021 Liberal voters not they won’t be voting Liberal partly or entirely because of the carbon tax. This sentiment is particularly pronounced in regions like Ontario and Atlantic Canada, presenting a tangible opportunity for the Conservatives to capitalize on this discontent and explains the double digit lead the Conservatives have build in those regions.

3. Challenges in Government Communications

The Liberal government’s 2016 rules on limiting government communications appear to have inadvertently restricted its ability to effectively convey policy rationales to the public. This is evident in the case of CAIP and pollution pricing. The reliance on earned media, which is becoming increasingly less effective, suggests a possible need to revisit these communication rules to enhance public understanding and support for government policies.

Now let’s dig into the survey results.

Detailed Insights from the Polling Data

1. Awareness and Belief in Receiving CAIP

The survey reveals that only about half of Canadians in eligible jurisdictions believe they received the CAIP payment. This figure points to a significant awareness gap, as the actual number of eligible recipients is much higher. This disparity suggests that the payment – which is designed to build support for the policy – is not being noticed by citizens.

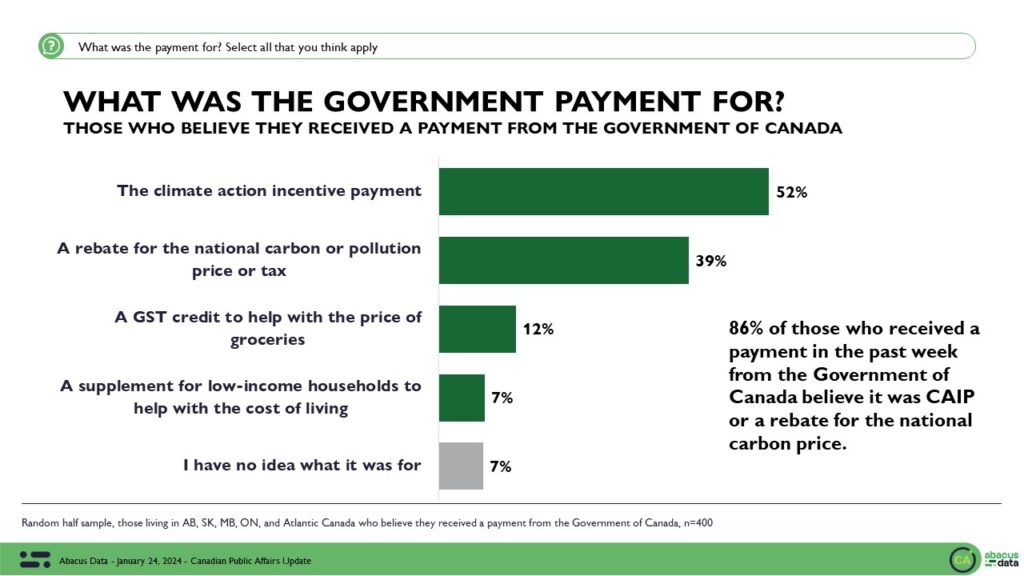

Among the minority who recognize receiving the payment, 86% correctly link it to the carbon tax, indicating effective communication to a segment of the population but an overall failure to reach the broader eligible demographic.

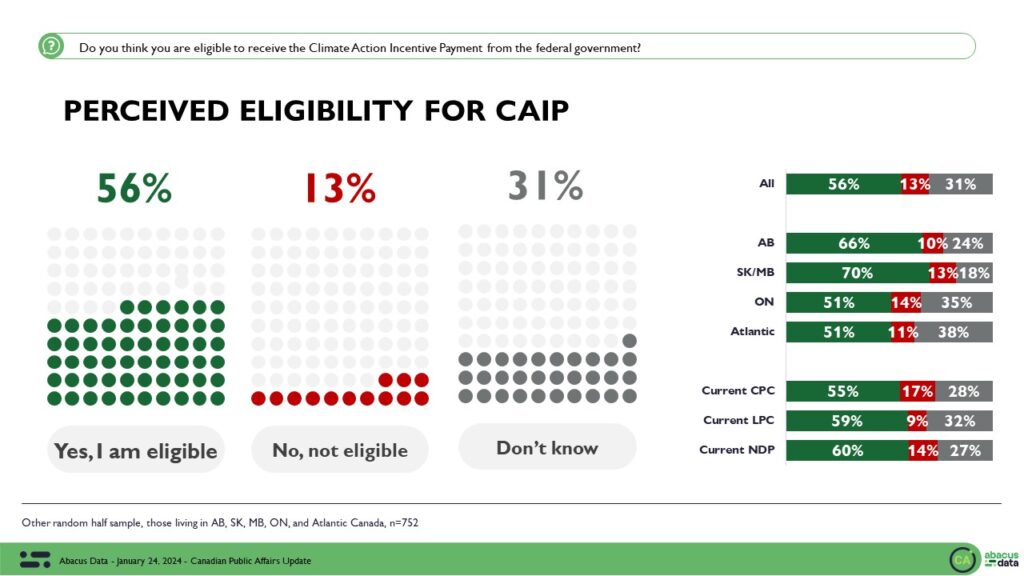

2. Regional Variations in CAIP Awareness:

Regional differences in CAIP awareness are stark. Awareness is highest in Saskatchewan and Manitoba at 84%, while it drops to 64% in Atlantic Canada. This regional disparity in awareness and perceived eligibility could reflect differing regional media coverage, political discourse, and public engagement with provincial governments.

In populous provinces like Ontario, only half of the residents believe they are eligible for the payment.

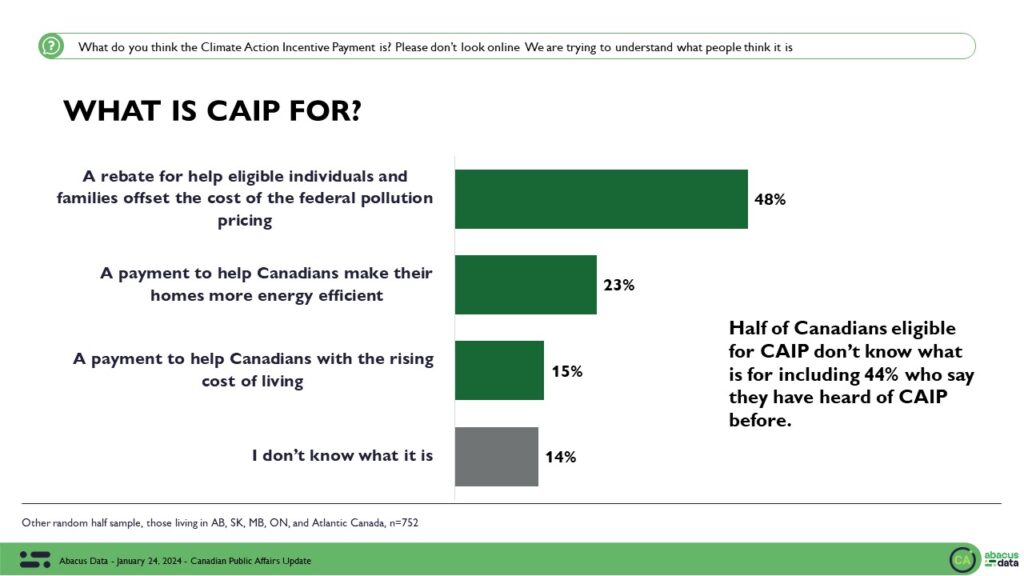

3. Misunderstandings About CAIP’s Purpose:

When it comes to understanding CAIP’s purpose, the confusion is widespread. Less than half correctly identify its link to carbon pricing. A significant portion, 23%, erroneously believe it’s a payment to enhance home energy efficiency, while 15% associate it with general cost-of-living support. This confusion dilutes the policy’s perceived effectiveness and relevance, undermining its intended impact as a tool for climate action awareness (see more below on this).

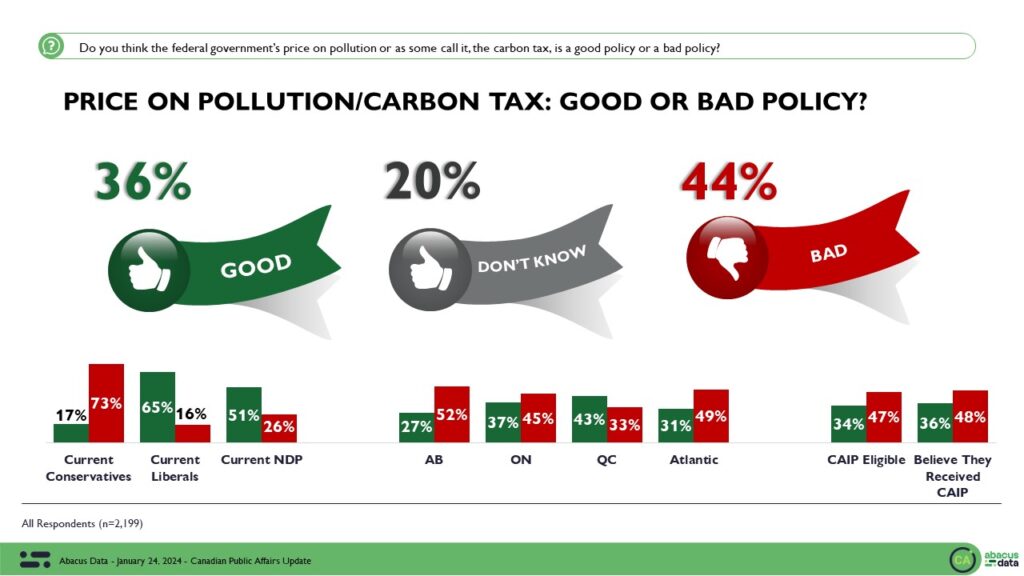

4. Divided Opinion on Carbon Tax Policy:

Canadians are almost evenly split in their perception of the carbon tax, with a slight plurality(44%) viewing it negatively. This divide is not a vast chasm but indicates a significant challenge in garnering broader public support. Notably, the negative perception is more pronounced in strategically important regions like Ontario and Atlantic Canada, areas crucial for federal electoral success. For example, Atlantic Canadians are almost as likely as Albertans to believe the carbon tax is bad policy.

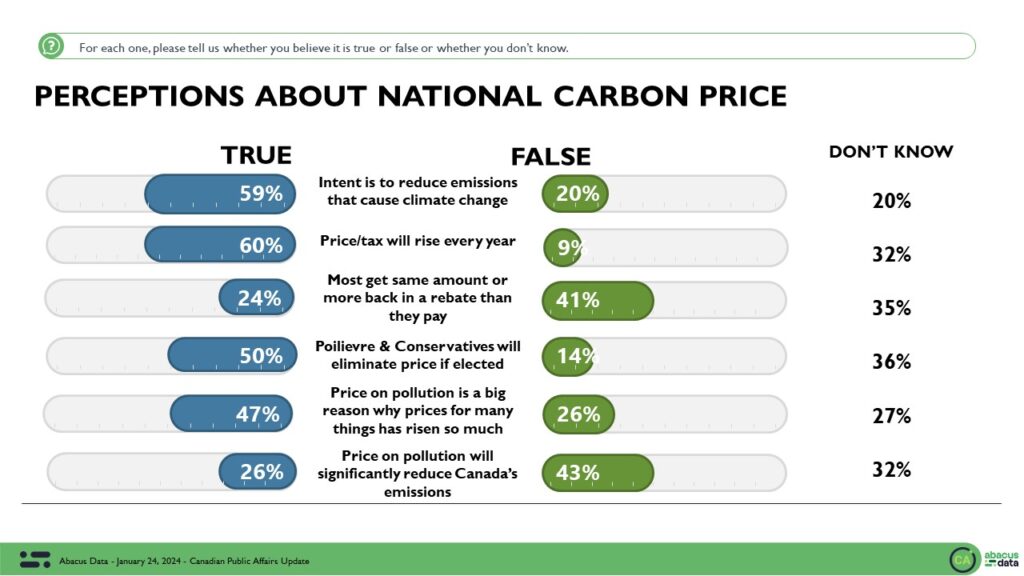

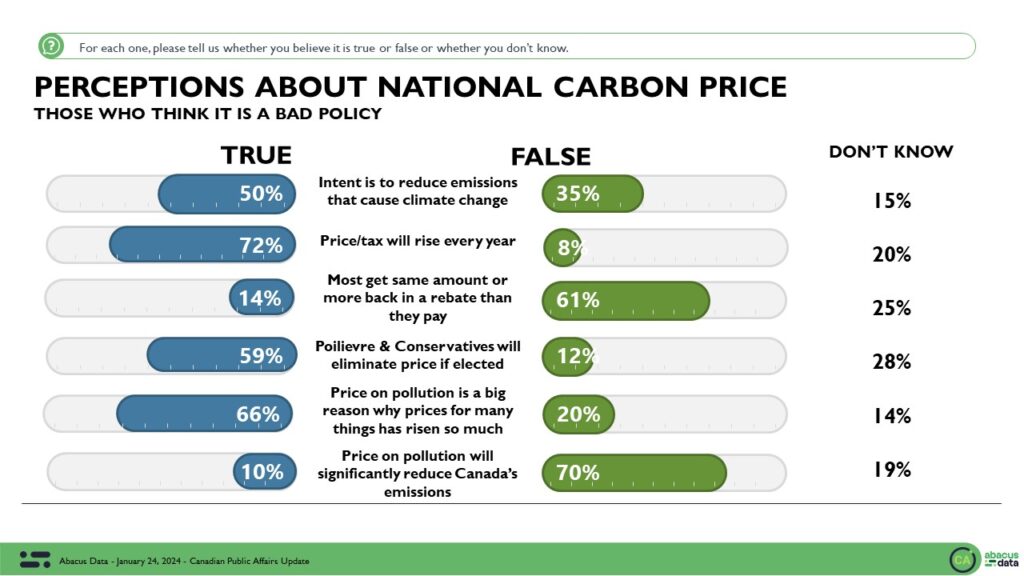

5. Perceptions vs. Reality of Carbon Tax Impacts:

The survey indicates a strong influence of misconception on public opinion. A significant 41% believe that the rebate does not compensate most people for the pollution prices they pay in energy costs (which is a main argument in favour of the policy design). Similarly, 43% doubt the policy’s efficacy in reducing emissions, and 47% attribute broad price increases to the carbon tax. These perceptions are not just knowledge gaps; they are potent narratives that have taken root in the public consciousness, likely fueled bythe political debate and what I believe is insufficient government communication.

And more striking, among those who think the carbon price is a bad policy are even more likely to hold the perceptions noted above. 1 in 3 don’t believe the price on pollution’s intent is to reduce emissions, 6 in 10 don’t believe most get what they pay back in a rebate, and 7 in 10 don’t think a carbon tax will significantly reduce emissions.

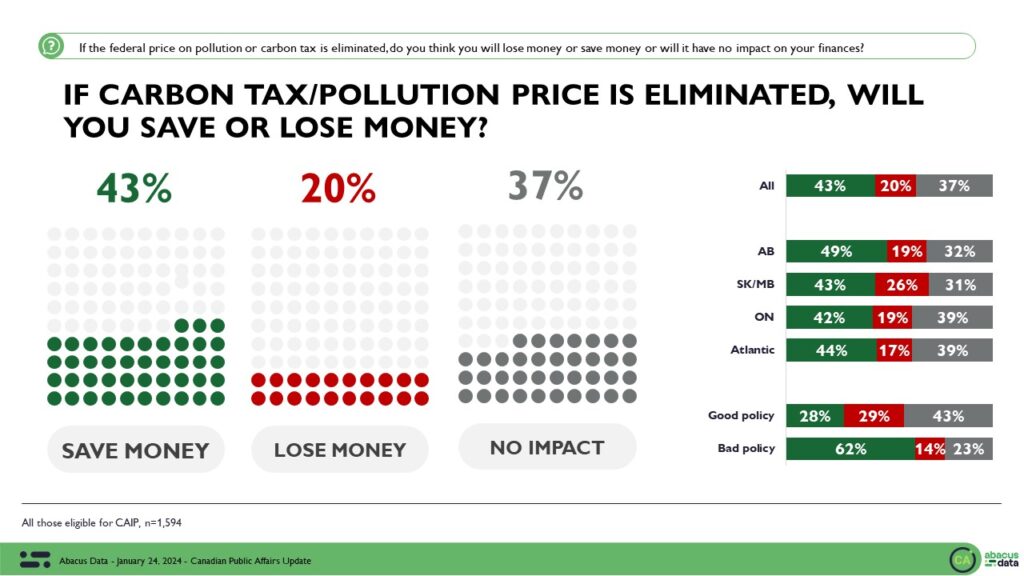

6. Financial Impact and Perception:

The belief about the financial impact of the carbon tax is a critical factor in public opinion. 43% of those eligible for CAIP think they would save money if the carbon tax were abolished, a perception more than twice as common as the belief that they would lose money. This sentiment is particularly strong among those who view the policy negatively, indicating a correlation between policy opposition and the perception of financial detriment.

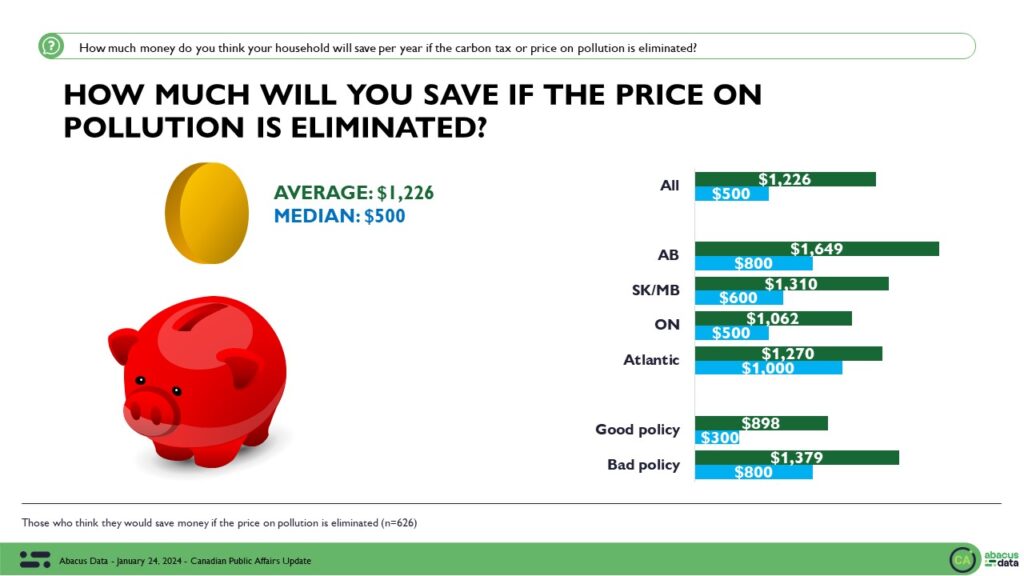

7. Estimated Savings and Policy Opposition:

The estimated savings if the carbon tax were eliminated further underscores the financial concern driving opposition. Those against the policy estimate a higher personal financial impact, with an average perceived saving of $1,226, compared to those who support the policy. This disparity suggests that opposition to the carbon tax is partly rooted in a belief in its significant financial burden, whether accurate or not.

8. Political Implications and Voter Trends:

The political ramifications of these perceptions are profound. One in four Canadians, including a notable 10% of past Liberal voters, cite the carbon tax as a reason for withdrawing their support from the Liberals. This trend is more pronounced in regions like the Prairies and Atlantic Canada, indicating a regional dimension to the policy’s unpopularity that could reshape the federal political landscape.

The Upshot

The survey data underscores three critical points for professionals engaged in policy communications and advocacy:

- Enhancing CAIP Awareness: There is a pressing need to improve awareness and understanding of CAIP among Canadians. Effective communication strategies must be developed to bridge this knowledge gap.

- Addressing Carbon Tax Opposition: The carbon tax’s potential electoral impact necessitates a nuanced approach to address the concerns of those opposed while reinforcing the policy’s benefits.

- Revisiting Government Communication Strategies: The current limitations on government communications are proving counterproductive in explaining complex policies like CAIP and pollution pricing. A revision of these rules could be instrumental in fostering better public comprehension and support.

This research not only provides a snapshot of the current Canadian sentiment towards the carbon tax and CAIP but also highlights the intricate challenges and opportunities that lie ahead for policymakers, communicators, and advocates. Opponents are clearly winning the debate and public opinion on this issue could be decisive in the next election.

Good research like this can help guide policy communications, stakeholder engagement, and policy design.

Looking to conduct polling or market research in 2024? Have budget left to spend before the end of March? Send Yvonne an email to connect with the Abacus Data team today!

Methodology

The survey was conducted with 2,199 Canadian adults from January 18 to 23, 2024. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.1%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.