Earlier this week I was in Calgary speaking to a business group about the political environments in Canada and Alberta. I shared some data from a new survey Abacus Data completed last week exploring the public mood as well as political opinions and perceptions.

The data in this briefing comes from an online survey of a representative sample of 1,000 Albertan adults from December 6 to 10, 2023.

Key Takeaways:

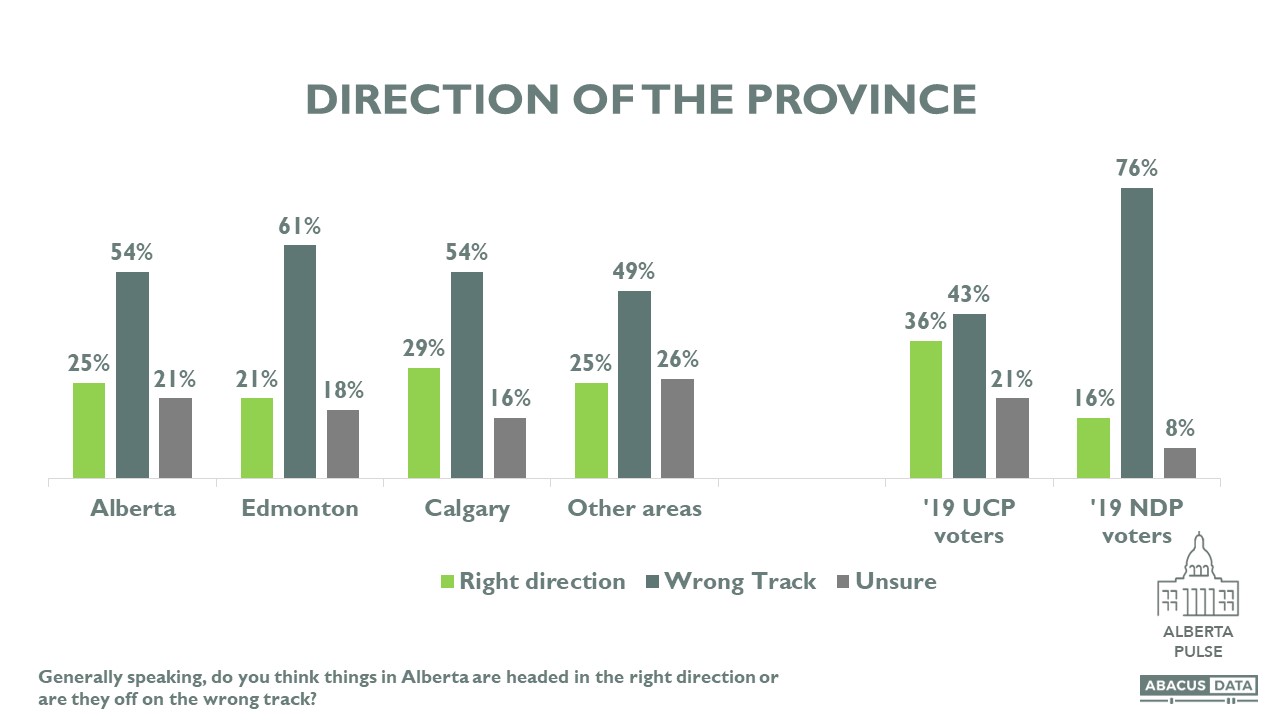

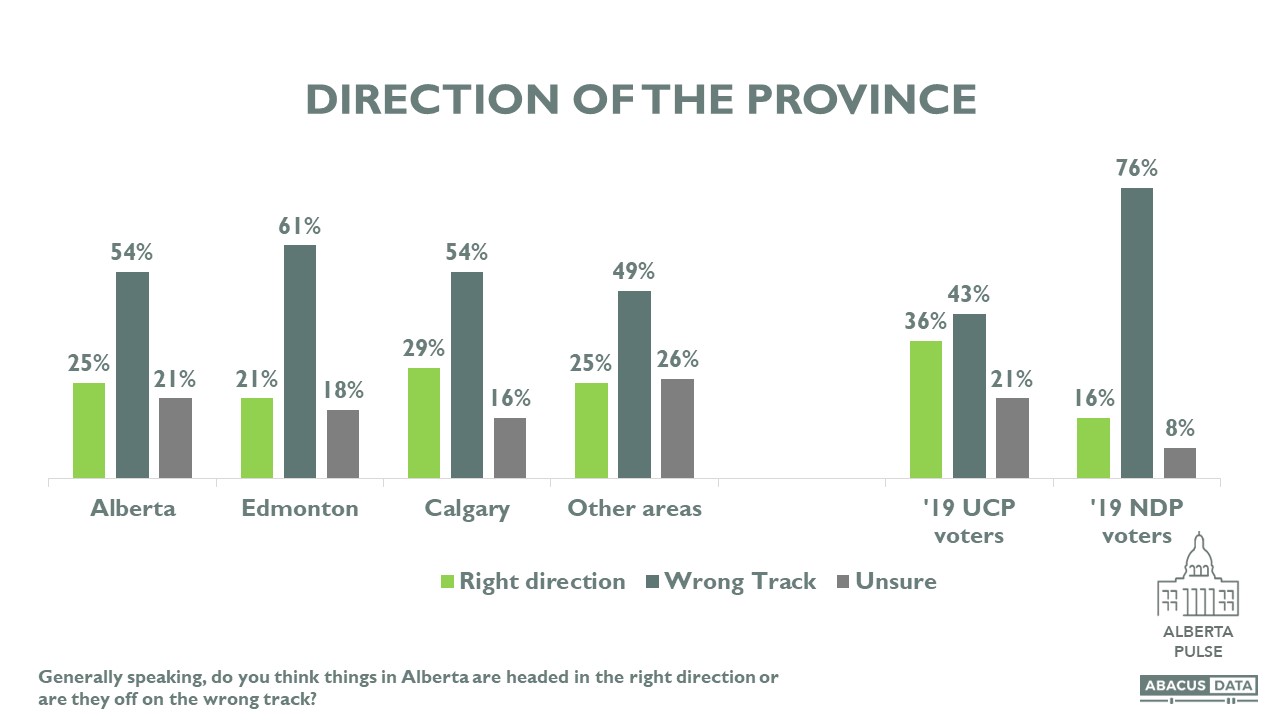

1. Only 25% of Albertans think the province is headed in the right direction.

2. The top issues are cost of living, healthcare, the economy, taxes, and housing.

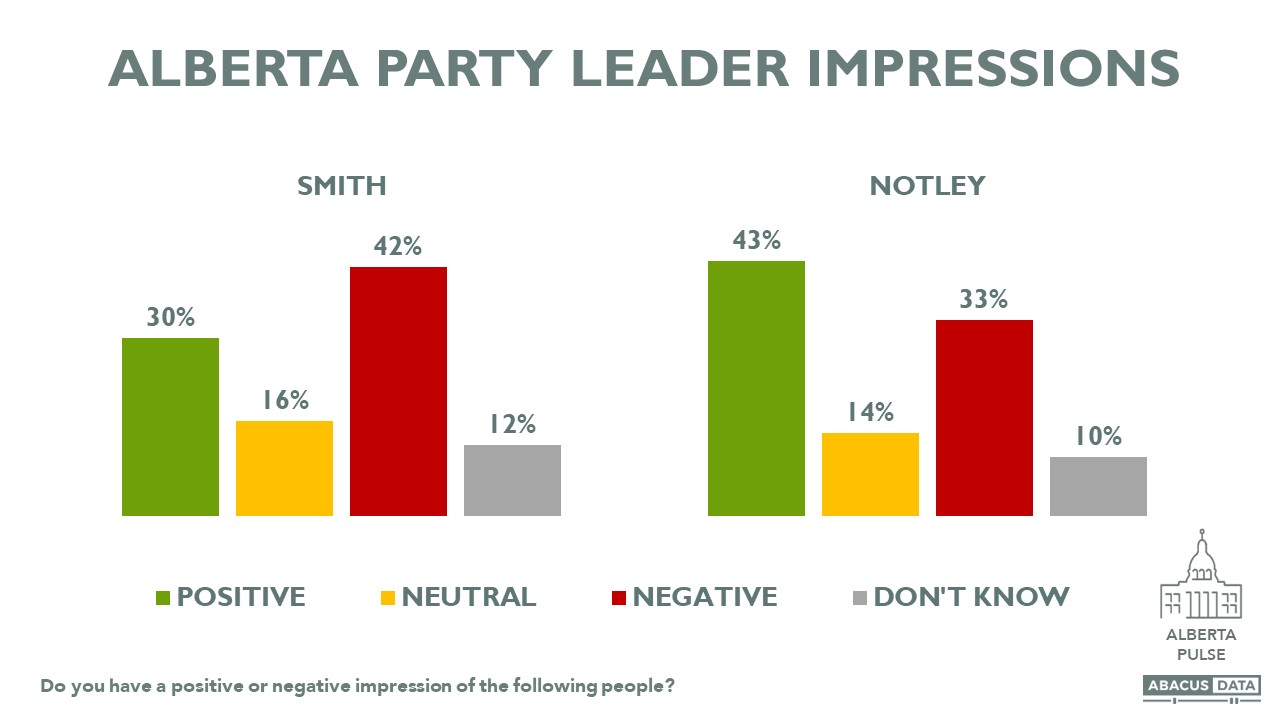

3. Rachel Notley is viewed more positively than Danielle Smith.

4. NDP leads the UCP by 9 among decided voters. 25% of Albertans are undecided.

5. But the gap is only 4 points on preferred premier: Notley 52% vs. Smith 48%.

6. Understanding how “reluctant UCP” voters react over the next few months will be critical to anticipating the results of the next election.

Here’s my full read of the data and what it means about five months from a provincial election.

ONLY 1 IN 4 THINK THE PROVINCE IS HEADED IN THE RIGHT DIRECTION

The overall mood of the public is fairly negative. 1 in 4 think the province is headed in the right direction while a slight majority (54%) think it’s off the track. This view is consistent across the province. Perhaps most important, more 2019 UCP voters think the province is off on the wrong track than think it’s headed in the right direction.

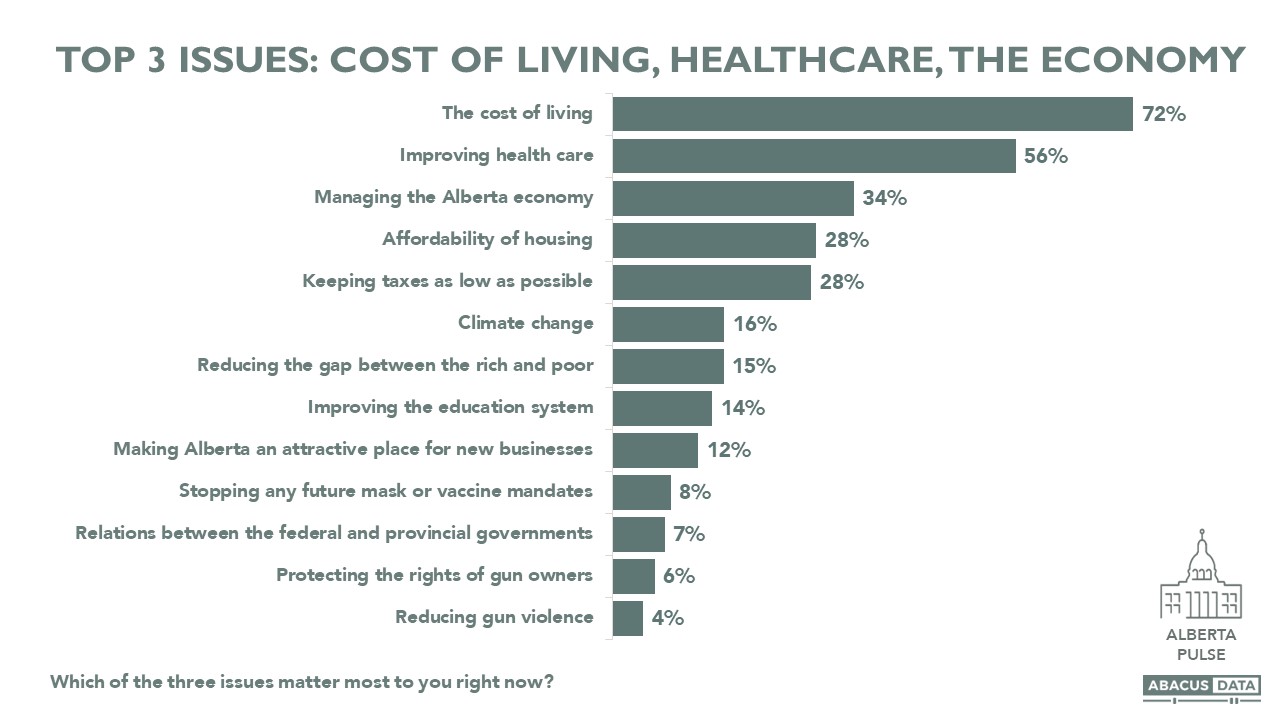

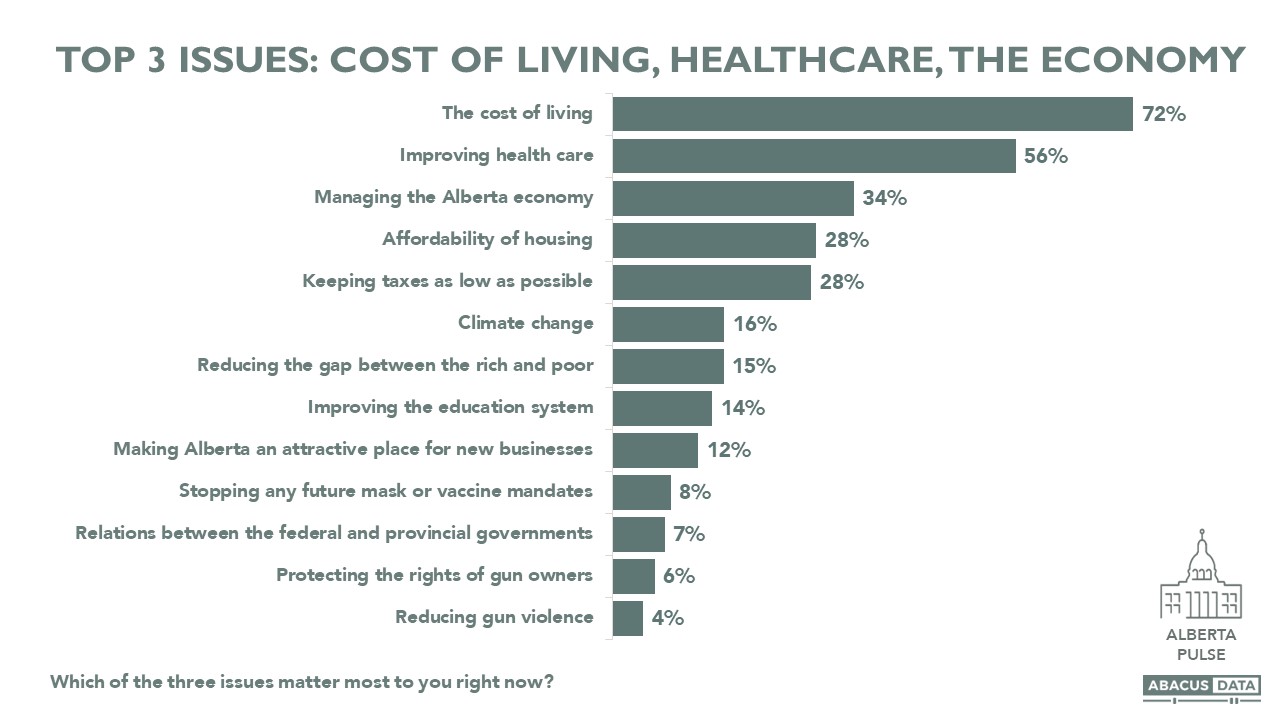

COST OF LIVING, HEALTHCARE & THE ECONOMY ARE THE TOP ISSUES

Albertans are most likely to rank the cost of living, improving health care and managing the economy as their top three issues right now. Housing affordability and keeping taxes low round out the top 5 with about 1 in 4 ranking it in their top three. Only 16% rate climate change as a top issue. For less than 10%, federal/provincial relations, stopping future mask or vaccine mandates or protecting the rights of gun owners are a top issue.

Comparing those who currently support the UCP with NDP supporters, we find both voter groups rank the cost of living as their top issue and are as equally as likely to feel housing affordability is a top issue. NDP supporters are 23 points more likely to rate healthcare as a top issue while UCP supporters are more likely to rate managing the economy (+13) and keeping taxes as low as possible (+22) as a top issue.

There’s a wide gap on other issues as well. NDP supporters are more likely to rate climate change, income inequality, and improving the education system as top issues while UCP voters are more likely to rate gun rights and mask or vaccine mandates as primary issues of concern.

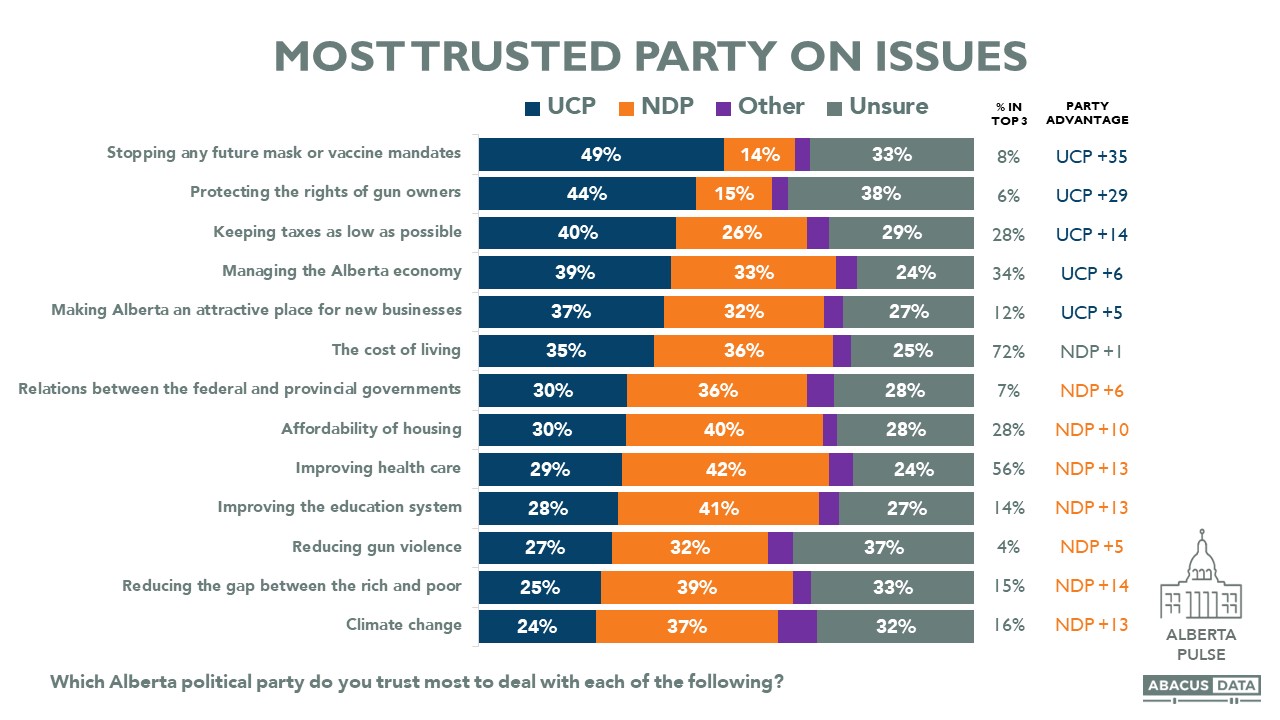

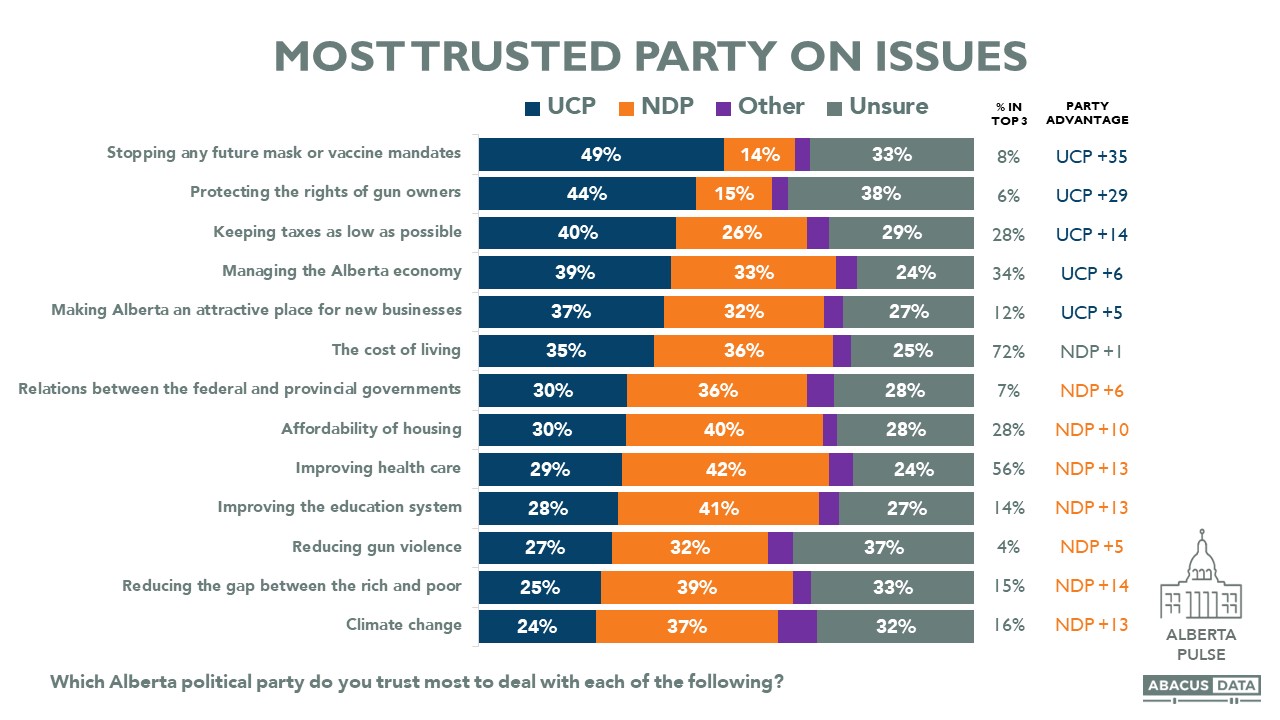

When asked which political party they trust most to deal with each of these issues, we find some clear advantages for both major parties.

Albertans are more likely to trust the UCP to stop future mask/vaccine mandates, protect gun rights, keep taxes low, and manage the economy.

In contrast, they are more likely to trust the NDP on climate change, reducing the gap between the rich and the poor, and improving education and healthcare, on housing, and on federal/provincial relations.

However, it’s worth focusing most on the top 3 issues of the cost of living, healthcare, and managing the economy. Neither party has an advantage on the cost of living (NDP 36% vs. UCP 35%). The UCP has a 6-point advantage on the economy (39% to 33%) while the NDP has a larger 13-point advantage on improving the healthcare system (42% to 29%).

This sorting gives us insight into how framing the election may have an impact on the outcome. As neither party has an advantage on the top issue – the cost of living – that issue may be neutralized. However, an election focused on healthcare would benefit the NDP while one focused on the economy may benefit the UCP.

LEADER IMPRESSIONS: NOTLEY VIEWED MORE POSITIVELY THAN SMITH

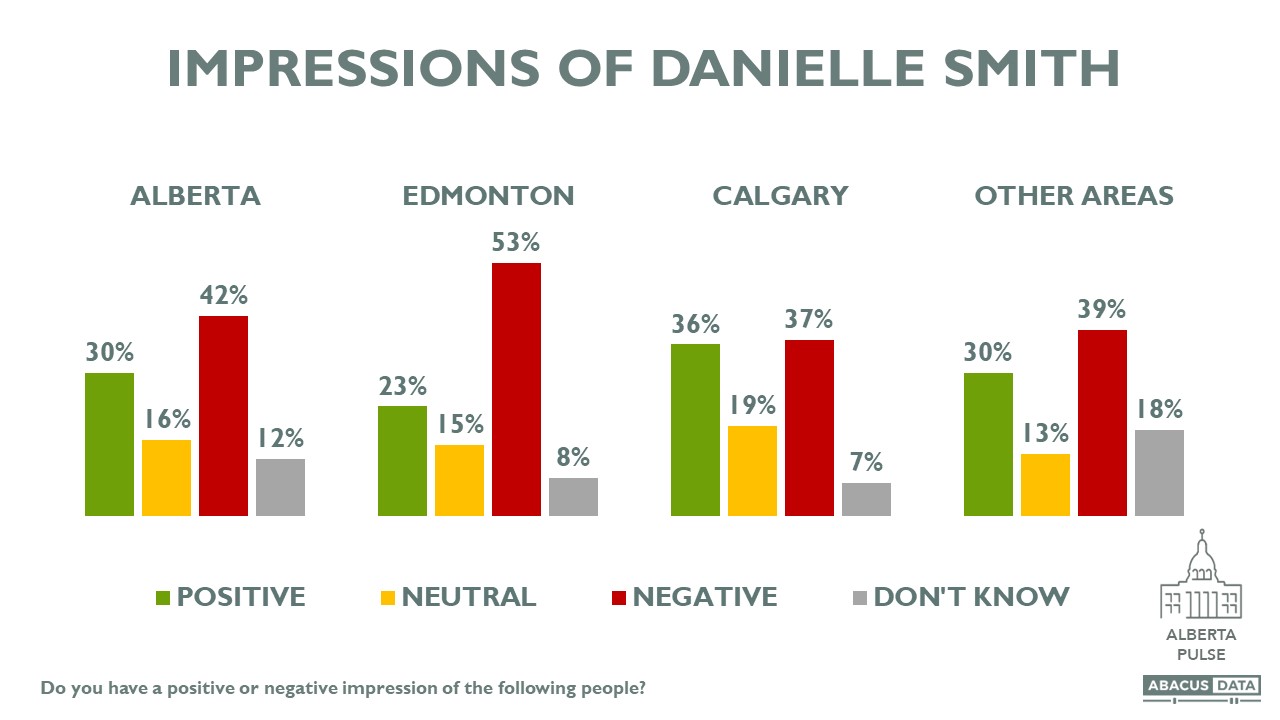

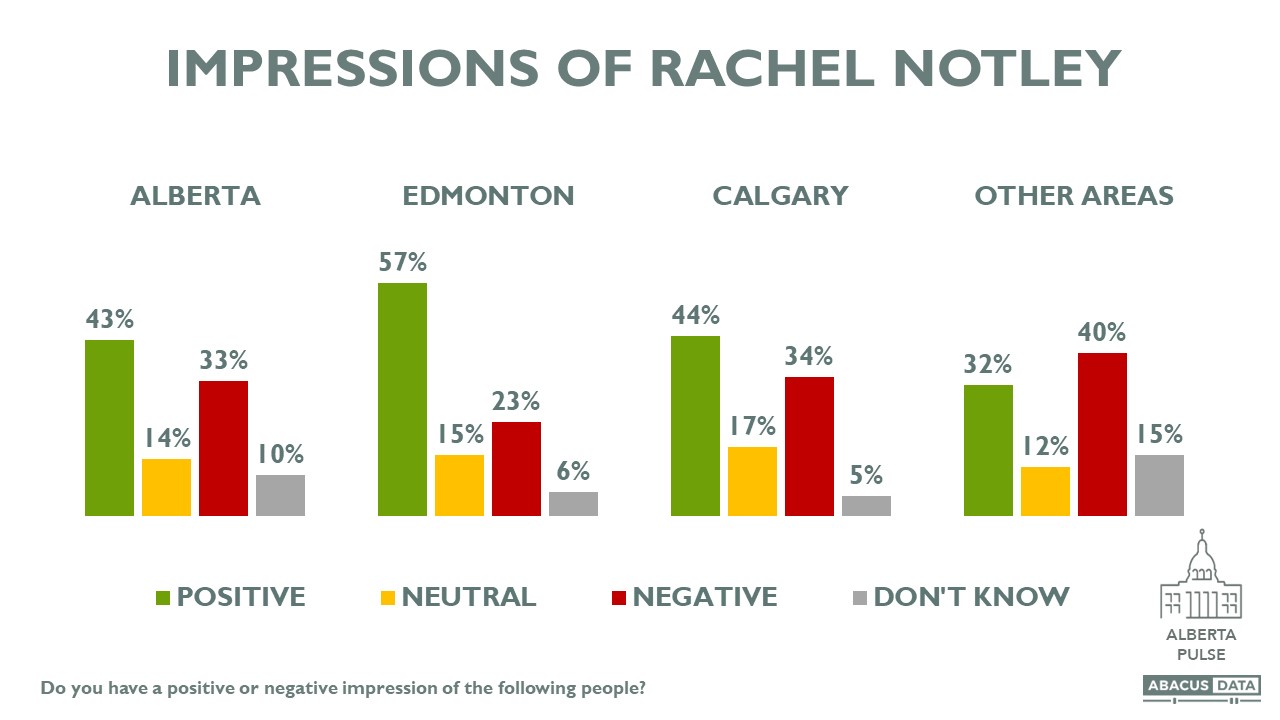

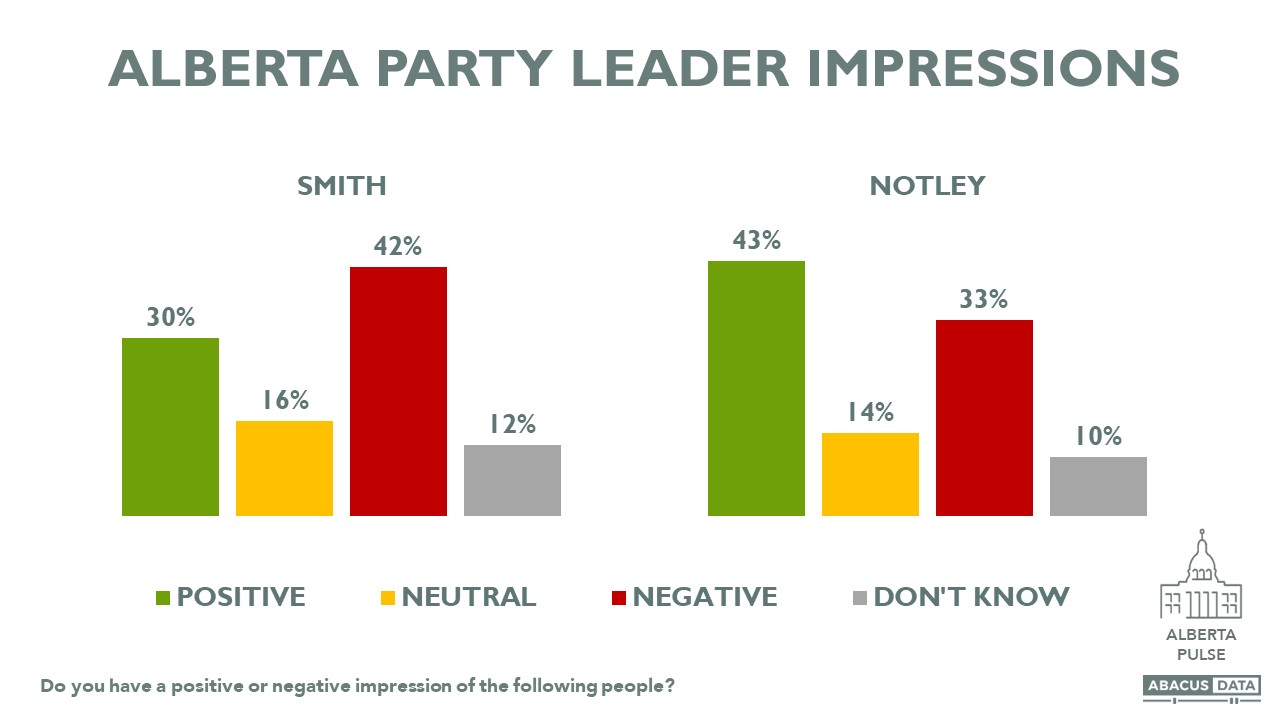

NDP Leader Rachel Notley has a net favourable rating of +10 with 43% having a positive view of her and 33% viewing her negatively. In contrast, Premier Danielle Smith’s net favourable rating is -12 with 30% positive and 42% negative. Both leaders are quite well known with about 1 in 10 Albertans saying they don’t know enough about both leaders to have an opinion. This suggests that views of these leaders are unlikely to change much – especially in the positive direction – given how well known they are. It’s hard to change people’s perceptions of you once they have an impression.

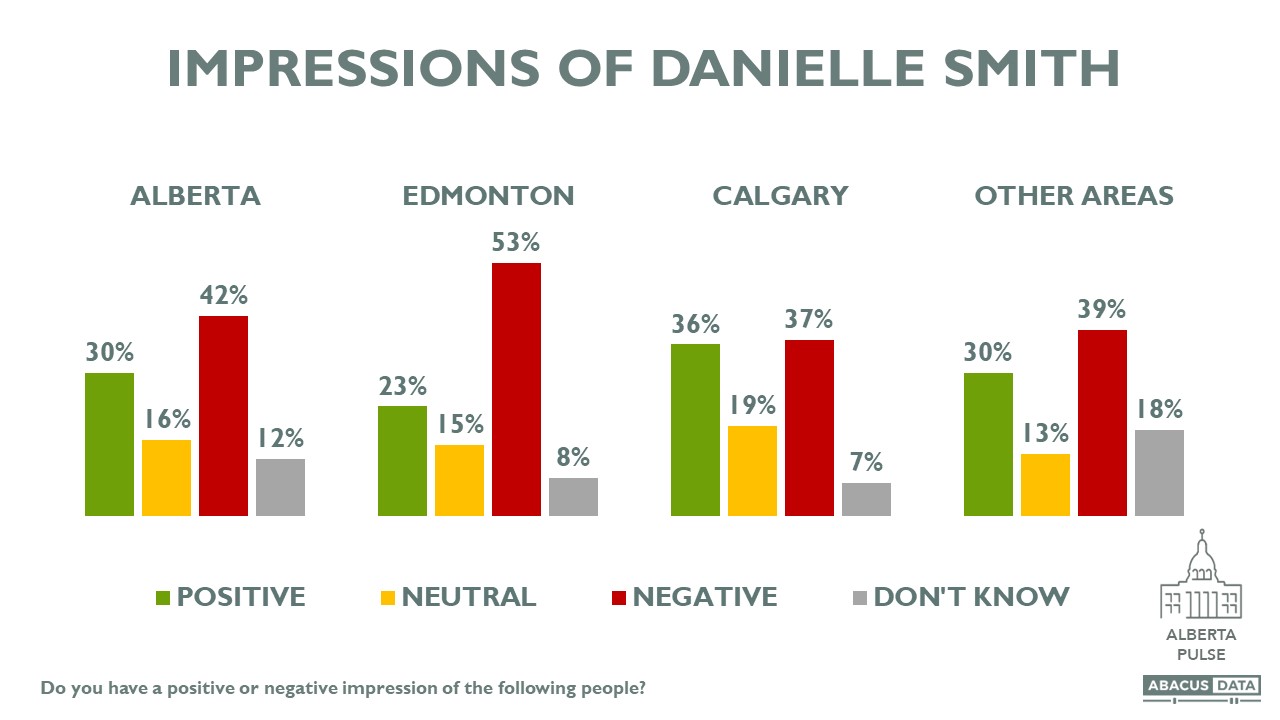

Regionally, Danielle Smith is viewed more negatively in Edmonton (-30) than in Calgary (-1) or other areas of Alberta (-9). Among past UCP voters, 50% have a positive view of her while 28% have a negative view (+22). Among those who voted for the Alberta Party in 2019, 37% have a positive view while 57% negative.

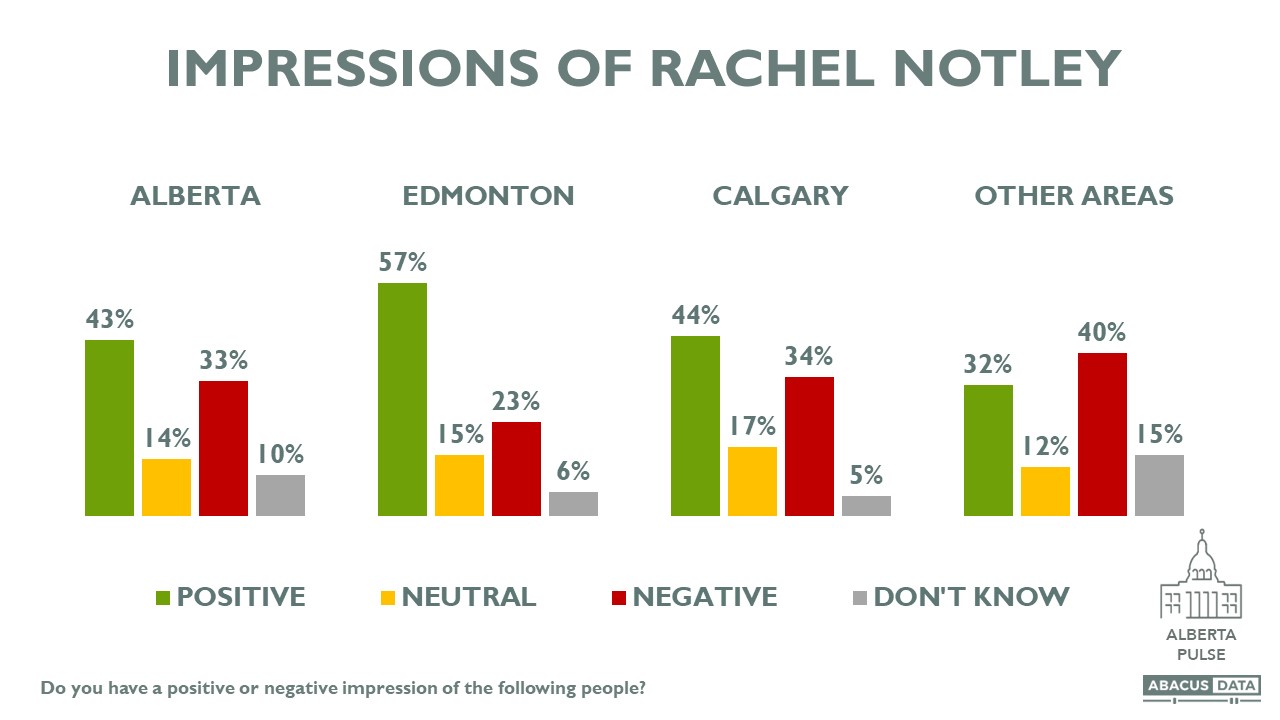

For Rachel Notley, she is viewed positively in Edmonton (+34), Calgary (+10) and negatively outside those two cities (-8). However, in all three regions, her net favourables are better than they are for Danielle Smith. Among past NDP voters, 89% have a positive view of Notley while 3% have a negative view – an very impressive +85 net rating. Among past UCP voters, her net rating is -39 with 20% having a positive view and 59% negative. Among those who voted for the Alberta Party in 2019, 58% have a positive view while 24% negative.

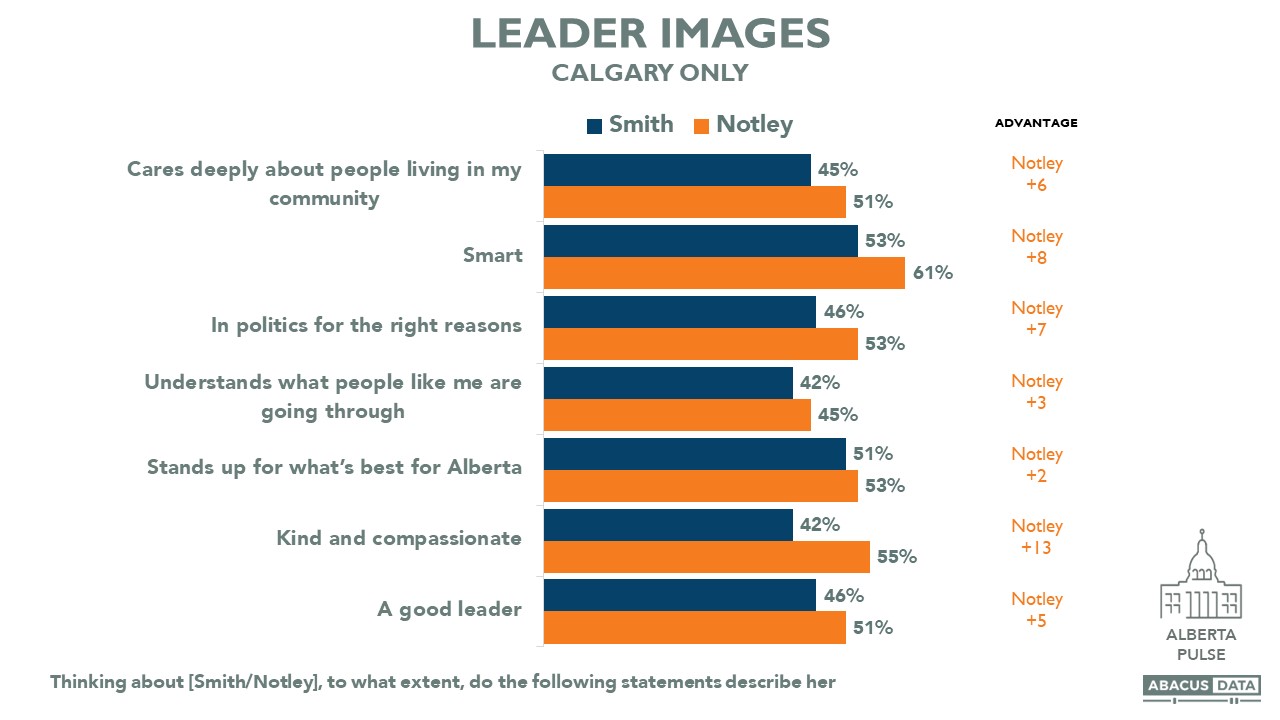

The survey also asked Albertans to rate the two leaders on several attributes. Overall, Rachel Notley’s image is more favourable than Danielle Smith. When asked whether the attribute describe each leader very well, pretty well, not that well, or not at all, among those with an opinion of both leaders (which is about the same across the board) Notley has a clear advantage on all except for standing up for what’s best for Alberta. There’s only a 2-point difference on that.

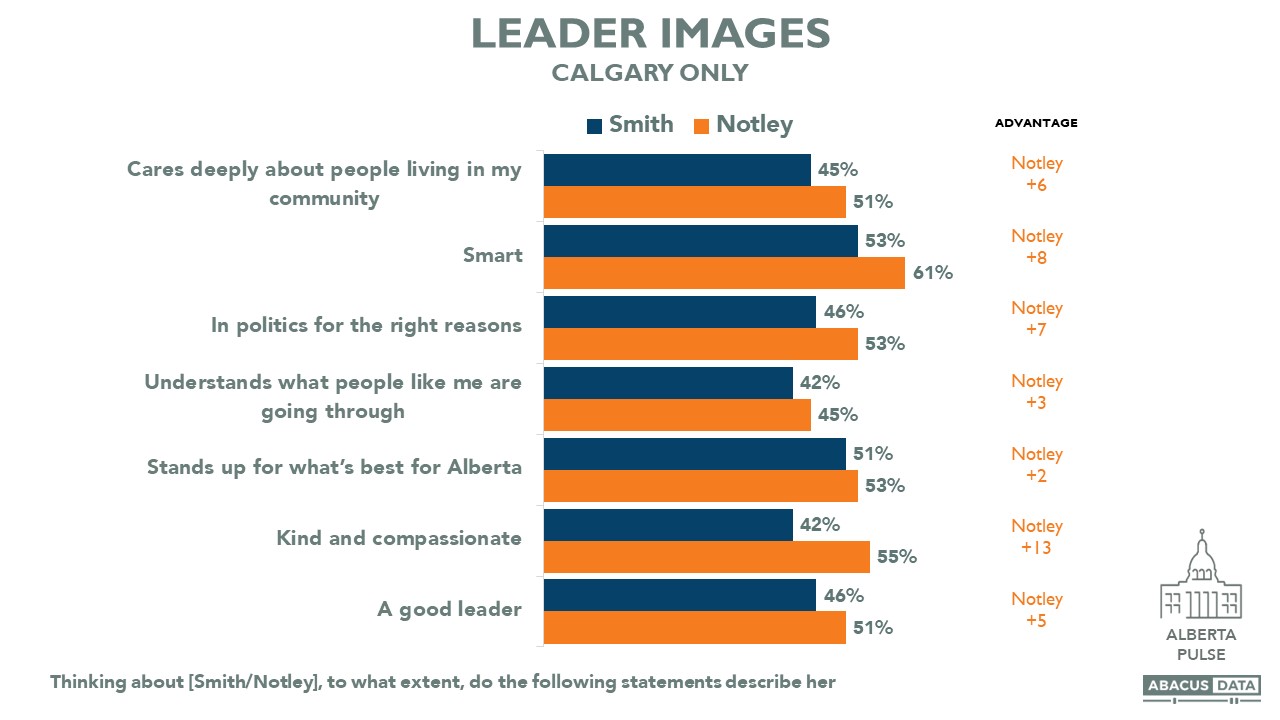

Even when we isolate only those living in battleground Calgary, Rachel Notley has an advantage on all, albeit to a lesser extent. Notley’s biggest advantage over Smith is on whether people think they are kind and compassionate (Notley ahead by 13), smart (Notley +8), and in politics for the right reason (Notley +7). For the other attributes, the gap between Notley and Smith are not as substantial.

Of note, the attribute that both leaders perform worst on is empathy – “understands what people like me are going through”. 45% think that terms applies well to Notley versus 42% for Danielle Smith.

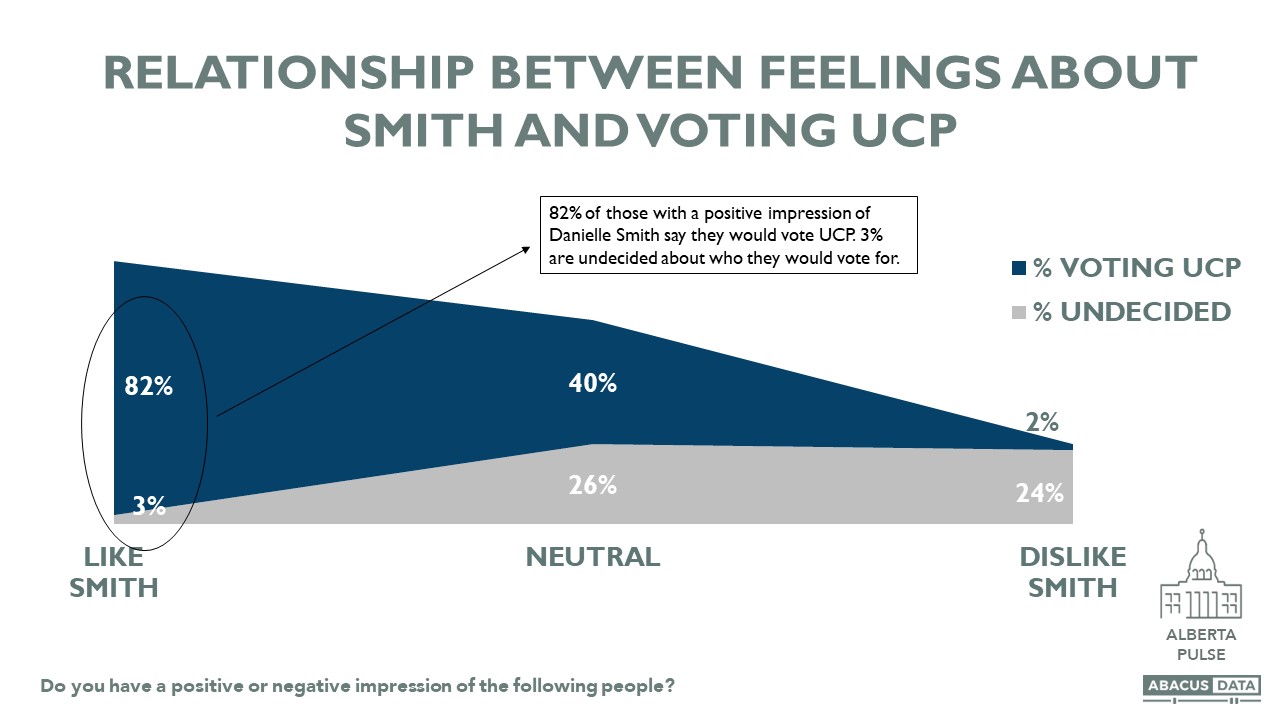

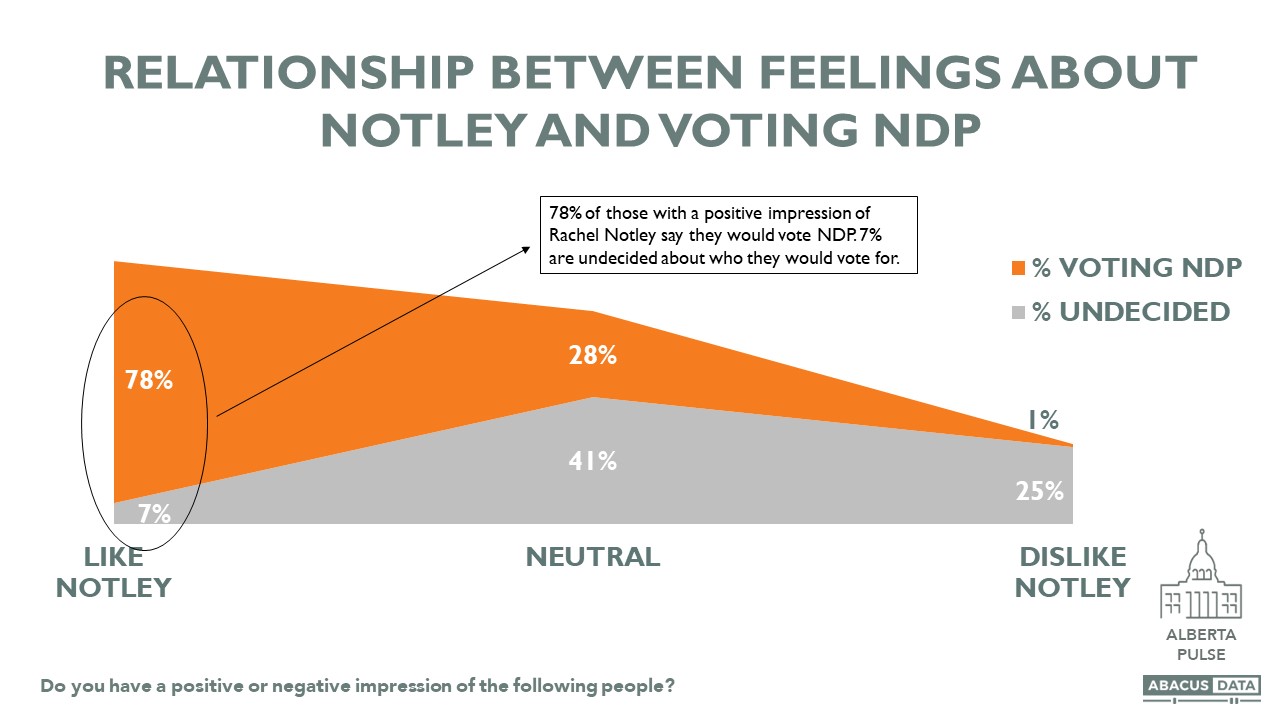

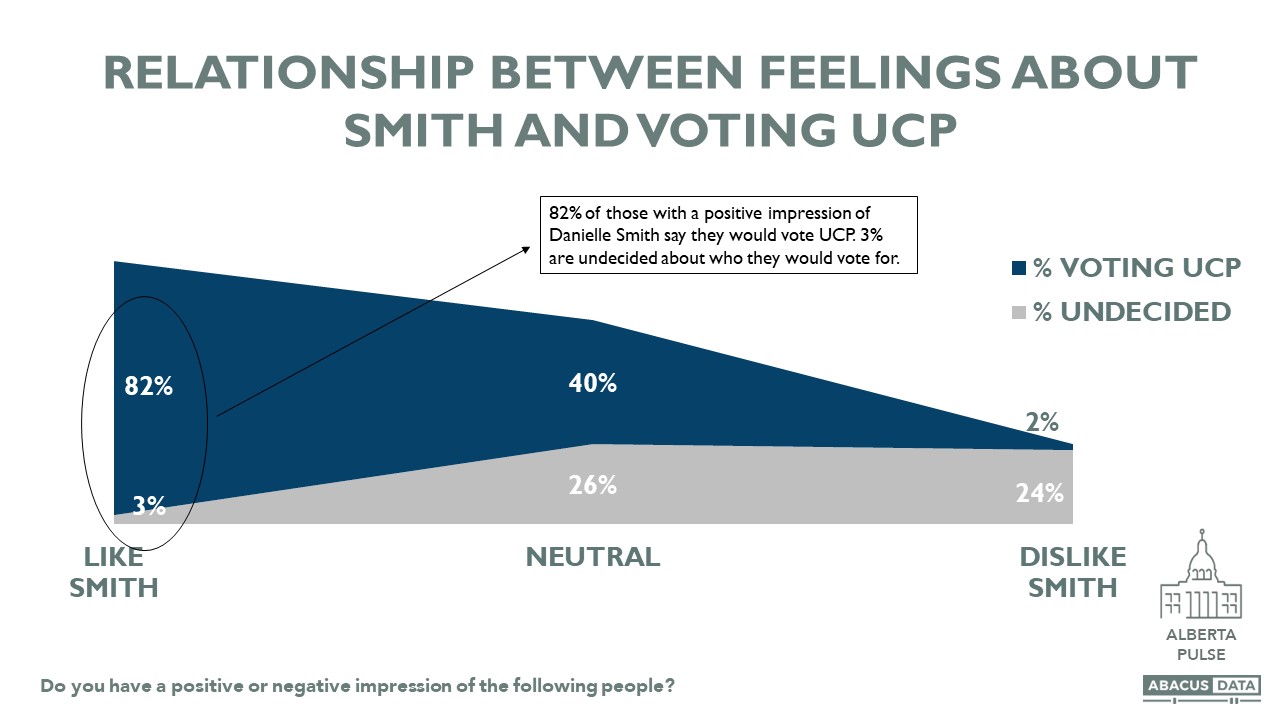

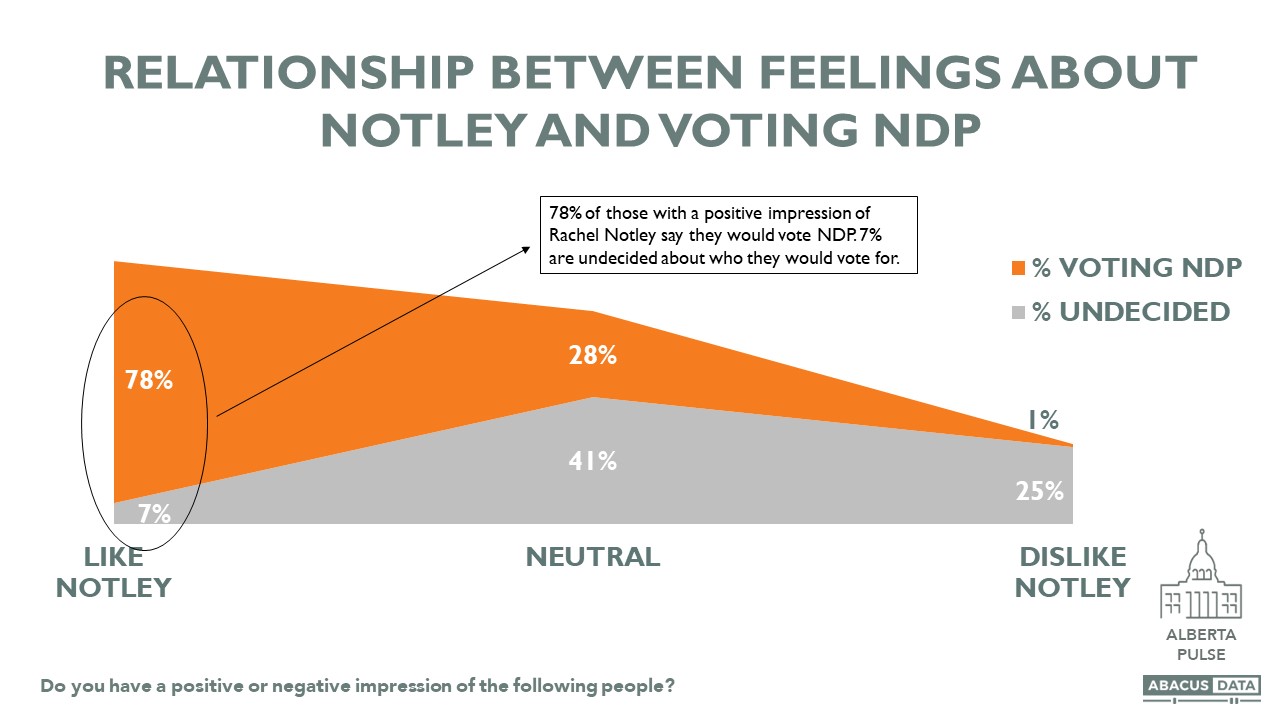

To underscore the importance of leader images to vote choice, the charts below show the vote share for both Danielle Smith and Rachel Notley depending on how a respondent feels about the leader.

82% of those who like Danielle Smith say they will vote UCP. That drops to 40% among those with a neutral opinion and to 2% among those who dislike Smith. Of note, 26% of those with a neutral view of Smith and 24% of those with a negative view of her say they are undecided about how they’d vote if an election was today.

The same pattern exists for Rachel Notley. 78% of those who like the NDP leader say they would vote NDP. This drops to 28% among those neutral towards her and down to 1% who dislike her. Of note, 41% of those with a neutral view of Notley say they are undecided, significantly higher than the vote intention of those neutral towards Smith.

Danielle Smith’s initial weeks in office have been challenging from a public opinion perspective.

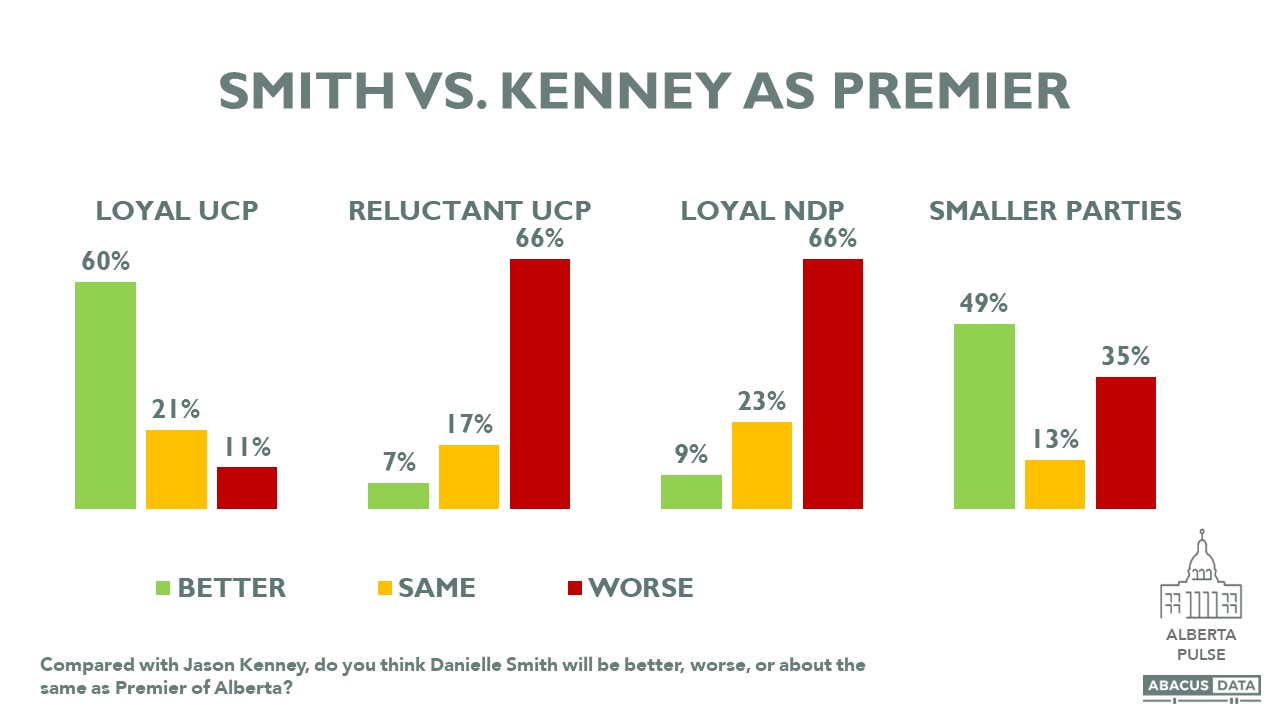

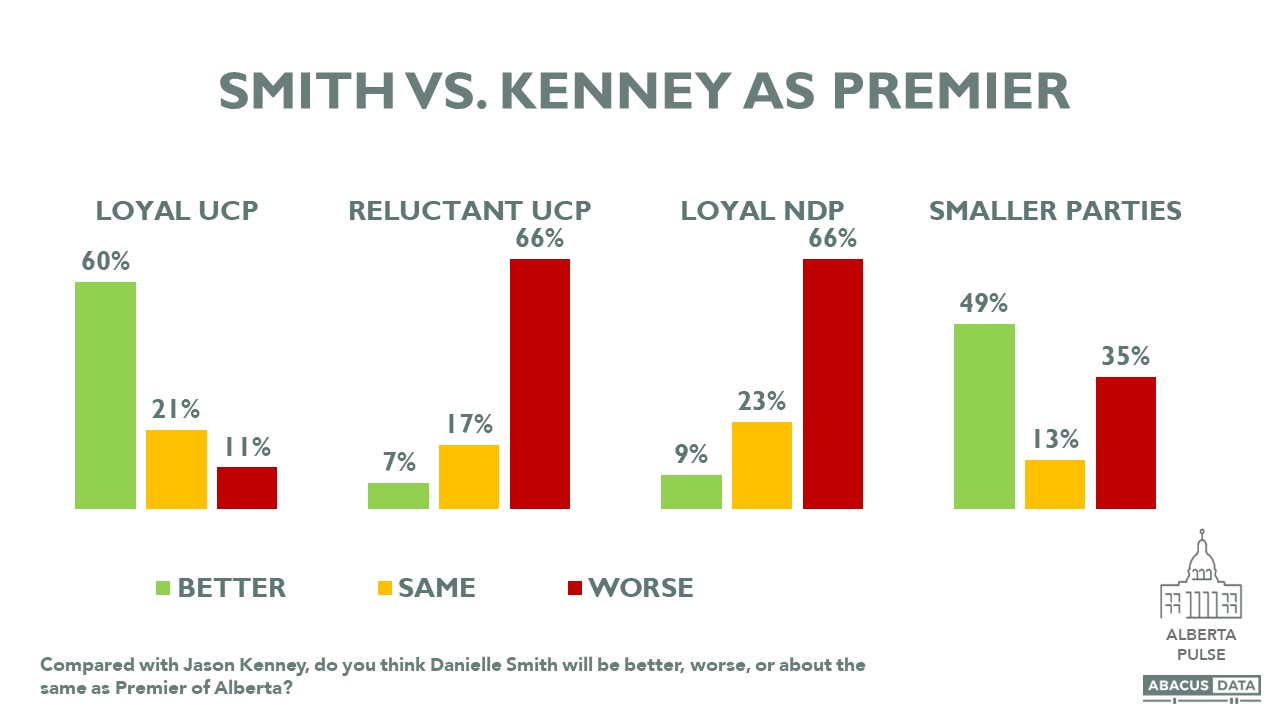

Case in point, when asked whether Danielle Smith will be a better or worse premier than Jason Kenney, 29% think she will be better, 38% think she will be worse while the rest are either unsure or think she will be about the same as Jason Kenney. But importantly, those thinking Danielle Smith will be much worse – the more intensely negative category – is more than double the percentage who think she will be much better (21% vs. 9%).

Moreover, among 2019 UCP voters, 39% think she will be better but 32% think she will be worse – an indication that rebuilding the 2019 voter coalition that easily elected Jason Kenney and the UCP won’t be easy.

In Calgary, opinion is just as split with 30% thinking Smith will be a better premier and 34% thinking she would be worse.

This evaluation could change as Smith continues to implement her agenda, but the early reaction is quite mixed.

WHAT DO ALBERTANS WANT? TO SHAKE THINGS UP OR FOR A FOCUS ON THE BASICS

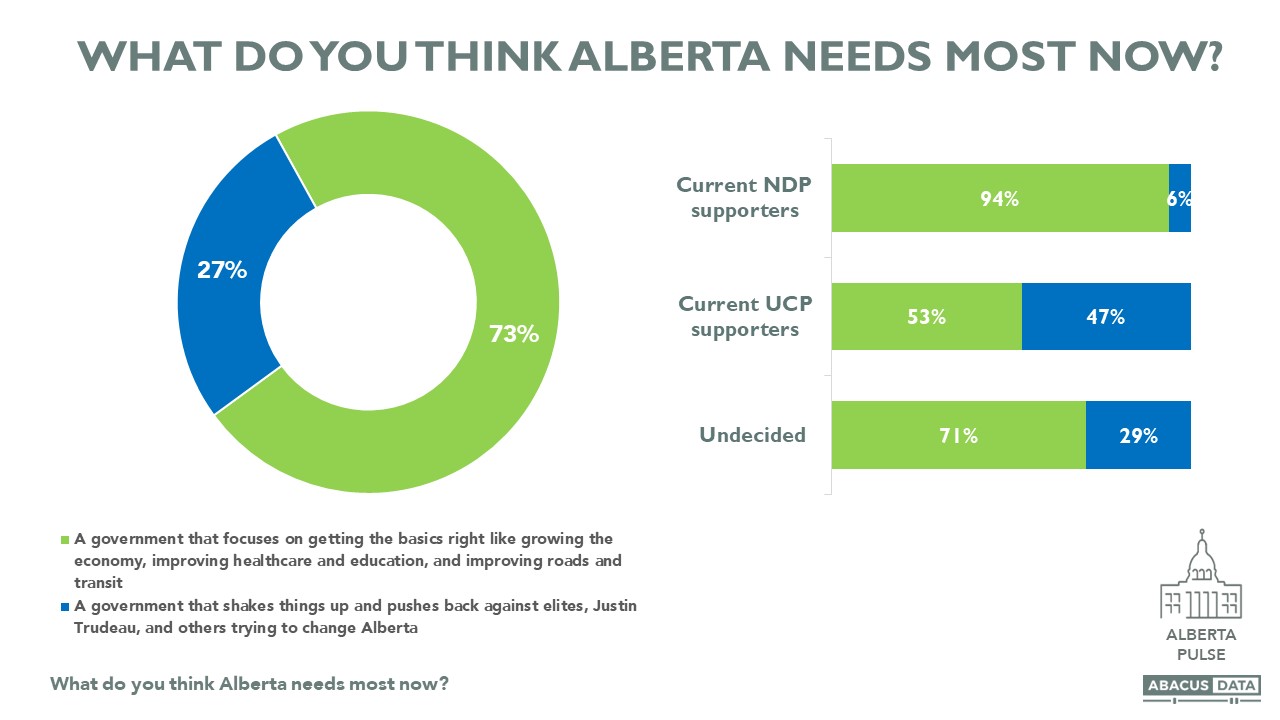

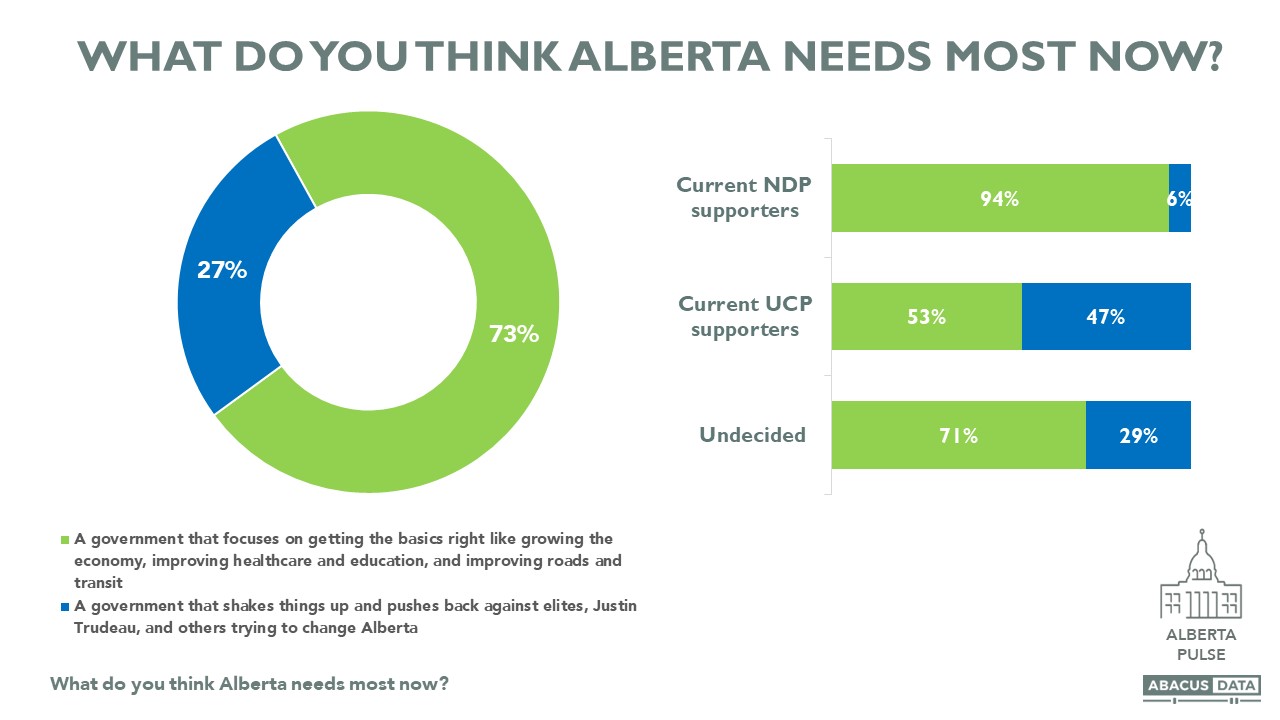

To understand the general orientation of Albertans, we asked people which of two statements they feel Alberta most needs now:

• A government that focuses on getting the basics right like growing the economy, improving healthcare and education, and improving roads and transit.

• A government that shakes things up and pushes back against elites, Justin Trudeau, and others trying to change Alberta

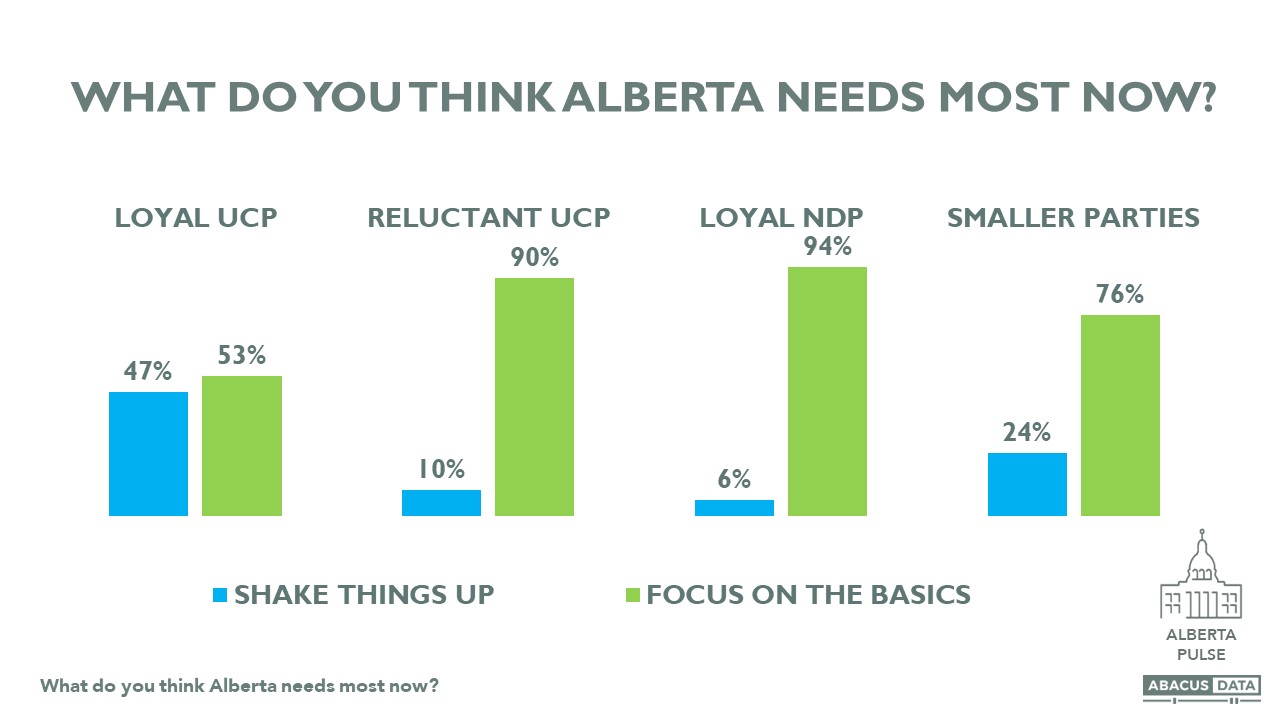

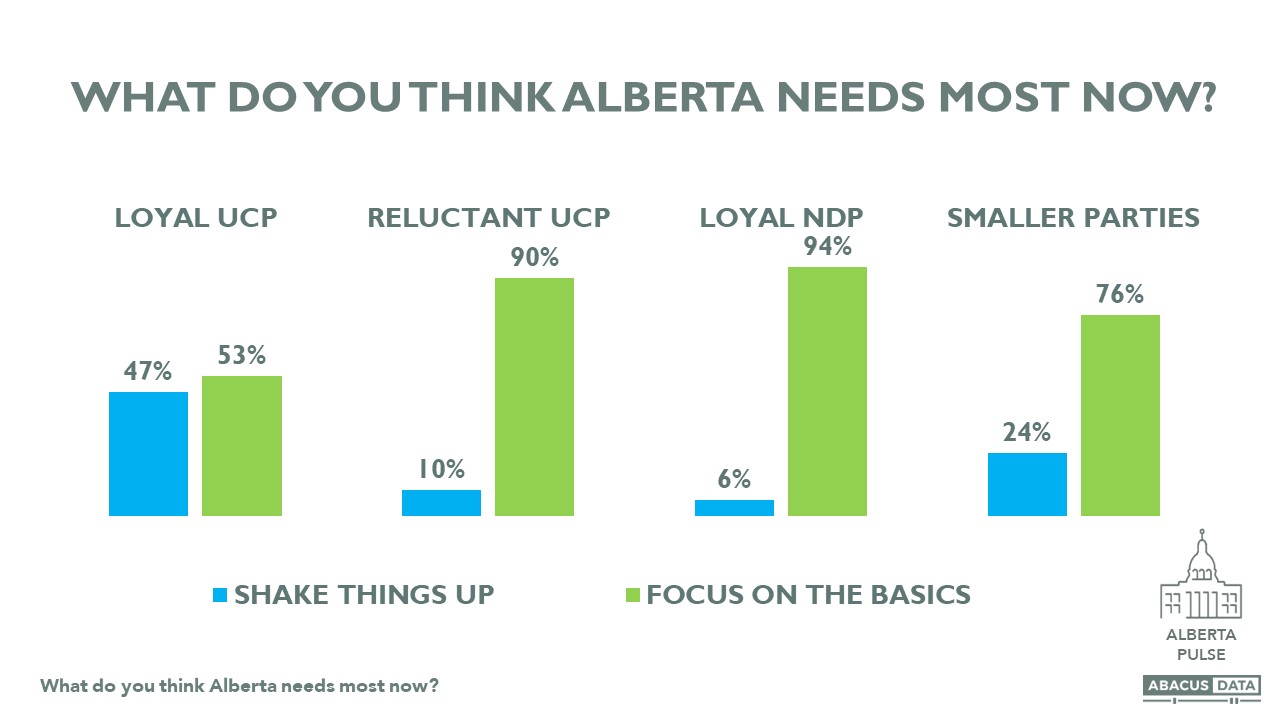

Overall, 3 in 4 want a government that focuses on the basics – the economy, healthcare, education, and transportation. 1 in 4 want a government that shakes things up.

Among current NDP supporters, 94% want a government to focus on the basics. Among undecided voters it’s 71%. But among current UCP supporters, views are split. 53% want a government that focuses on the basics while 47% wants a government that shakes things up and pushes back on people like Justin Trudeau. This divide within the UCP voter universe underscores the challenges facing Premier Smith. Her government’s initial focus on the Sovereignty Act and picking fights with Ottawa may find favour with a large part of her natural party base, but it may be off-putting to those she needs to convince to vote UCP again.

HOW ARE DANIELLE SMITH’S IDEAS PLAYING WITH ALBERTANS?

We asked Albertans whether four ideas were good or bad.

• Sovereignty Act: 29% think it’s a good idea versus 41% who think it’s a bad idea. Those who think it’s a very bad idea outnumber those who think it’s a very good idea almost 3 to 1.

• Alberta Police Force: 27% think it’s a good idea while 49% think it’s a bad idea.

• Private delivery in Alberta’s healthcare system: 35% think it’s a good idea while 41% think it’s a bad idea.

• Preventing school boards from bringing in mask mandates: 30% think it’s a good idea while 51% think it’s a bad idea.

HOW WOULD ALBERTANS VOTE? NDP LEADS BY 8 AMONG DECIDED VOTERS.

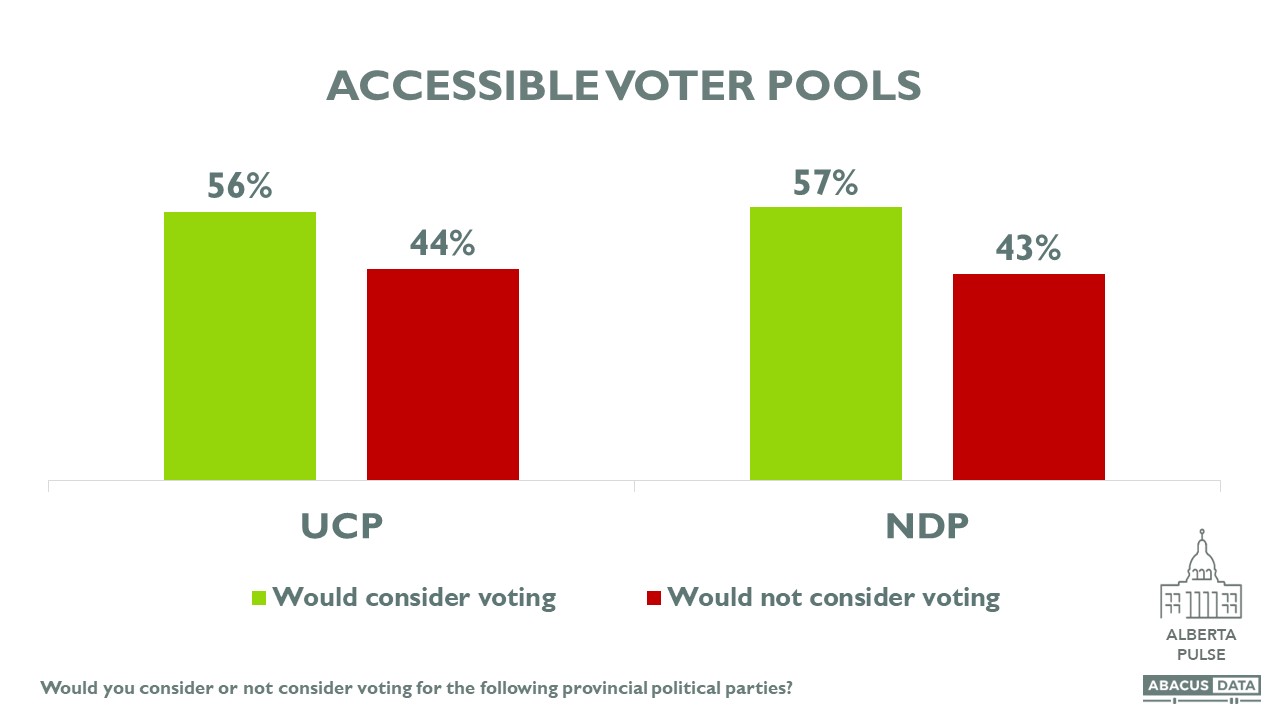

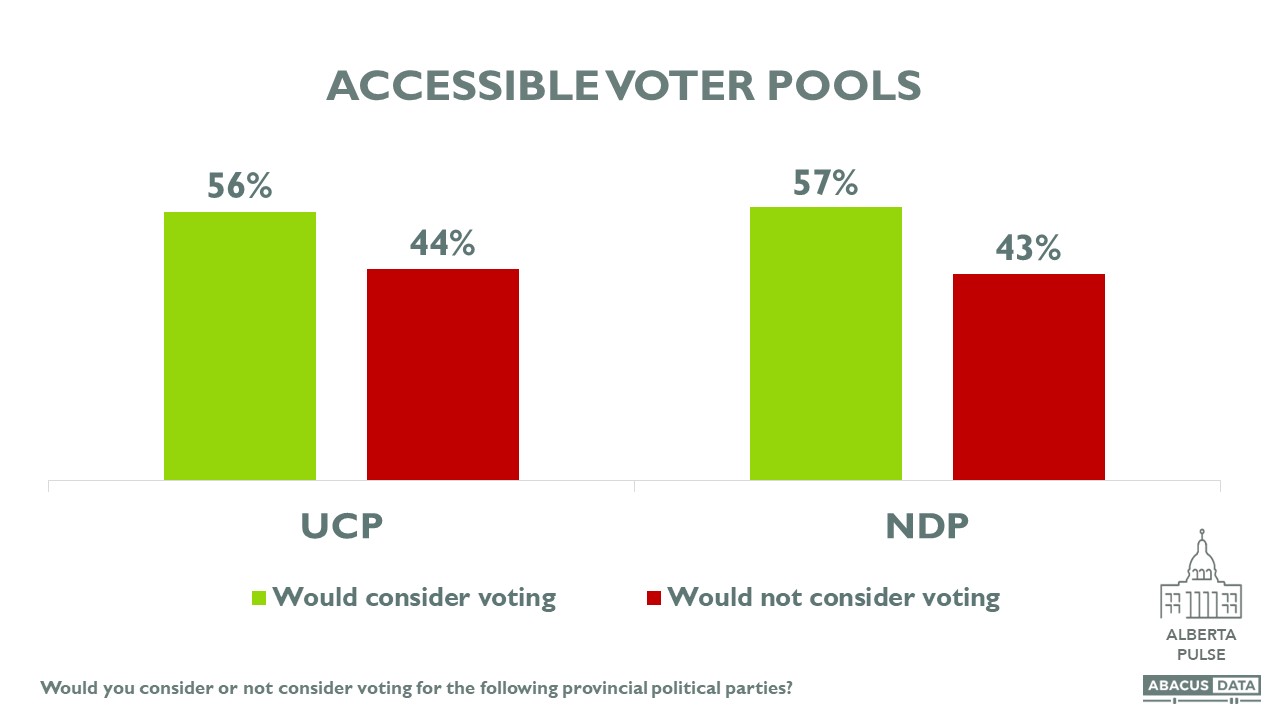

The UCP and NDP have equal-sized accessible voter pools. 57% of Albertans say they would consider voting NDP while 56% would consider voting UCP. The fact that the Alberta NDP has the same sized accessible voter pool as the UCP is noteworthy given Alberta’s political history.

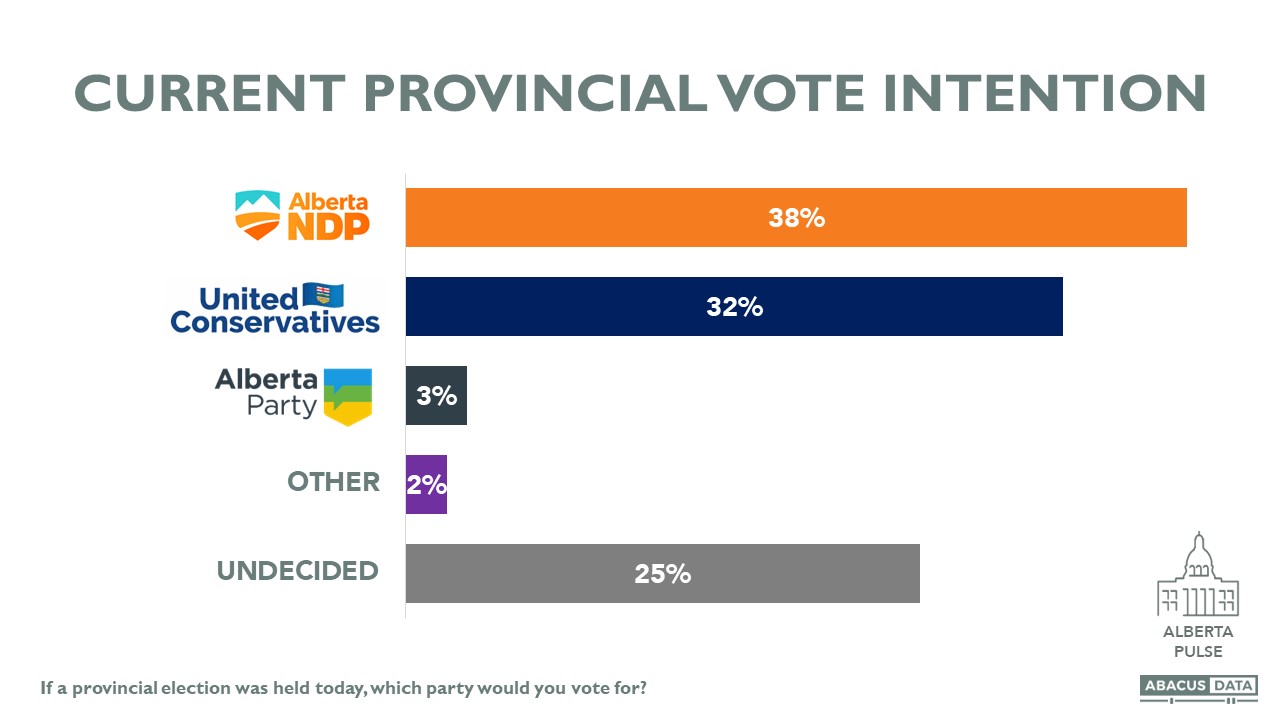

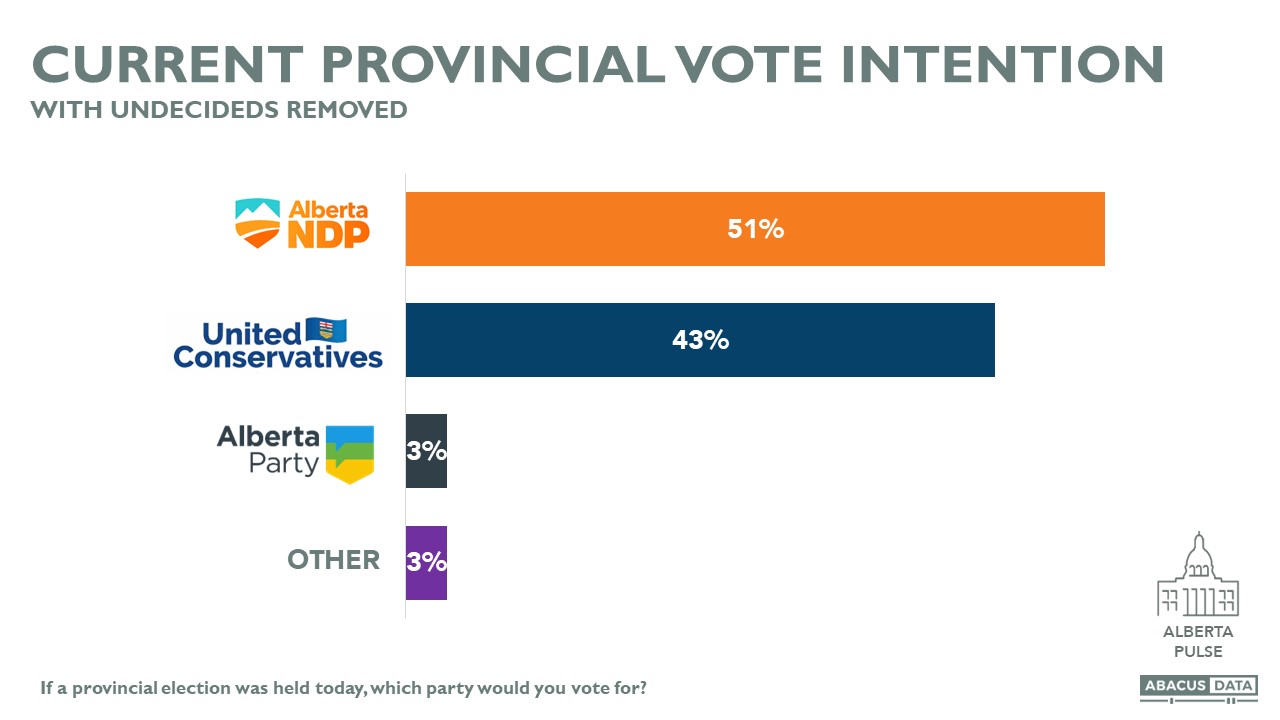

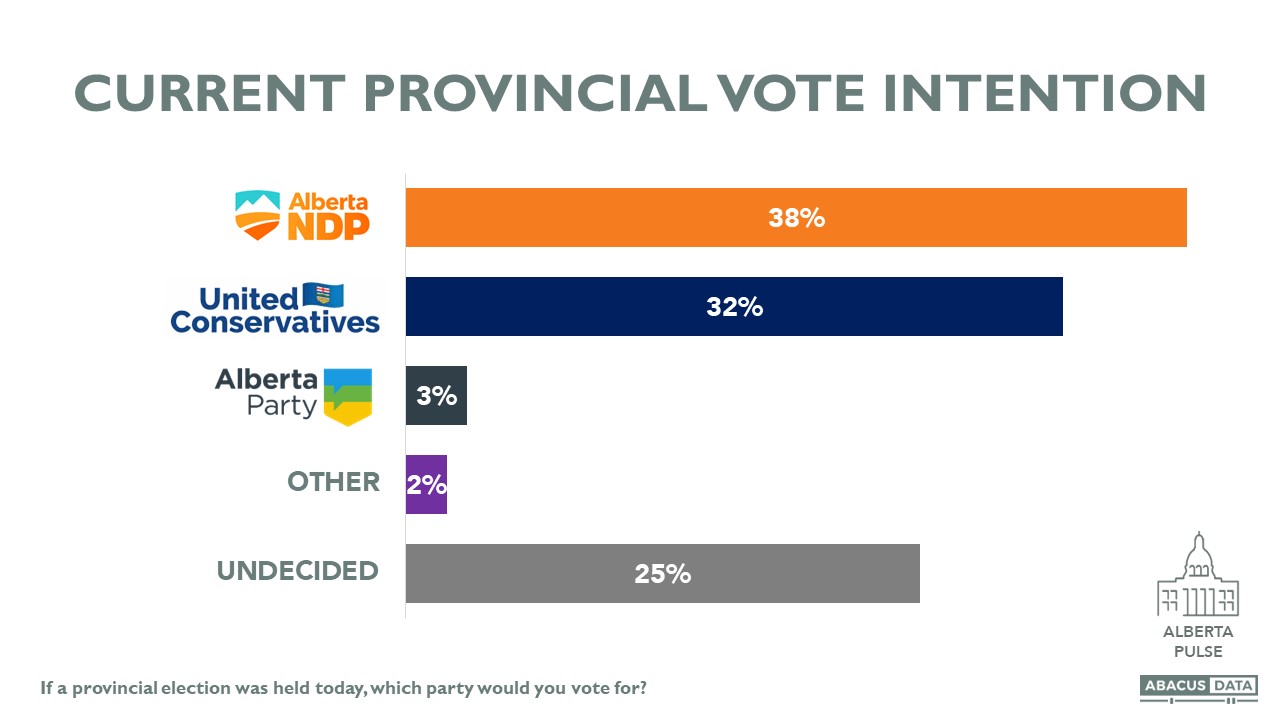

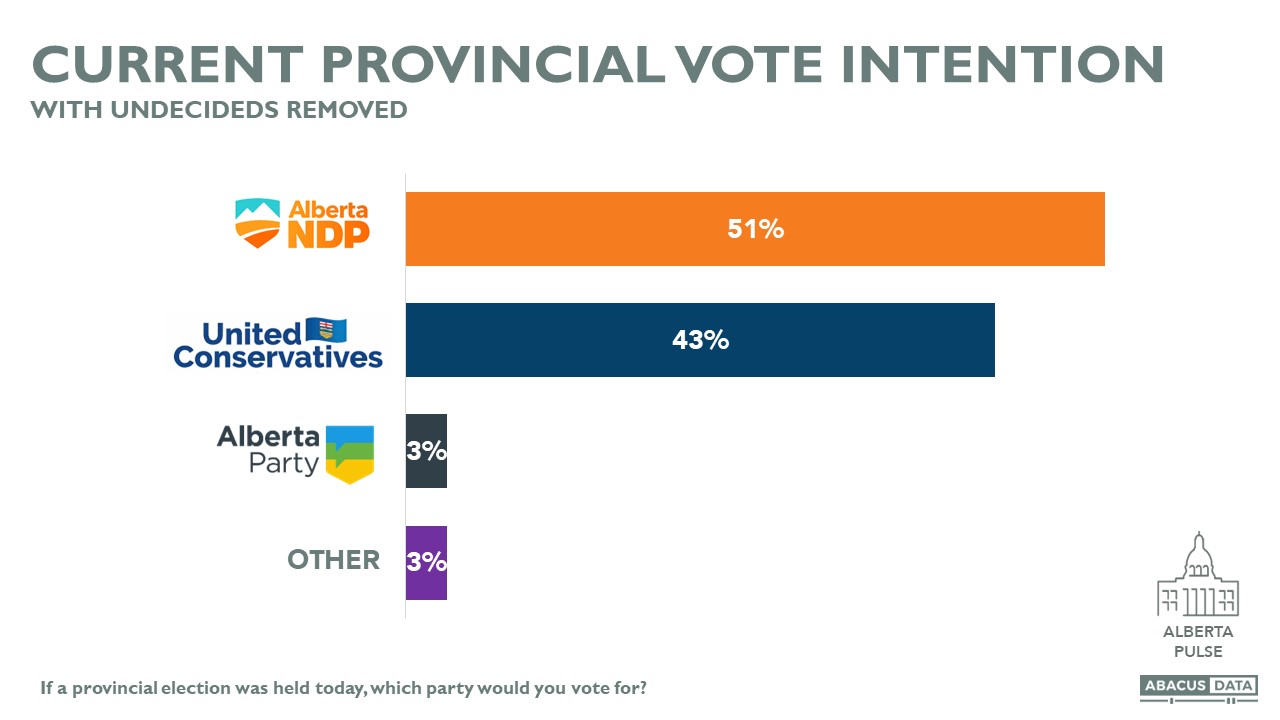

If an election was held today, the Alberta NDP would likely win more votes. Among the entire electorate, 38% would vote NDP, 32% UCP, 3% for the Alberta Party and 2% for other parties. 25% say they are undecided.

Among decided voters, the NDP leads the UCP by 8 – 51% to 43%.

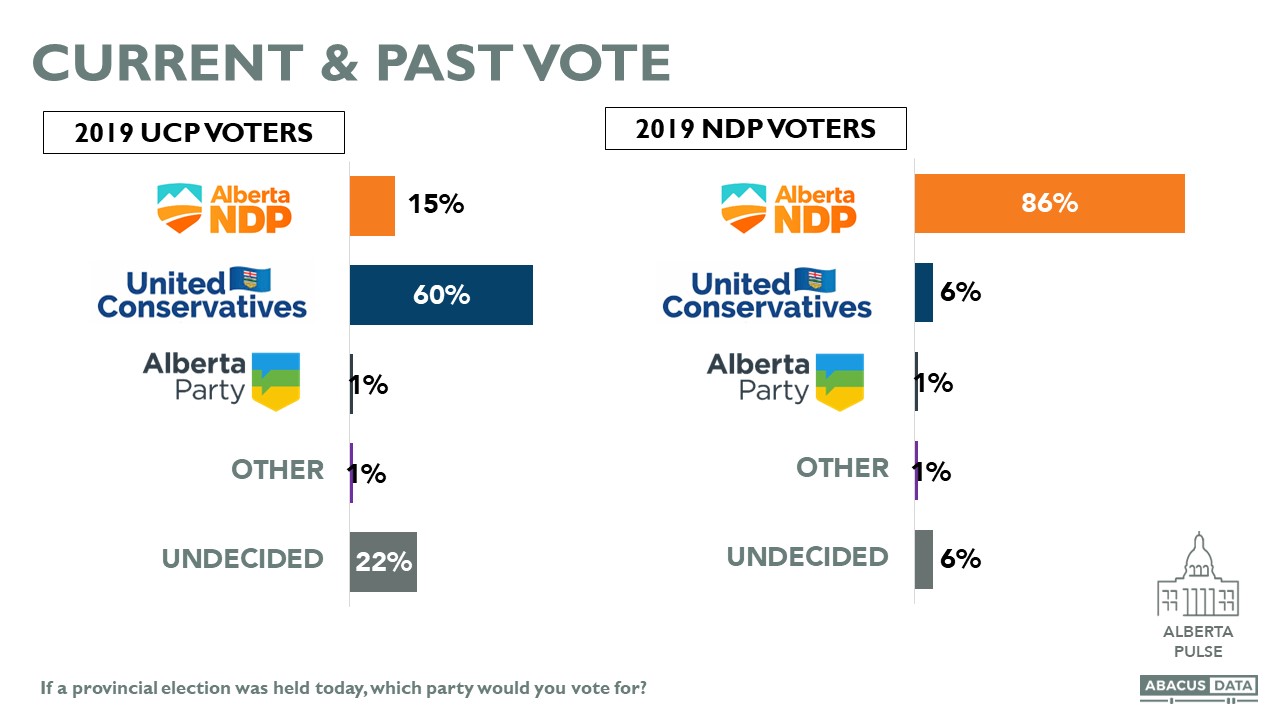

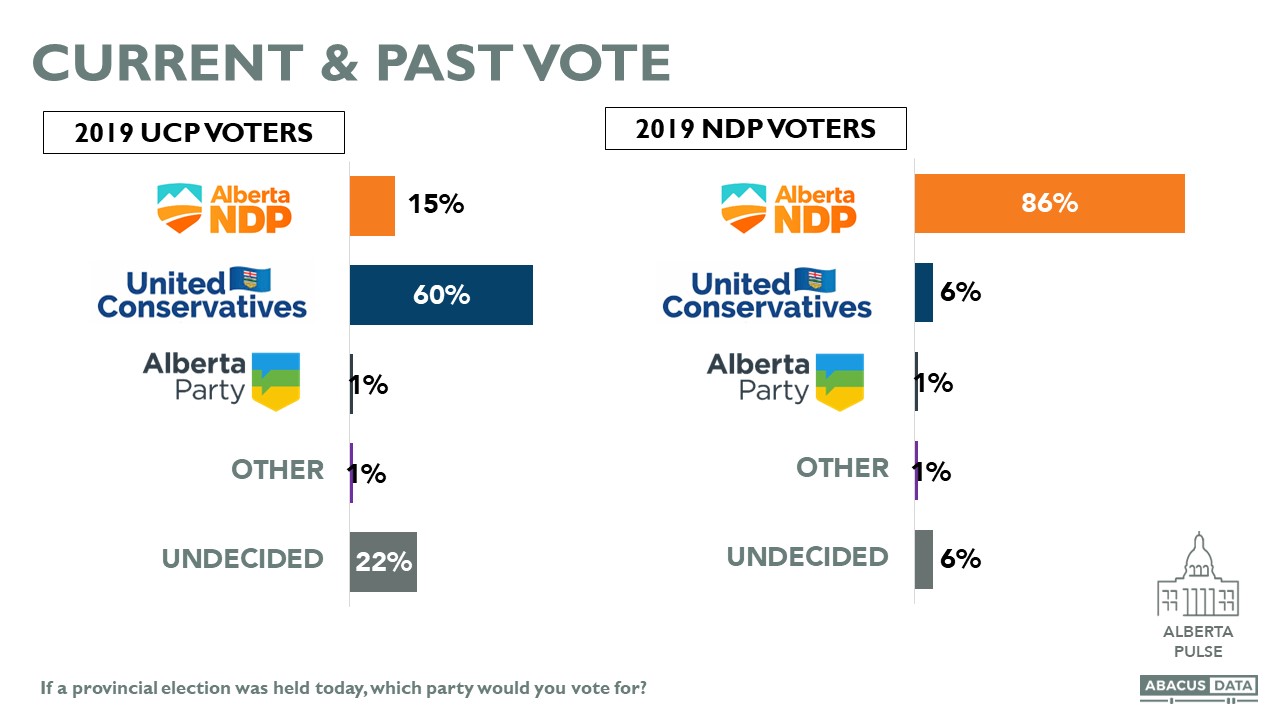

When we compare current vote intention with past vote, 86% of past NDP voters say they would vote NDP again. 6% would defect to the UCP, 2% to other parties, and 6% are undecided.

Among past UCP voters, only 60% say they would vote UCP again with 15% defecting to the NDP and 2% to other parties. Almost 1 in 4 past UCP voters say they are undecided.

Demographically, the NDP and UCP are statistically tied among those under 45 with younger Albertans be far more likely to be undecided than older Albertans. The NDP leads among those 45+. The NDP also leads among men and women.

Regionally, the NDP is well ahead in Edmonton, tied with the UCP in Calgary, and trail the UCP outside of the two major cities.

NOTLEY BARELY AHEAD OF SMITH AS PREFERRED PREMIER

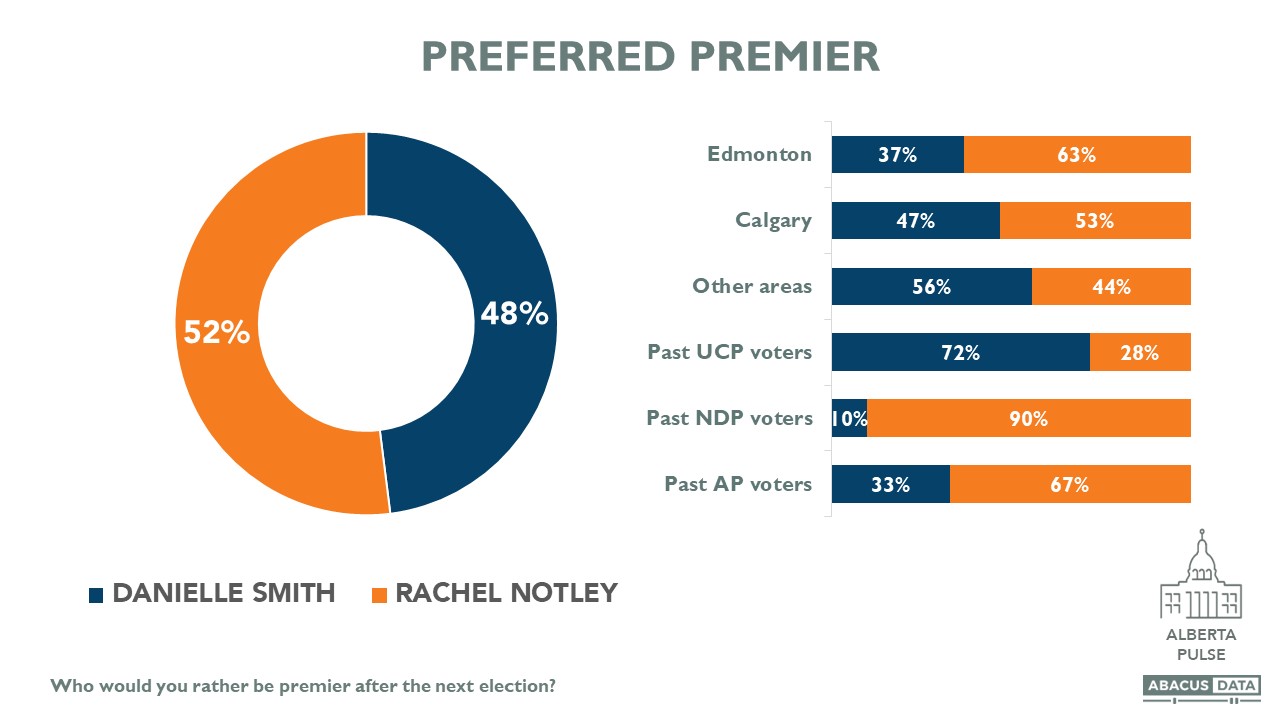

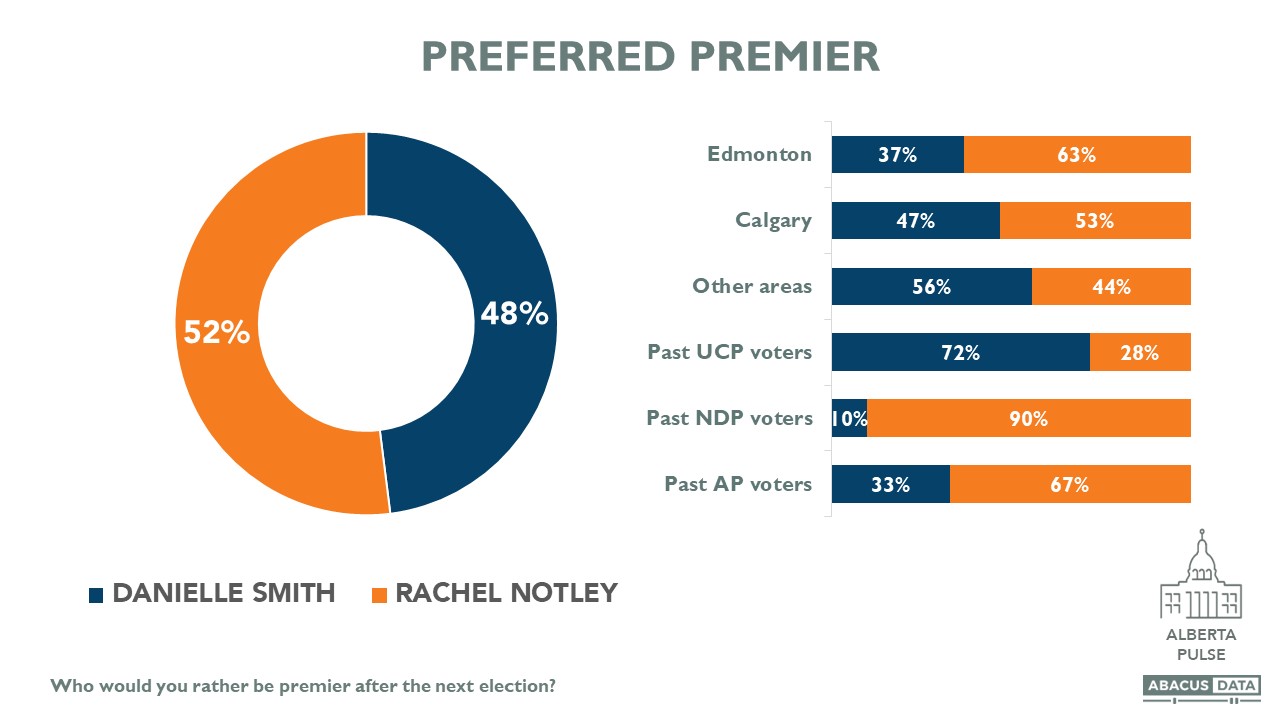

Despite a 9-point lead among decided voters, Albertans are split on who they would prefer to be Premier after the next election. 52% would prefer Rachel Notley while 48% would prefer Danielle Smith.

90% of past NDP supporters would prefer Notley while 10% would prefer Smith. Among past UCP supporters, 72% would prefer Smith while 28% would prefer Notley. In Edmonton, Notley leads by almost 30 points while in Calgary, it’s almost evenly divided 53% to 47%. In other areas of the province, Smith leads Notley by 12 (56% to 44%).

CONCLUSIONS SO FAR

This snapshot of Alberta public opinion points to an advantage for the Alberta NDP and Rachel Notley in the early days of Danielle Smith’s time in office. The Alberta NDP has a lead in vote intentions, the more popular leader, and issues ownership on more of the top issues for voters.

Danielle Smith starts her mandate as Premier with a mixed-opinion environment. The UCP has an equal-sized voter pool as the NDP but the Premier’s image is more negative than Rachel Notley’s, a significant portion of 2019 UCP voters believe she will be worse as premier than Jason Kenney, and she trails Notley on some key issues.

But to really understand the dynamics heading into the next election, we need to step away from demographic or regional comparisons, and focus on segments of the electorate based on their past and intended behaviours and preferences.

THE ROAD TO THE 2023 PROVINCIAL ELECTION

There are four key voter segments within the electorate that will be key to the outcome of the next provincial election.

• Loyal UCP voters are those who voted UCP in 2019 and say they would vote UCP again today. They represent about 27% of eligible voters.

• Loyal NDP voters are those who voted NDP in 2019 and say they would vote NDP again today. They represent about 24% of eligible voters.

• Smaller party voters are those who voted for the Alberta Party, Liberal Party or another one of the smaller parties in the last election.

• Reluctant UCP voters are those who voted UCP in 2019 and today say they are undecided or would vote for another party, not the UCP. They represent about 16% of the electorate. In my opinion, understanding and tracking this group is critical to anticipating how the next election will turnout.

• The remaining electorates either didn’t vote in the last election (and likely won’t vote again unless they are newly eligible) or are the small segment who voted NDP but say they wouldn’t vote NDP again.

Let’s unpack how these four groups differ and put a spotlight on that reluctant UCP group.

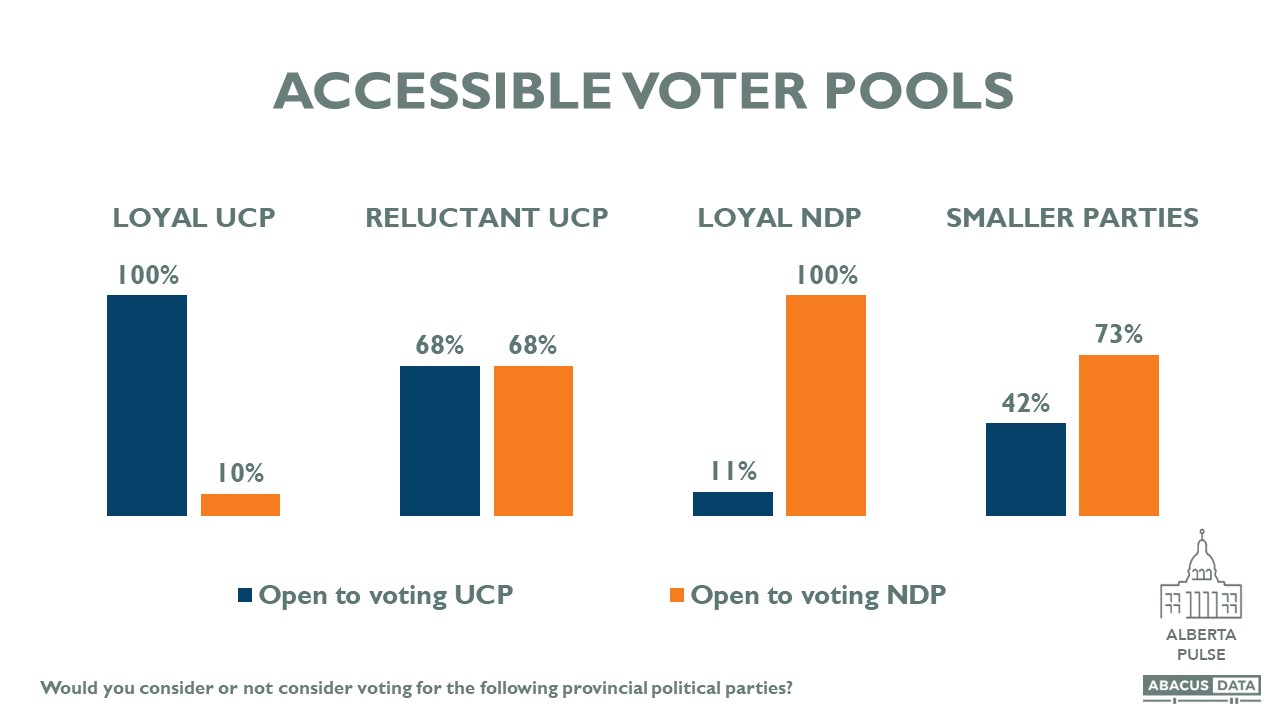

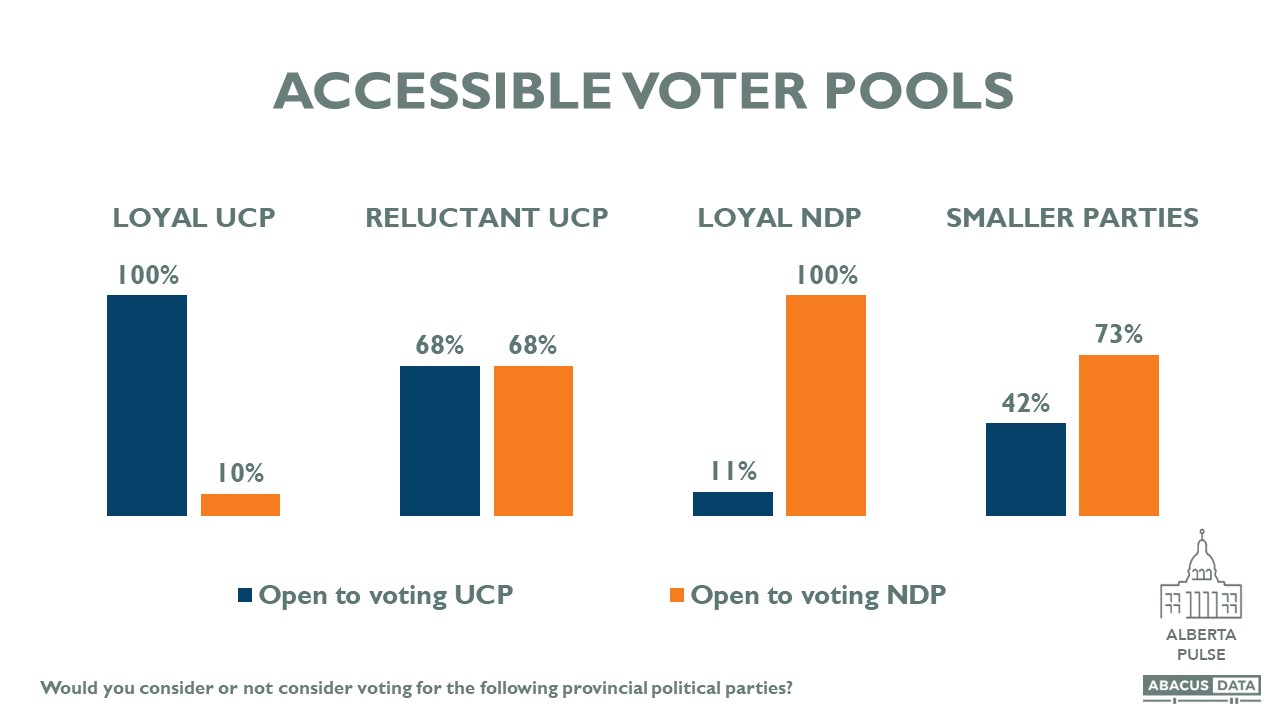

First, let’s look at accessible voter pools. 100% of loyal UCP voters would consider voting UCP but only 10% would consider the NDP. In contrast, 100% of loyal NDP voters would consider voting NDP but only 11% would consider the UCP. There’s not much growth for the opposing party in these two groups so we can expect these two to remain constant in size and mobilizing them becomes more important.

But interestingly, among the reluctant UCP group, 68% are open to voting UCP and 68% are open to voting for the NDP. That’s a high level of overlap demonstrating the potential “swingness” (I know, not a word) of this segment.

Among the smaller party voters, 73% are open to voting NDP while 42% are open to voting UCP.

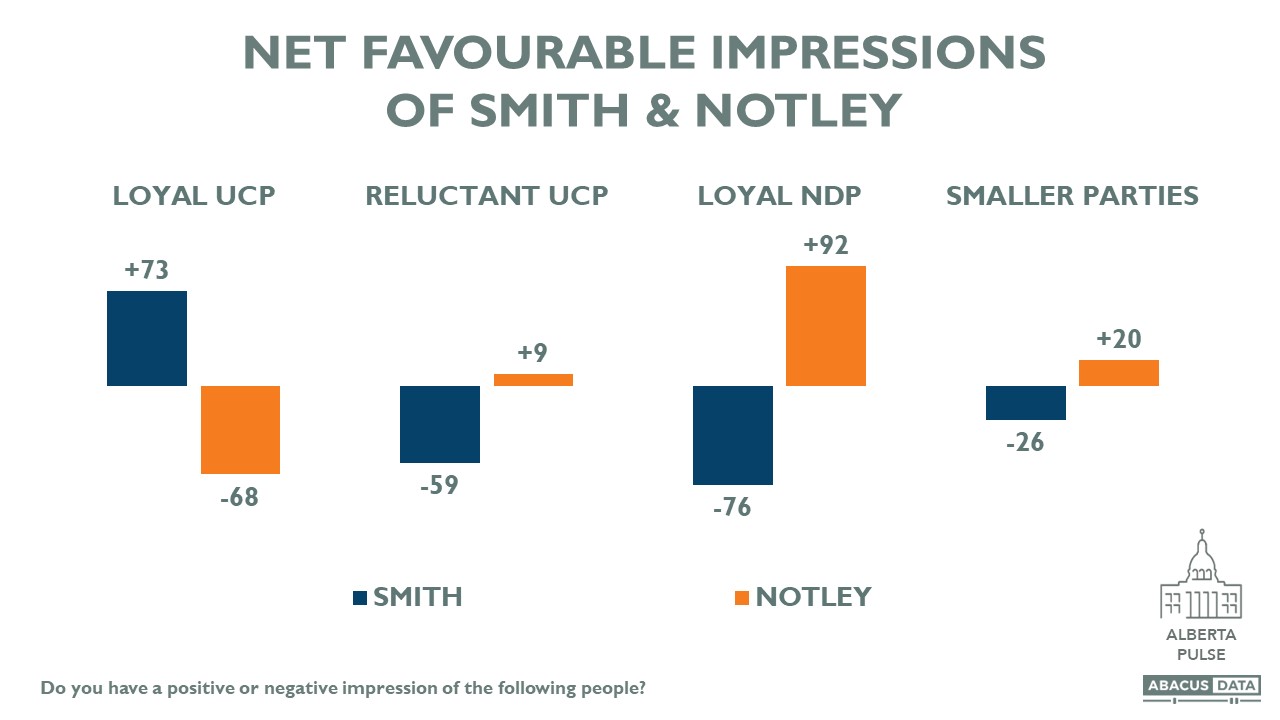

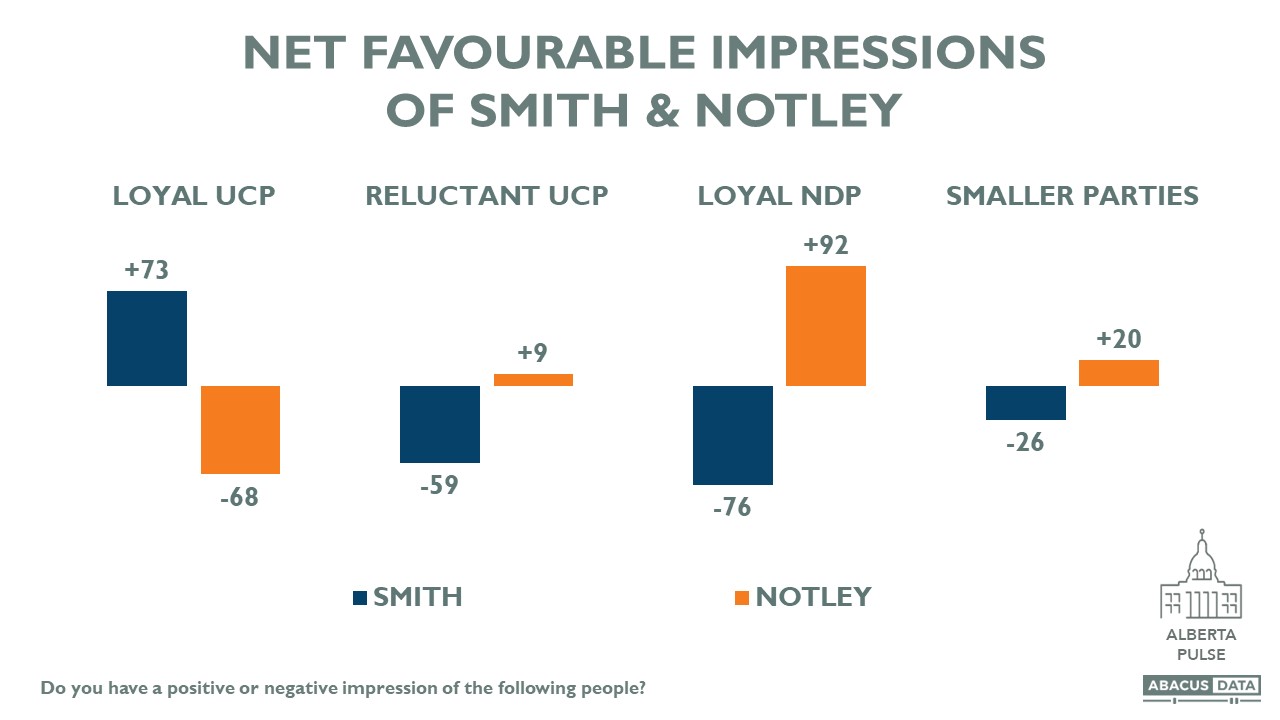

Second, when it comes to leader images, loyal UCP and NDP voters like their party’s leader and dislike the other major party leader. Among smaller party voters, Rachel Notley’s image is generally positive while Danielle Smith’s is negative.

But among the reluctant UCP group, Smith has a pretty negative net favourable rating (-59) while Notley has a net positive (+9). The Upshot: Notley is largely accepted by the group while Smith is disliked.

One challenge for Danielle Smith among the reluctant UCP group is that 2 in 3 think she will be a worse premier than Jason Kenney and only 7% think she will be better. This group’s perception is almost an exact replica of the loyal NDP group and a mirror opposite of the loyal UCP group. The Upshot: Smith needs to change this view among the reluctant group. One way to do that is to focus on issues they care about.

On issues, the priorities for reluctant UCP voters look more similar to loyal NDP voters than they do for loyal UCP voters. Healthcare is a top priority for 2 in 3 while only 46% of loyal UCP voters put healthcare as their top issue. But, reluctant UCP voters are more likely to rank keeping taxes low and managing the economy as a priority than loyal NDP voters. The Upshot: Framing the choice in the next election becomes critical. For the UCP to win over the reluctants, they should focus on the economy and taxes while NDP should make it all about healthcare.

And issue salience and ownership becomes important, depending on how the election is framed. For example, among reluctant UCP voters, the UCP has a 5-point advantage on who they would trust most to manage the economy. But they trail the NDP by almost 30 points on healthcare and 7 points on the cost of living. On the two most important issues for these voters today, the NDP has a clear advantage.

The Upshot: Many are unsure – which leaves the door open for this to change over time – but right now, this is advantage NDP.

Beyond specific issues, the perceived approach the government and government-in-waiting take in governing is important. Earlier I shared the results of a question asking Albertans to choose between two approaches. 1 in 4 overall wanted a government that would shake things up and takes on the elites and Justin Trudeau who are trying to change Alberta.

The results across these four groups are instructive, in my view, to explain why so many of the reluctant UCP voters have defected from the UCP. They aren’t interested in shaking things up – they just want a government that focuses on the basics – manage the economy, improve health and education, and improve transit and transportation.

But among the loyal UCP, views are more split. Almost equal numbers are divided between the two options. The Upshot: Smith and her government have done a good job engaging a big part of their base in the early days but they have alienated a key component of the 2019 coalition. That has exposed them and opened a door for the NDP to convert this group.

The survey also asked Albertans to rate several political leaders on a scale from 0 to 100 where 0 means they really dislike the person and 100 means they really like them.

The results provide a useful look the differences between the groups. Perhaps most important are these two findings. First, loyal UCP voters have a more positive impression of Donald Trump than they do of Rachel Notley or Justin Trudeau. In fact, it’s fair to say that the loyal UCP group hates Justin Trudeau.

But views are quite different among the reluctant UCP group. They really dislike Trump, are less angry with Trudeau and like Jason Kenney far more than they like Daniel Smith. In fact, Smith’s average rating is only slightly higher than that of Justin Trudeau in this group.

Then there’s a comparison about how these groups feel about some surrounding issues.

Reluctant UCP voters are closer to the loyal UCP group when it comes to views about the influence of oil companies in politics (they are pro-energy) and they share the view that the economic policies of the federal government seem to help other provinces at the expense of Alberta.

But they are in between the two loyal groups on climate change, social conservatism, and on whether vaccine mandates are wrong and go against people’s basic human rights. 59% of loyal UCP voters agree that mandates are wrong compared with only 27% of the reluctant group and 11% of loyal NDP voters.

Finally, you’re probably wondering who are these reluctant UCP voters?

They are more likely to be female than male (62% vs. 38%). They are evenly distributed across age groups. They are more concentrated in Calgary and in other communities across the province and less likely to be living in Edmonton. 88% of them voted Conservative in the last federal election.

Perhaps the best way to describe them is they are traditional PC voters. Think those who felt comfortable voting for Alison Redford, Jim Prentice, or Ed Stelmach. These are likely the same voters who also cast ballots for Nenshi or Gondek in Calgary.

They are pro-growth, pro-energy in their outlook, but are looking for sensible, responsible government. They don’t want drama, they want a policy focus on things that matter to them – a strong economy, good public services, and stability.

This group is leaning NDP right now because they don’t think Danielle Smith and her government are offering that.

Take their views on the Sovereignty Act. Only 10% think it’s a good idea while 65% think it’s a bad idea – including 42% who think it’s a very bad idea.

FINAL THOUGHTS

If the next election will be won or loss in Calgary and some of the smaller cities like Lethbridge and Red Deer, then how this reluctant UCP votes (if they vote at all), will likely be the determining factor in the election. They represent about 15% of voters in Calgary and about 20% in the smaller cities across the province.

Alberta is now a two-party province. The core UCP and NDP vote pools are similar in size. The swing vote, a group of mostly female, progressively conservative voters, will decide the outcome of the next provincial election. If the UCP and Danielle Smith think they will win simply by motivating their core base to vote with policy ideas that repel far more voters than they attract, Alberta may wake up the day after the election with another NDP government.

METHODOLOGY

The survey was conducted with 1,000 Alberta adults from December 6 to 10, 2022. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 3.1%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Alberta’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT DAVID COLETTO

David Coletto is CEO and a founding partner of Abacus Data a full-service market research and strategy firm based in Ottawa and Toronto. With over a decade and a half of experience in the industry, David and his partners founded Abacus 12 years ago and since then David has become one of Canada’s most respected social researchers regularly commenting on politics, the labour market, and consumer behaviour.

David Coletto is CEO and a founding partner of Abacus Data a full-service market research and strategy firm based in Ottawa and Toronto. With over a decade and a half of experience in the industry, David and his partners founded Abacus 12 years ago and since then David has become one of Canada’s most respected social researchers regularly commenting on politics, the labour market, and consumer behaviour.

He earned a PhD in Political Science from the University of Calgary in 2010 is an adjunct professor at Carleton University. He is the host and producer of inFocus with David Coletto a podcast that explores the intersection of public opinion, politics, public policy, and consumer behaviour.

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.