Evaluating Canadian Interest: Energy-Efficient Homes in the Housing Landscape

From August 18 to 23, 2023, Abacus Data conducted a national survey of 2,205 Canadians (18+) to assess their perceptions of energy-efficient housing.

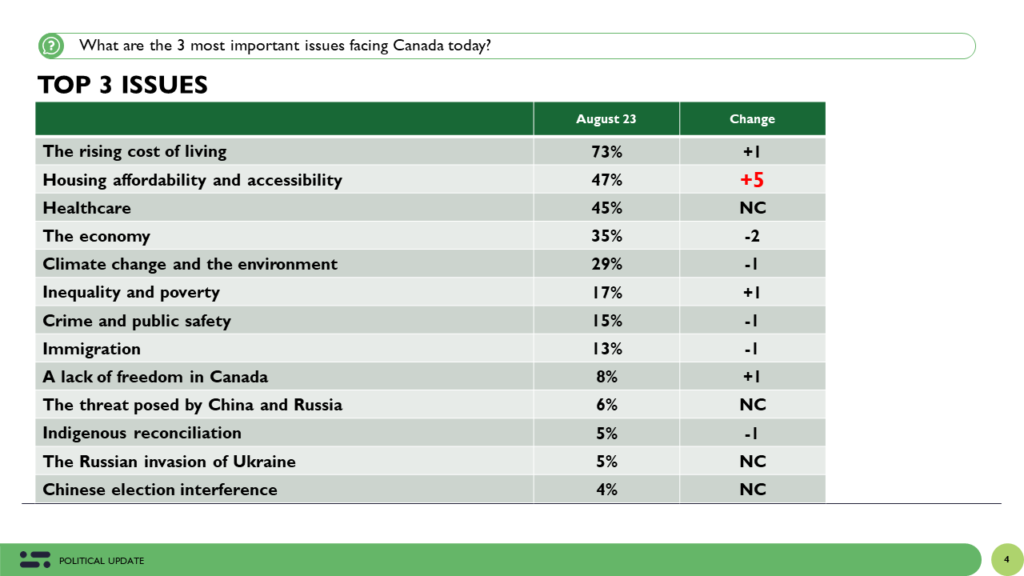

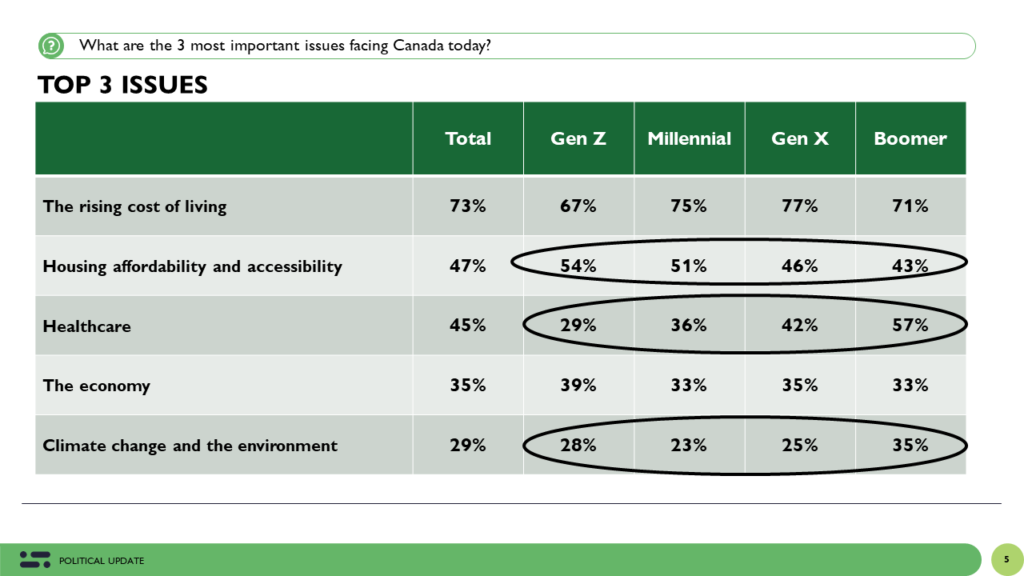

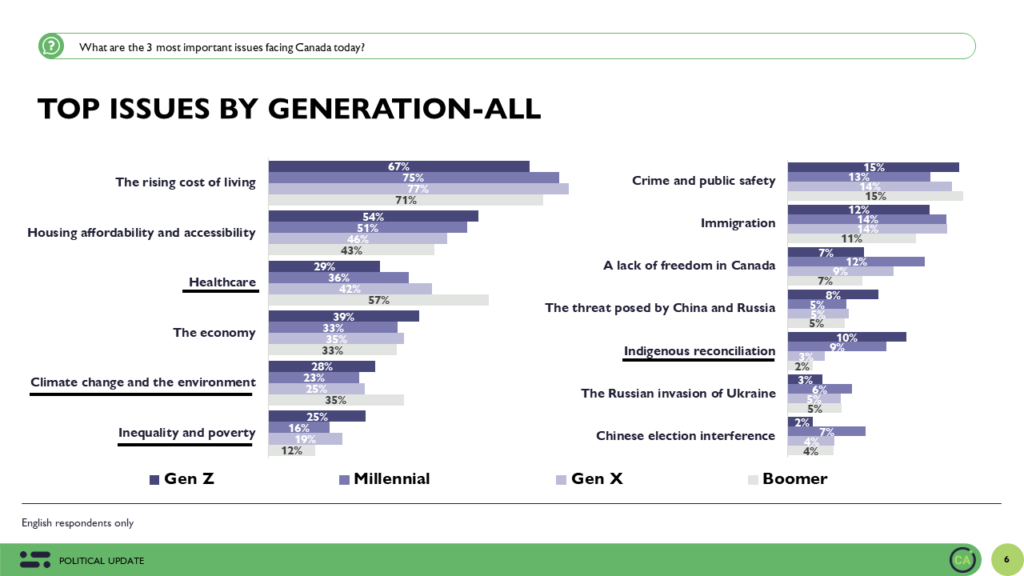

As we contemplate the foremost concerns occupying the thoughts of Canadians, it remains evident that housing and climate change consistently occupy prime positions. With mounting pressure to bolster housing construction nationwide, it becomes imperative to deliberate on how we can address housing challenges without compromising our environmental commitments.

In this survey, we investigated Canadian interest in energy-efficient homes, their motivations for considering (or not considering) such homes, and the specific technologies and products that pique their curiosity. The findings underscore Canadians’ appetite for energy efficiency in homes, although their primary motivation may not necessarily revolve around environmental concerns.

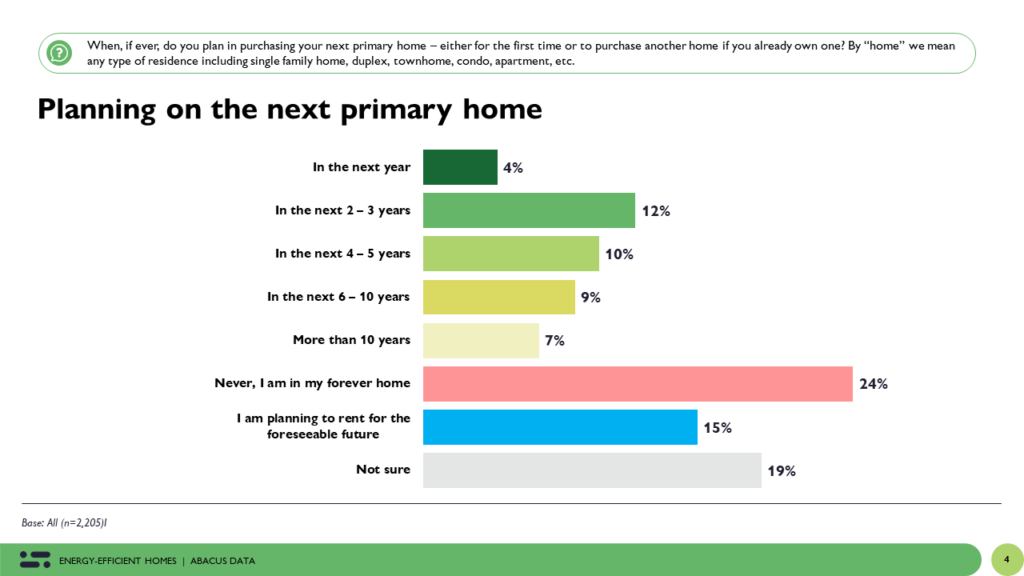

Decision to Purchase a New Home

Among Canadians, few intend to purchase a home within the next year (4%) with only 12% intending to purchase in the next 2-3 years. The decision to purchase a new home farther down the road is highest among young Canadians (38% intend to do so in the next 4 to 10 years), while 46% of older Canadians (60+) are in their forever homes. These relatively low intent purchase intent rates are likely due to the challenges many Canadians face with respect to housing affordability and availability.

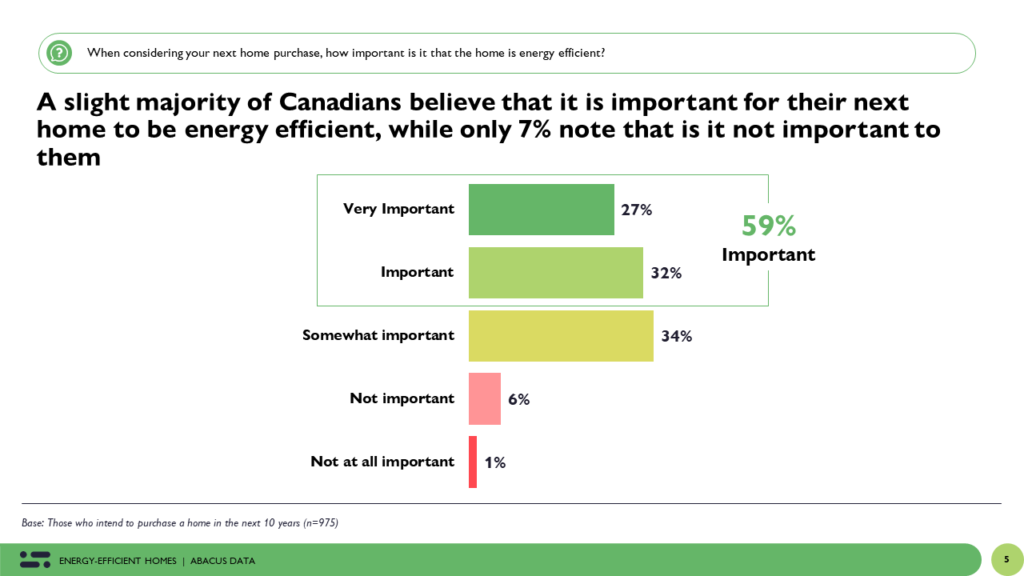

Interest in Purchasing an Energy Efficient Home

Among individuals planning to buy a home in the coming years, 59% expressed the importance of having an energy-efficient home. In contrast, only 7% stated that energy efficiency was not a priority for their future home. Notably, Canadians aged 30-44 (61%), 45-59 (68%), and 60 and older (71%) were significantly more inclined to consider the importance of purchasing an energy-efficient home compared to those aged 18-29 (47%). Regionally, respondents from British Columbia (61%), Saskatchewan/Manitoba (72%), Ontario (60%), and Atlantic Canada (77%) were more likely to emphasize the significance of acquiring an energy-efficient home, while those in Quebec (40%) placed relatively less importance on this aspect.

Reasons to (or not to) Purchase an Energy Efficient Home

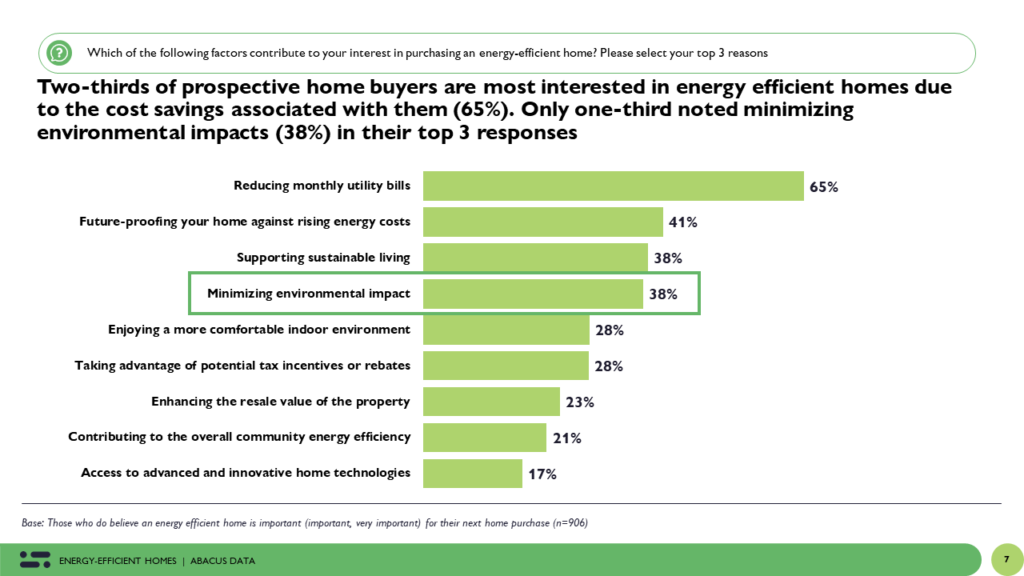

Among those who are interested in an energy-efficient home, the primary driver in doing so is significant cost savings (65% included in top 3 reasons). Additionally, 41% of respondents express interest in energy-efficient homes to safeguard against rising energy expenses. Beyond financial considerations, 38% of respondents are drawn to energy-efficient homes as a means of promoting sustainable living, while an equal percentage aims to minimize their environmental footprint. These findings indicate that most prospective homebuyers are primarily motivated by the tangible financial benefits of energy-efficient homes, notably the potential for substantial savings.

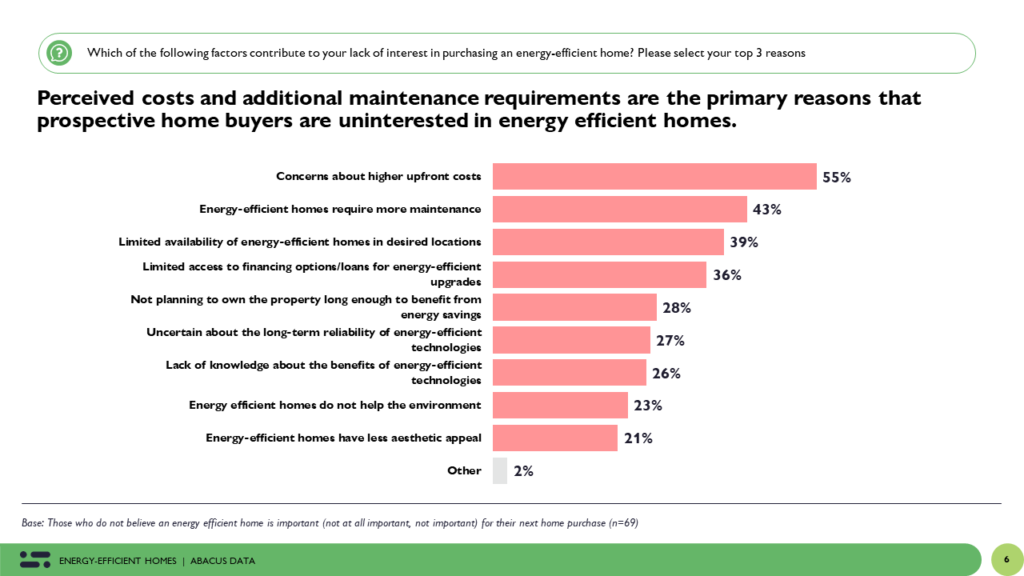

Among those who emphasized that an energy-efficient home was not a priority, a substantial 55% prominently cited concerns about higher upfront costs as one of their top three reasons, while 43% pointed to the perception that energy-efficient homes demand more maintenance. In aggregate, 79% of respondents placed concerns about costs and maintenance at the forefront of their top three considerations. Although it is essential to approach these findings cautiously due to a relatively smaller sample size, it is important to highlight that the prevailing barriers linked to energy-efficient homes are unequivocally cost-related and maintenance-related.

Home Upgrades of Interest

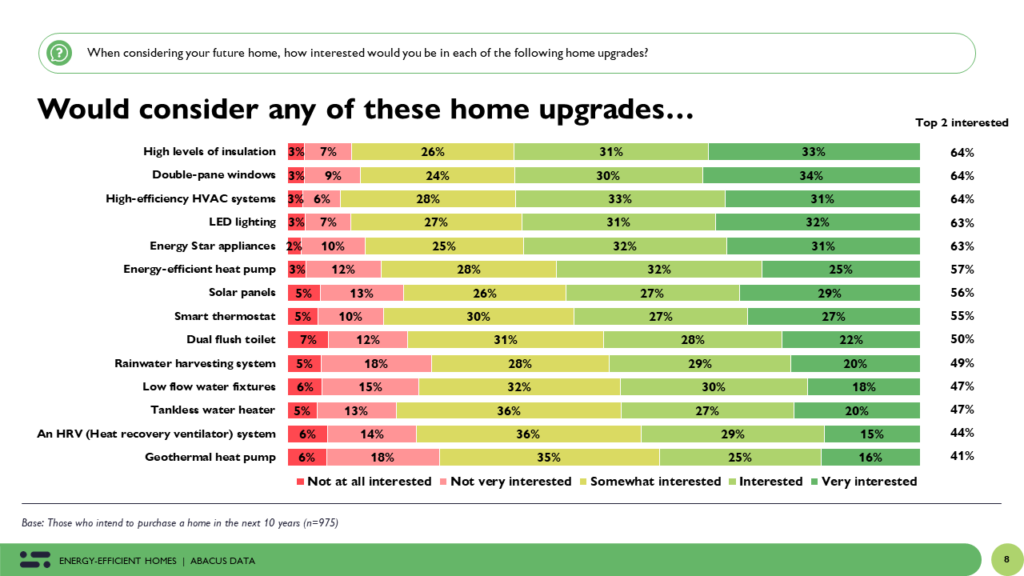

When we look at the features that are of interest to potential home buyers, some clear preferences stand out.

First, 64% of those surveyed prefer homes with high levels of insulation. At the same time, 64% also like the idea of double-pane windows, which help moderate temperatures and save energy. In addition to this, 64% of respondents are interested in high-efficiency HVAC systems. This indicates that advanced heating and cooling solutions are a big deal for future homes.

Beyond these key considerations, the survey revealed that 63% of respondents prefer homes with energy-efficient LED lighting, with another 63% who are interested in Energy Star appliances. This shows a strong commitment to sustainability and using less energy in their homes.

Willingness to Pay for Energy-Efficient Upgrades

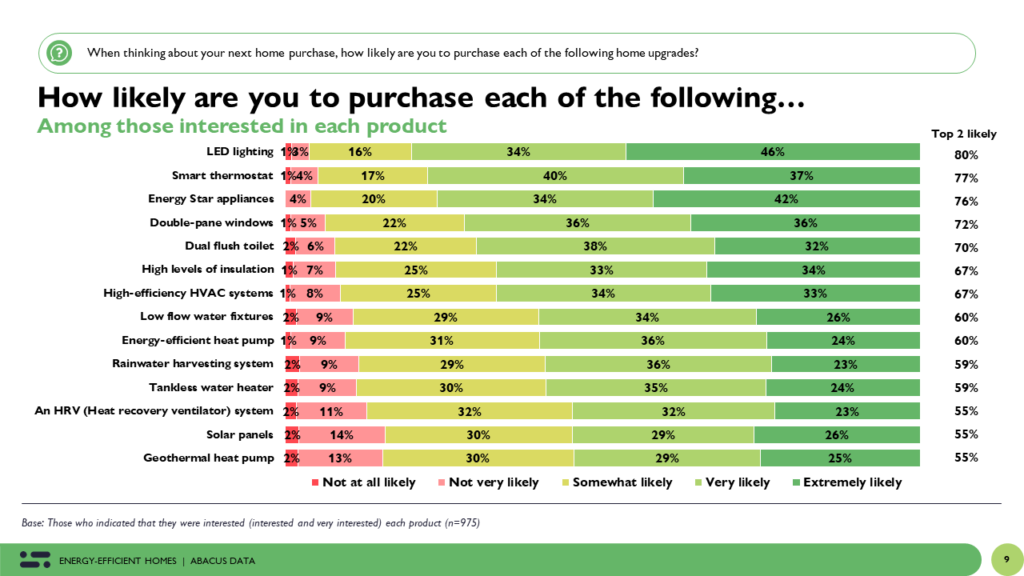

Moving from interest to actual investment, it is important to explore what homebuyers are truly open to purchasing. The front-runner in this regard is energy-efficient LED lighting. To be precise, among those who said they were interested in LED lighting, 80% would be willing to buy it. Right behind, 77% of those interested in smart thermostats are willing to make the purchase. These results may be due to the perception that LED lighting and smart thermostats are affordable and easy to find.

Moreover, 76% of prospective home buyers expressed their intention to invest in Energy Star Appliances. Energy Star appliances have been shown to bring monthly savings to homeowners due to their energy efficiency, which is a strong motivator for those seeking energy-efficient housing.

On the other hand, when it comes to bigger investments like geothermal heat pumps, solar panels, and heat recovery ventilation (HRV) systems, the willingness to purchase drops to 55% (among those interested in these products). These higher-cost items, while undoubtedly effective in enhancing energy efficiency, seem to prompt more careful consideration among prospective buyers. This reflects the delicate balance between cost, long-term benefits, and environmental consciousness.

The Upshot

In the housing realm, most Canadians are interested in owning an energy-efficient home. This interest is largely driven by the promise of real financial benefits like lower utility bills and protection from rising energy costs, followed by eco-conscious motivations. This presents a prime opportunity for organizations to emphasize these personal advantages alongside the environmental impact.

While most are enthusiastic about energy-efficient homes, there’s a small group that remains unconvinced. Their main concern? The perception of higher upfront costs. It’s important to bridge this gap by educating consumers about the long-term savings and benefits as it will provide them with actionable information to make informed decisions on.

Moving beyond interest in energy-efficient homes and technology, it’s crucial to grasp what prospective homebuyers are truly willing to invest in. Expressing interest doesn’t always translate into action, especially when considering higher-cost items. The findings indicate that while potential homebuyers express high interest in products like high-efficiency HVAC systems, high levels of insulation, or energy-efficient heat pumps, they lean more towards considering readily-available, lower-cost items like LED lighting and smart thermostats when it comes to making actual purchases.

Overall, educating buyers about the importance and benefits of energy-efficient homes is vital for builders, as it not only enhances marketability but also cultivates a deeper understanding of their lasting value. Builders wield substantial influence in shaping the housing landscape and consumer choices, making this education pivotal in fostering sustainable living.

Methodology

The survey was conducted with 2,205 Canadian adults from August 18 to 23, 2023. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.09%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region.

This survey was paid for by Abacus Data Inc.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are the only research and strategy firm that helps organizations respond to the disruptive risks and opportunities in a world where demographics and technology are changing more quickly than ever.

We are an innovative, fast-growing public opinion and marketing research consultancy. We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

We were one of the most accurate pollsters conducting research during the 2021 Canadian election following up on our outstanding record in 2019.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.