How Financially Literate are Canadians?

November 30, 2015

Research Objectives

In June, Canada launched its first-ever National Strategy for Financial Literacy and the country is now examining how best to increase the financial knowledge and skills of Canadians.

On behalf of the Canadian Bankers Association, Abacus conducted an extensive nationwide study of Canadians’ financial aspirations and their know-how when it comes to managing money in ways that will help them achieve their goals. This research is designed to explore the values, financial goals and priorities of Canadians of different ages and to get a better understanding of what financial issues they would like to know more about and where they go to look for information. This study is being widely released so that all financial literacy organizations can use the knowledge to properly evaluate their programs and ensure that they are reaching all generations in this digital age.

This is the third of a series of releases to highlight key elements of this fascinating study.

How Financially Literate Are We?

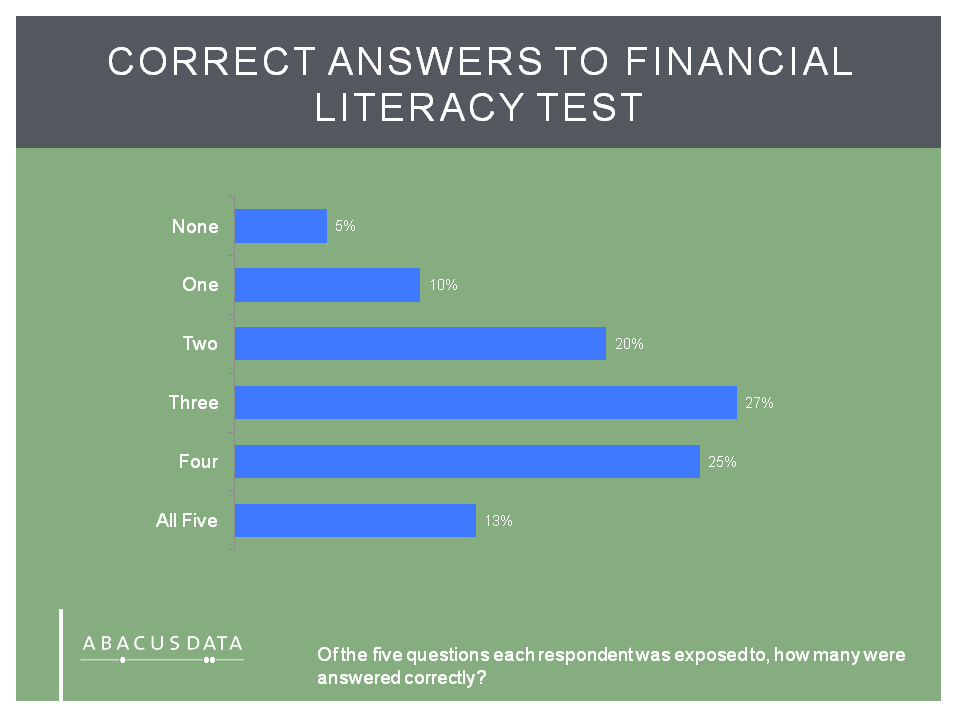

As part of the study, we asked respondents five financial knowledge multiple choice questions. The questions had varied levels of difficulty to provide some insight into how financially literate Canadians from different generations and socio-economic backgrounds are.

The questions we asked are reported at the end of this report.

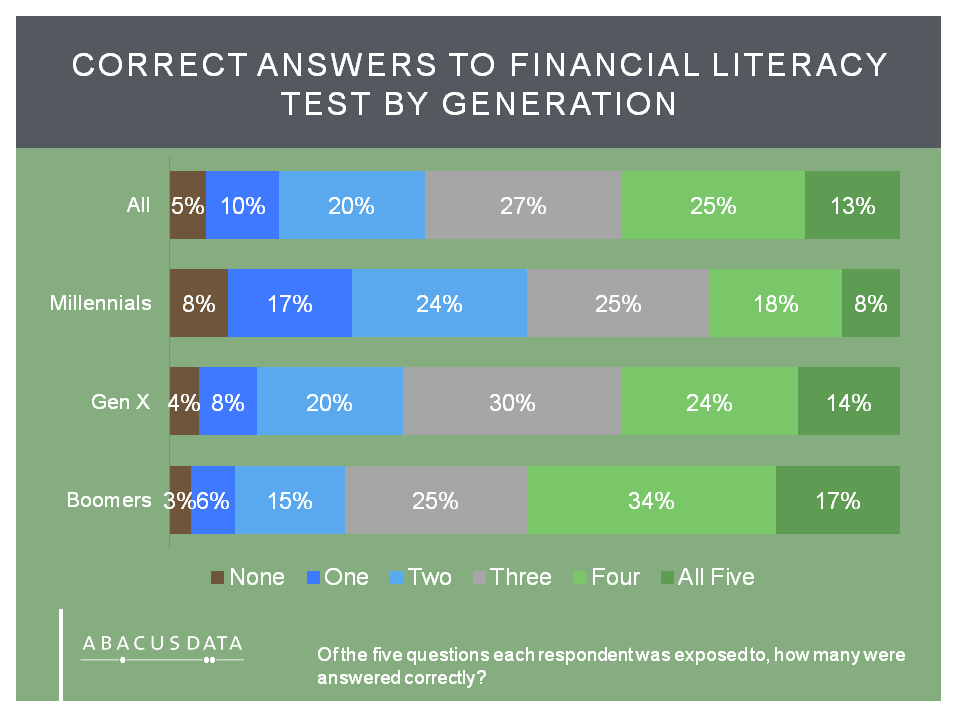

Overall, only 13% of Canadians aged 18 and over got all five questions correct. Another 25% got four right with 27% getting three right. Over one in three failed to get more than two of the questions correct.

Profiling the Most and Least Financially Knowledgeable

Significant demographic and socio-economic differences exist between Canadians who have the most and least financial knowledge. We detail those who answered all five questions correctly (most knowledgeable) and those who answered none or only one of the questions correctly.

Most Financially Knowledgeable – Correctly Answered all 5 Questions

Representing just over one in ten Canadians (13%), those who correctly answered all five of the financial knowledge questions correctly are more likely to be male (58%), are generally older (80% are aged 45 or older), and most (54%) have a university education. Household incomes among the most financially knowledgeable are also the highest, with 54% making $75,000 per year or more. Four in ten (44%) say they have a financial advisor.

Least Financially Knowledgeable – Correctly Answered None or Only One Question

Also representing over one in ten Canadians (15%), those who answered none or only one of the financial knowledge questions correctly are more likely to be female (61%), are younger (54% are aged 35 or younger), and most (57%) have high school education or less. Household incomes among the least financially knowledgeable are lowest on average, with 48% living in households that make less than $50,000 per year. Only 26% say they have a financial advisor.

The results also reveal:

• Millennials are less financially knowledgeable than Gen Xers or Baby Boomers. Only 26% of Millennials got four or more questions right, compared with 38% of Gen X, and 51% of Baby Boomers.

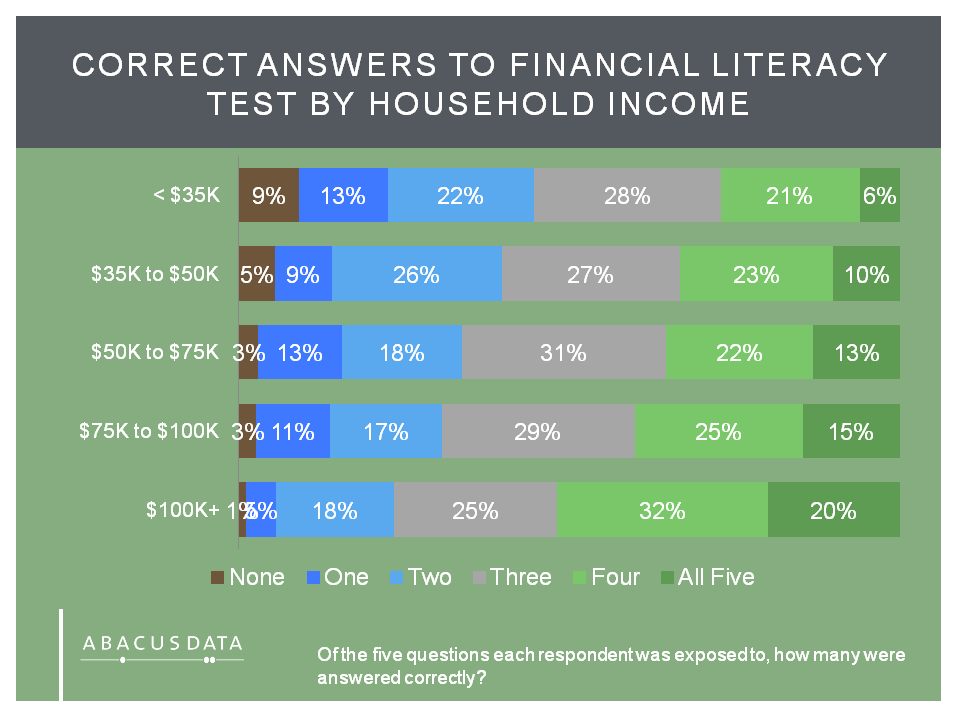

• Those with lower household incomes were less financially literate. Among those in households earning less than $35,000 per year, 44% failed the test and only 27% got four or more right. Canadians in the highest income bracket were the most financially literate with 52% getting four or more right and few getting one or less right.

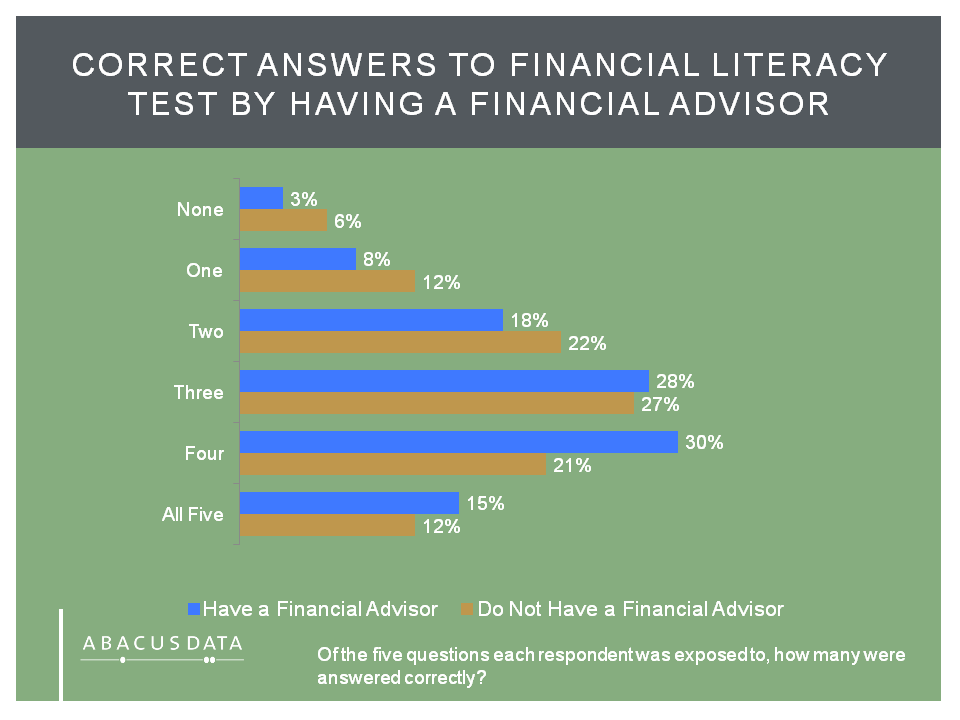

• Among those with a financial advisor, 45% got four or more questions correct compared with 33% among those without a financial advisor.

• Respondents have a more difficult time answering questions that relate to interest and choosing which financial strategy is better in certain circumstances. Many also underestimate what the cost of housing will have on their monthly budgets.

The Upshot

Our financial literacy test reveals that a substantial proportion of Canadians lack a basic understanding of simple financial concepts. Just over two in three respondents we surveyed could correctly answer a majority of the questions we asked and 15% answered one or less correctly.

Noteworthy are the generational and socio-economic differences our study found. Younger Canadians, those earning less, and those without a financial advisor are less knowledge about financial matters.

Financially literacy test questions and percent of respondents selecting them.

1. Suppose you had $100 in a savings account and the interest rate was 2% per year. After 5 years, would you have: $102, more than $102, less than $102?

$102 – 7%

More than $102 [correct answer] – 83%

Less than $102 – 4%

Not sure – 7%

2. Imagine that you put $10,000 into a savings account that paid interest of 1% a year. Inflation was 2% per year. After 1 year, would you be better off, worse off, or no better or worse off?

Better off – 15%

Worse off [correct answer] – 51%

No better or worse off – 16%

Not sure – 18%

3. Let’s imagine someone has a $100,000 mortgage on their home and the mortgage interest rate is 3.0%. They come into a windfall of $10,000. Would they be better to invest that $10,000 in a bond that pays them 5%/2% (split sample) or put the $10,000 towards reducing their mortgage?

(split sample with 5%)

Bond that pays 5% [correct answer] – 37%

$10,000 towards reducing their mortgage – 42%

Not sure – 21%

(split sample with 2%)

Bond that pays 2% – 13%

$10,000 towards reducing their mortgage [correct answer] – 66%

Not sure – 22%

4. For the average household, what percentage of a household’s monthly income should ideally be spent on housing?

5% – 5%

25% – 52%

40% [correct answer] – 28%

70% – 2%

Not sure – 13%

5. How big should a household’s emergency fund ideally be?

1 week’s income – 3%

1 month’s income – 17%

6 months’ income [correct answer] – 58%

1 year’s income – 13%

Not sure – 10%

Methodology

The survey, commissioned by the Canadian Bankers Association, was conducted online with 1,978 Canadians aged 18 to 70 from April 10 to 21, 2015.A random sample of panelists was invited to complete the survey from a large representative panel of over 500,000 Canadians, recruited and managed by Research Now, one of the world’s leading provider of online research samples.

The Marketing Research and Intelligence Association policy limits statements about margins of sampling error for most online surveys. The margin of error for a comparable probability-based random sample of the same size is +/- 2.2%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

Abacus Data Inc.

We offer global research capacity with a strong focus on customer service, attention to detail and value added insight. Our team combines the experience of our Chairman Bruce Anderson, one of Canada’s leading research executives for two decades, with the energy, creativity and research expertise of CEO David Coletto, PhD.