Election 2015: The Politics of a Soft Economy

September 1, 2015

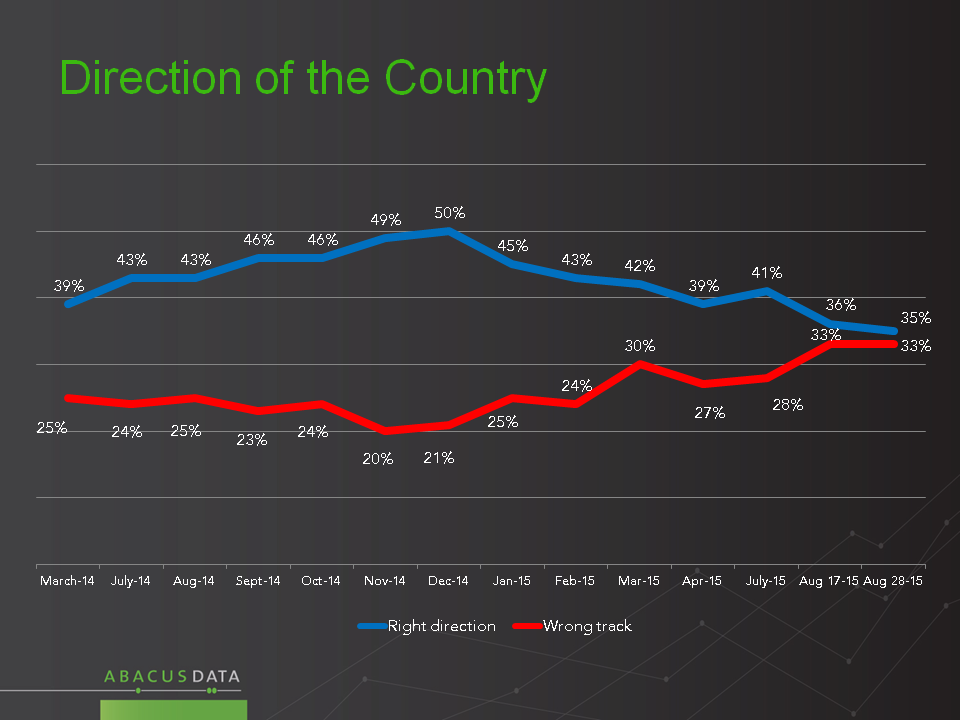

Only 35% believe the country is heading in the right direction, while 33% say it is on the wrong track. These are the weakest indicators we have seen since we began tracking this question 18 months ago. Among those who say the country is heading in the right direction, 46% intend to vote CPC, 25% NDP, and 23% LPC. Among those who have the opposite view, 38% intend to vote LPC, 37% intend to vote NDP, and 12% intend to vote CPC.

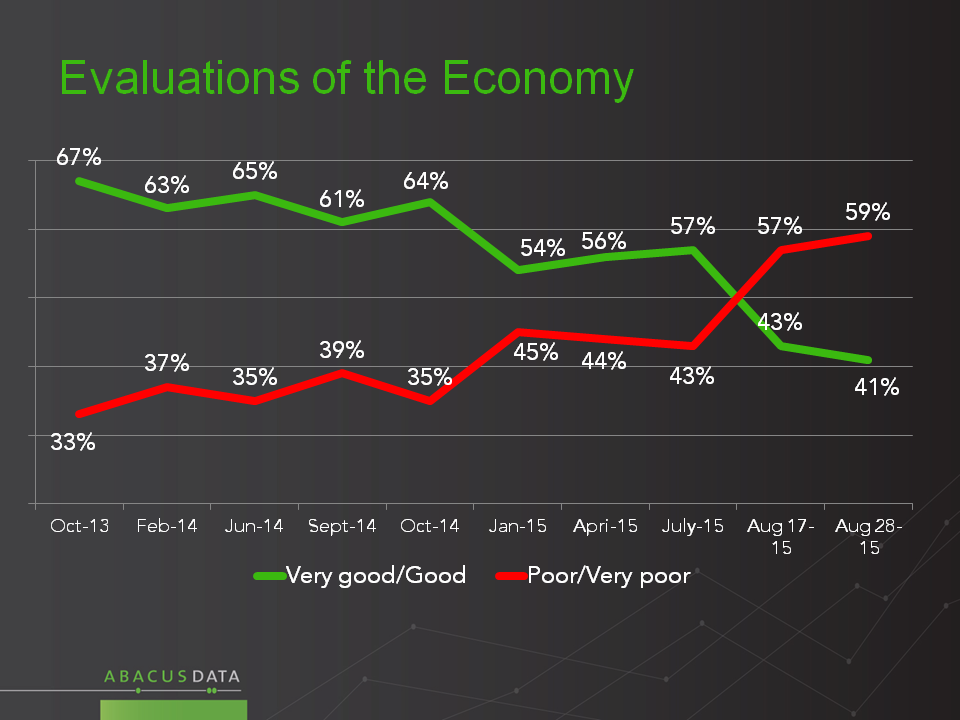

State of the Economy

A majority say the economy is in poor or very poor health, also the highest number we have seen since we began measuring this in October 2013. Among those who say the economy is in good shape, 45% intend to vote CPC, 24% NDP, and 23% LPC.. Among those who have the opposite view and describe the economy as poor or very poor, 37% intend to vote NDP, 32% LPC and 18% CPC.

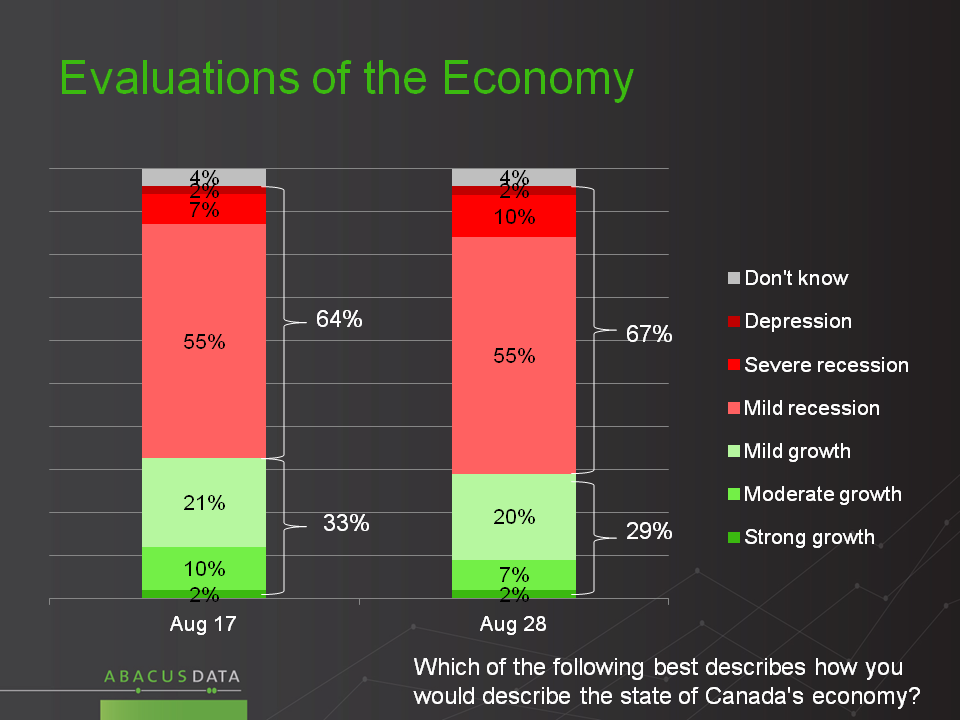

In this wave of surveying, 29% say the economy is growing, down 4 points from our last measurement that ended August 17th. A total of 67% say the economy is shrinking and in a recession.

How Canada’s Economy Compares

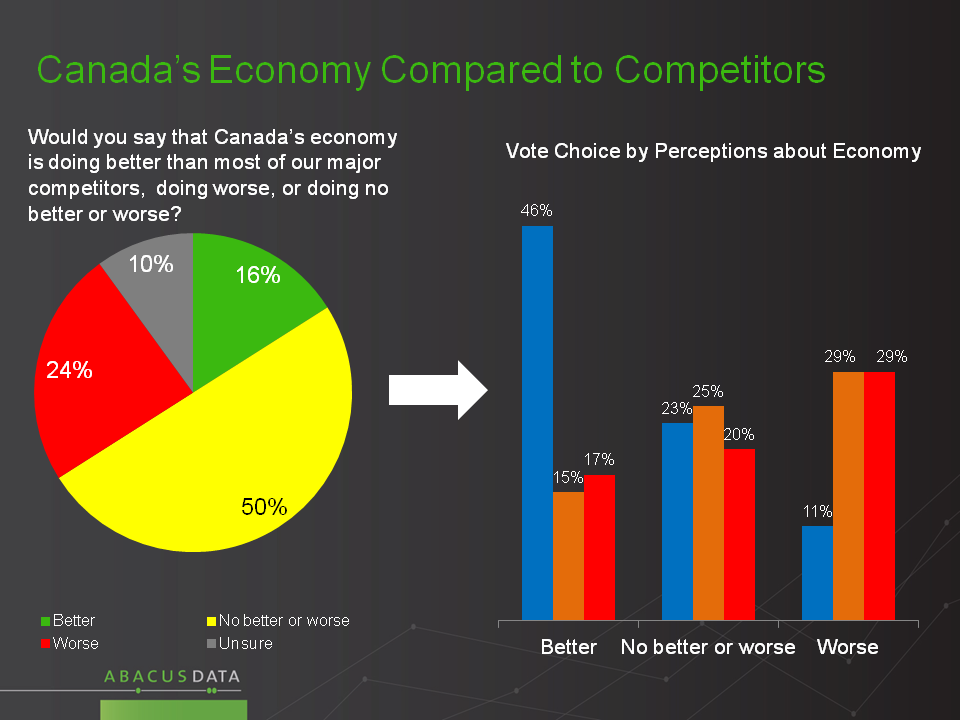

While many people aren’t thrilled with the state of the economy, it is important to note that only 24% think our economy is doing worse than that of our major competitors. 16% believe that we are outperforming others, and 50% think our situation is more or less the same.

Among those who think our economy is outperforming, the Conservatives can count on the votes of 46%, with the other parties well behind. Among those who think we are underperforming, only 11% are planning on voting Conservative, while the Liberals and NDP are tied at 29%. Among those who think we are roughly on par with our competitors, the three main parties are closely bunched.

What Economic Conditions Cause Anxiety?

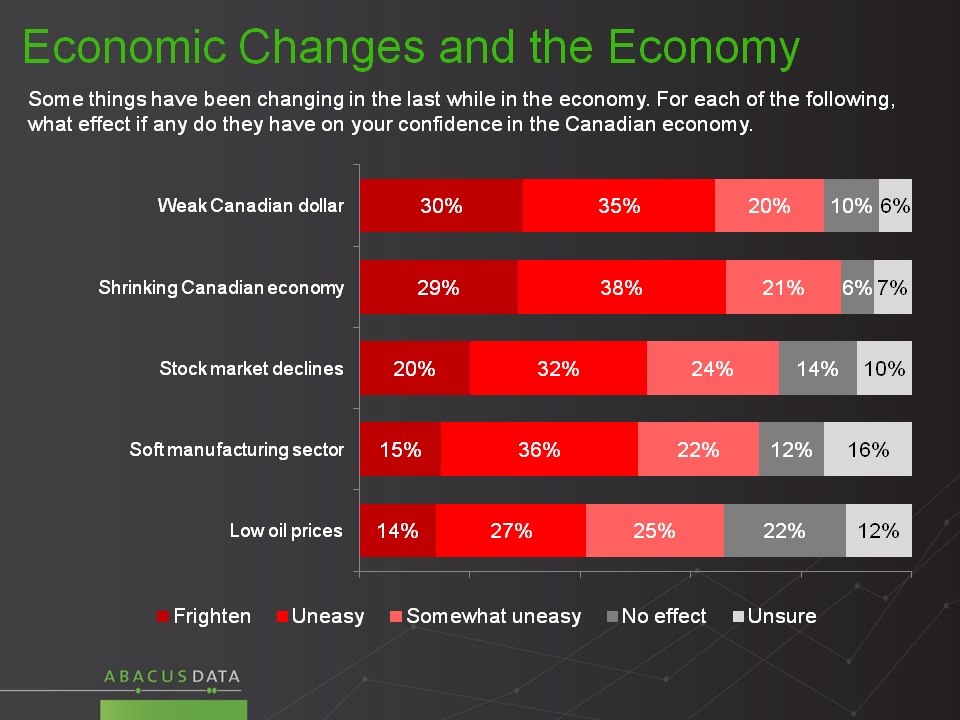

We measured levels of fear about different economic conditions, in part because we wanted to see the impact of large fluctuations in world stock markets during the week we were in the field. The results show that a weak Canadian dollar and a shrinking Canadian economy are the two things that create the most fear. Relatively speaking a soft manufacturing sector and low oil prices cause considerably less anxiety, although these factors also cause uneasiness among a majority of those surveyed.

Deficits

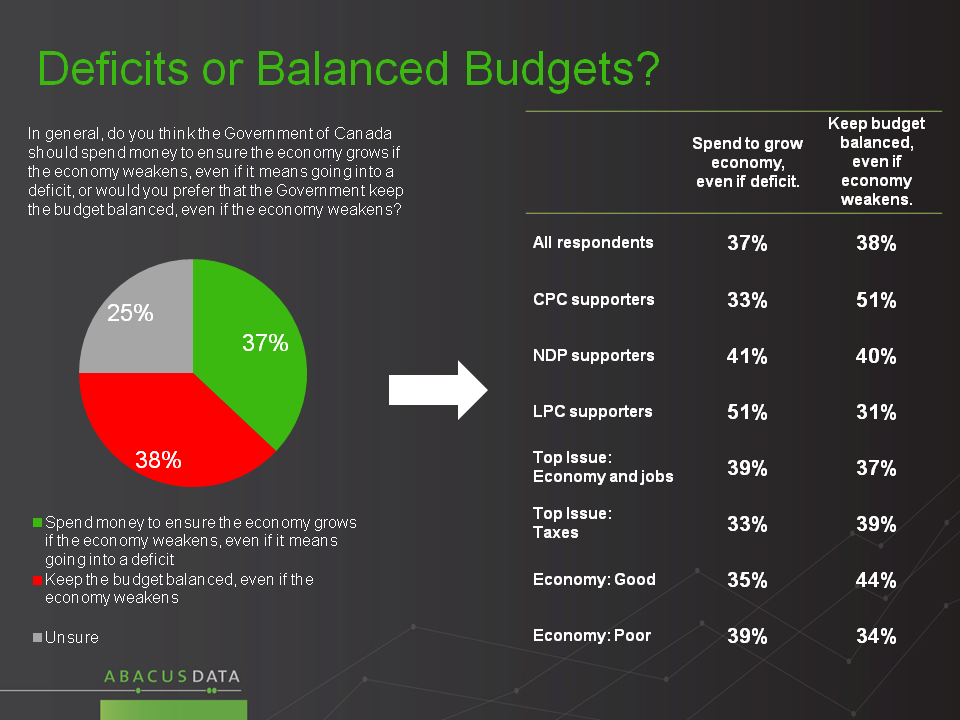

37% people believe that the government should spend money to ensure the economy grows, even if it means going into deficit”, while 38% prefer “to keep the budget balanced, even if the economy weakens”. On this question, 25% were unsure of where to come down.

Liberal Party supporters were more likely to favour spending (51%-31%) while CPC supporters were almost the mirror opposite (33%-51%). New Democrats were evenly split 41%-41%.

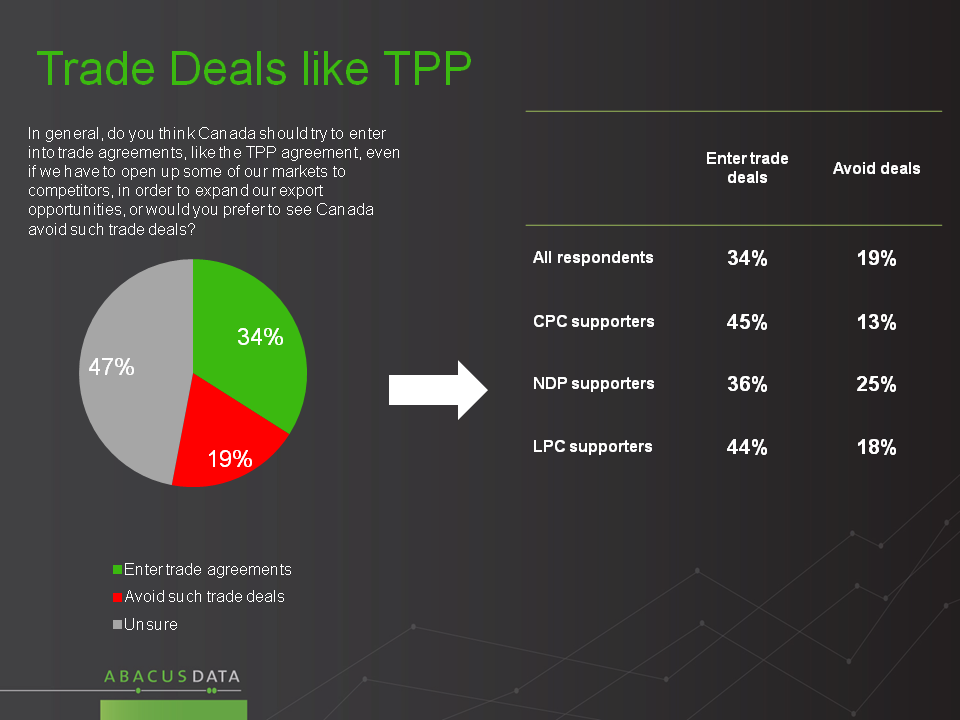

Trade Deals like TPP

34% believe that Canada “should try to enter into trade agreements, like the TPP agreement, even if we have to open up some of our markets to competitors, in order to expand our export opportunities” while 19% would prefer to see Canada avoid such trade deals. Roughly half (47%) are unsure.

The supporters of all major parties tend to be more inclined to support entering into such trade deals, rather than to avoid them.

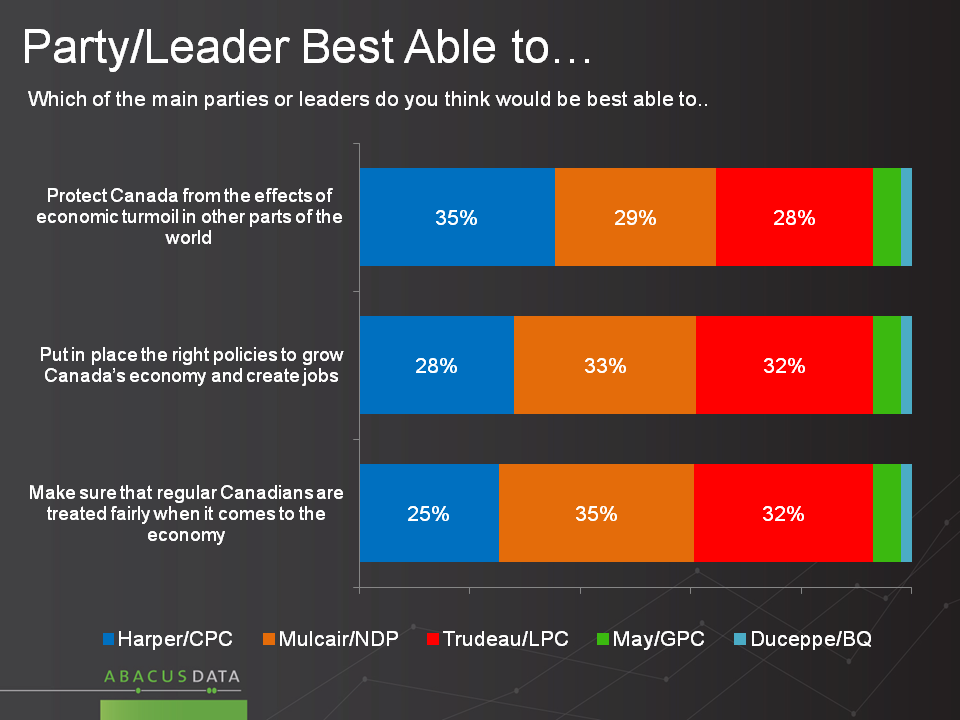

Political Parties and Economic Purposes

If the question is which party and leader is best able to “protect Canada from the effects of economic turmoil in other parts of the world”, the Conservatives (35%) would win this ballot question, followed by the NDP (29%) and the Liberals (28%).

However when we asked a question about “putting in place the right policies to grow Canada’s economy and create jobs”, the Conservatives drop to third place (28%) behind the Liberals (32%) and the NDP (33%).

Finally, when probed on which party/leader would do best at making “sure that regular Canadians are treated fairly when it comes to the economy”, the NDP lead (35%) followed closely by the Liberals (32%) and the Conservatives again trail at 25%.

The Upshot

The economy may well become the issue that carries the most weight in this election campaign, and current economic conditions are testing the popularity of the incumbents. Among those who think the economy is healthy and growing and doing better than our competitors, the Conservatives enjoy solid levels of support, however the economic mood has soured recently, and voters are evaluating whether other parties would provide better economic leadership.

The Conservative Party is seen as best when it comes to buffeting global economic pressures, but other parties come more readily to mind when the topic is how to generate growth in the economy.

Results on deficit and TPP questions show Canadians remain largely pragmatic, not dogmatic. They will support policies they believe might work to improve things, and with three quarters of voters inclined to want change in this election, the conversation is more likely to be about what new measures might help.

Right now, this is an election without a defining ballot question. If it becomes an election about how to avoid economic risk, that may play to the Conservatives’ advantage. If it becomes about how to create and distribute economic upside, other parties may stand to gain more.

Methodology

Our surveyed, commissioned by Abacus Data, was conducted online with 1,500 Canadians aged 18 and over from August 26 to 28, 2015. A random sample of panelists was invited to complete the survey from a large representative panel of over 500,000 Canadians, recruited and managed by Research Now, one of the world’s leading provider of online research samples.

The Marketing Research and Intelligence Association policy limits statements about margins of sampling error for most online surveys. The margin of error for a comparable probability-based random sample of the same size is +/- 2.6%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

Abacus Data Inc.

We offer global research capacity with a strong focus on customer service, attention to detail and value added insight. Our team combines the experience of our Chairman Bruce Anderson, one of Canada’s leading research executives for two decades, with the energy, creativity and research expertise of CEO David Coletto, PhD.