Financial Goals and Know How

November 26, 2015

Research Objectives

In June, Canada launched its first-ever National Strategy for Financial Literacy and the country is now examining how best to increase the financial knowledge and skills of Canadians.

On behalf of the Canadian Bankers Association, Abacus conducted an extensive nationwide study of Canadians’ financial aspirations and their know how when it comes to managing money in ways that will help them achieve their goals. This research is designed to explore the values, financial goals and priorities of Canadians of different ages and to get a better understanding of what financial issues they would like to know more about and where they go to look for information. This study is being widely released so that all financial literacy organizations can use the knowledge to properly evaluate their programs and ensure that they are reaching all generations in this digital age.

This is the first of a series of releases to highlight key elements of this fascinating study.

How We Define Our Financial Goals

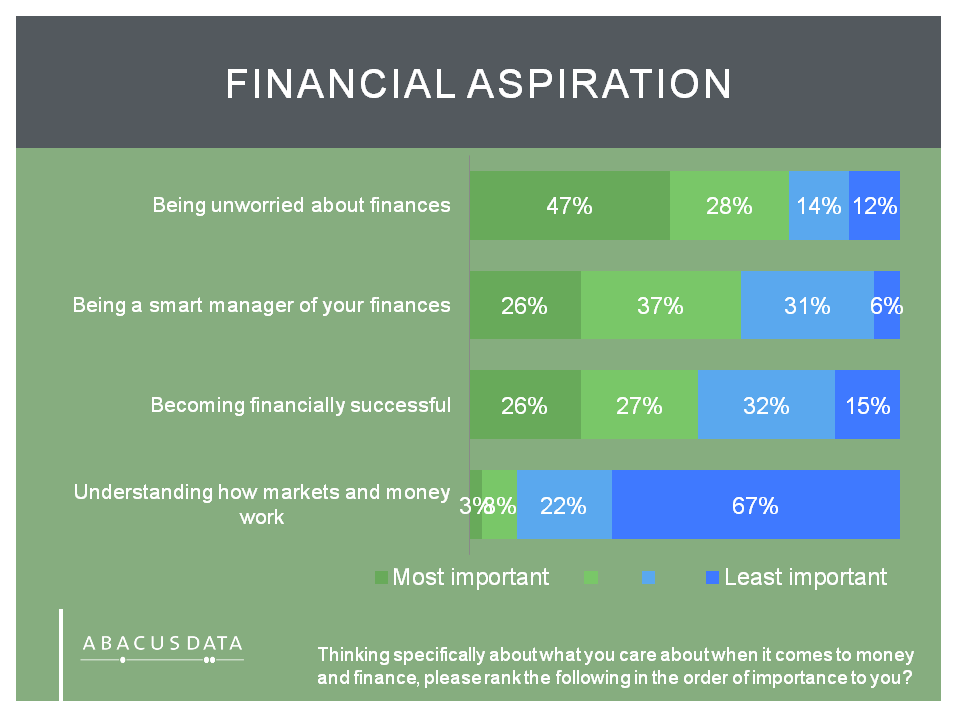

For most people, learning about how to manage their finances well is a means towards an end, not an end unto itself. And the aspiration that most people have in mind is the absence of worry. When given a choice of four different aspirations, the most important, easily, was “being unworried about finances”.

After that, equal numbers cite “being a smart manager of finances” and “becoming financially successful”. Far fewer embrace the goal of “understanding how markets and money work”.

This is an important backdrop when it comes to designing initiatives aimed at promoting financial literacy and know how. People want to achieve a sense of confidence rather than a particular level of detailed expertise.

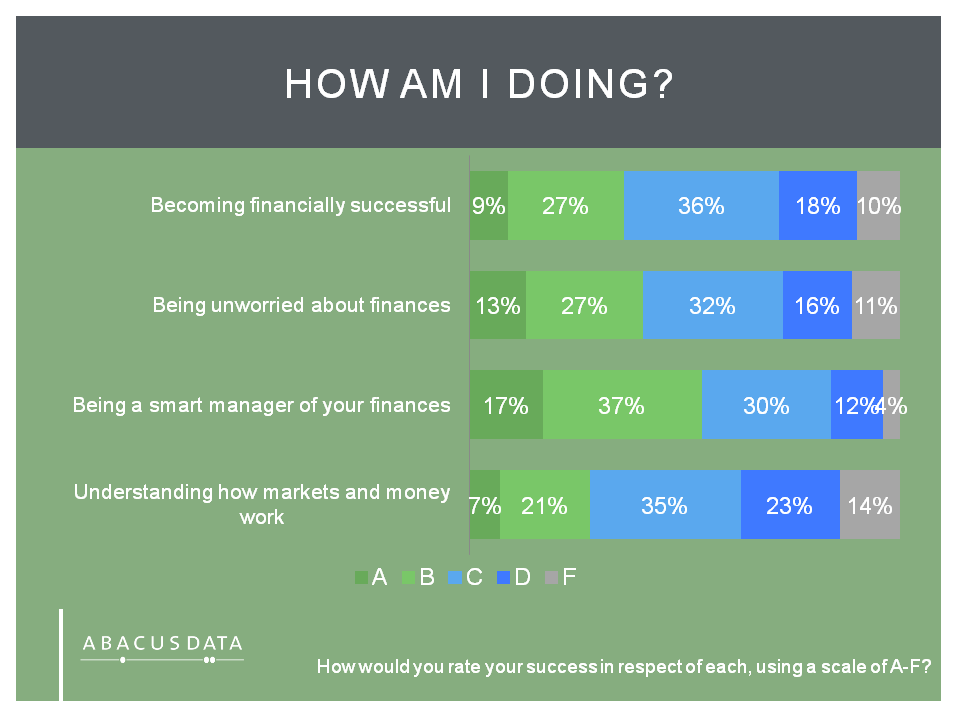

We then asked people how well they thought they were doing at achieving each of these financial aspirations. The results show that very few people think they are failing (assigning themselves an “F” grade) on any of the aspirations, but few give themselves top marks either.

On the top ranked aspiration “being unworried about finances”, 40% gave themselves an A or B, while the plurality gave themselves a C, and 16% a D. When it comes to being “a smart manager of finances” the majority (52%) gave themselves an A or B, only 16% gave themselves a D or F. This highlights the fact that while improving financial literacy/know how is a useful initiative, the vast majority do not think they are starting from a very low level of knowledge.

What We Want to Know More About

We asked respondents to tell us which of a list of financial topics they felt like they needed to learn more about, as this information can help in developing priority content for financial literacy/know how initiatives. The results reveal:

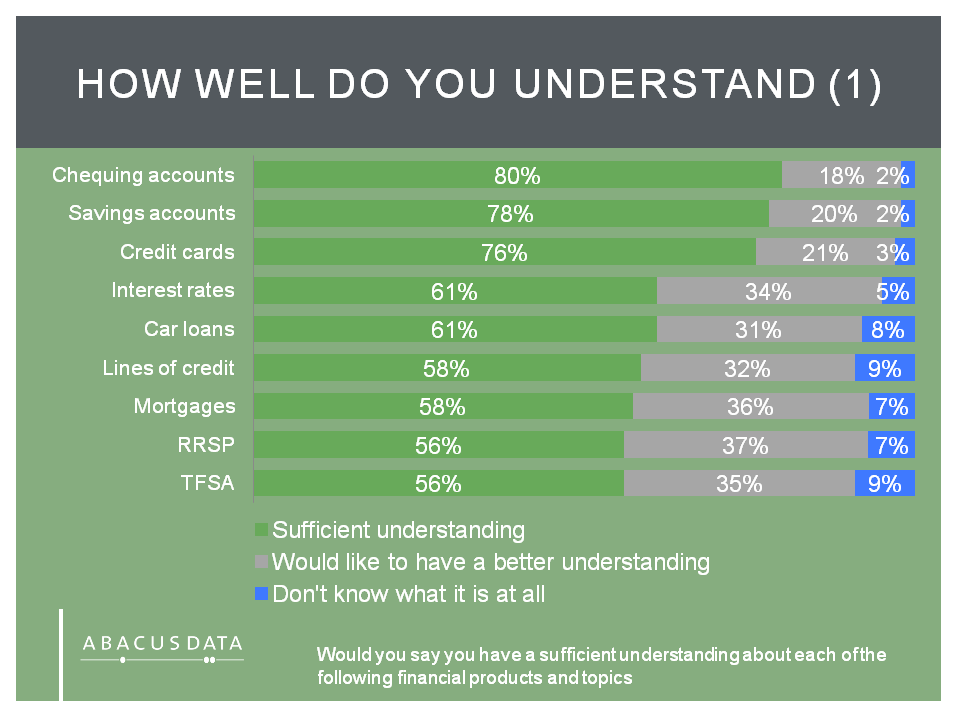

• The large majority of people say they are knowledgeable enough about chequing accounts, savings accounts and credit cards. Roughly 20% say they could stand to know more about these common financial products.

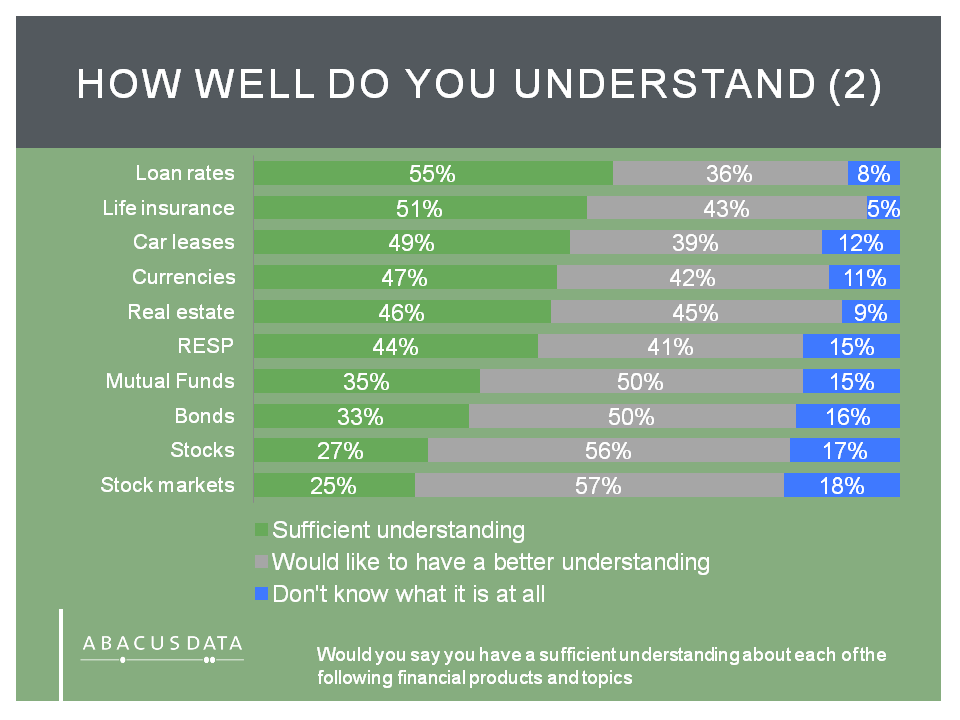

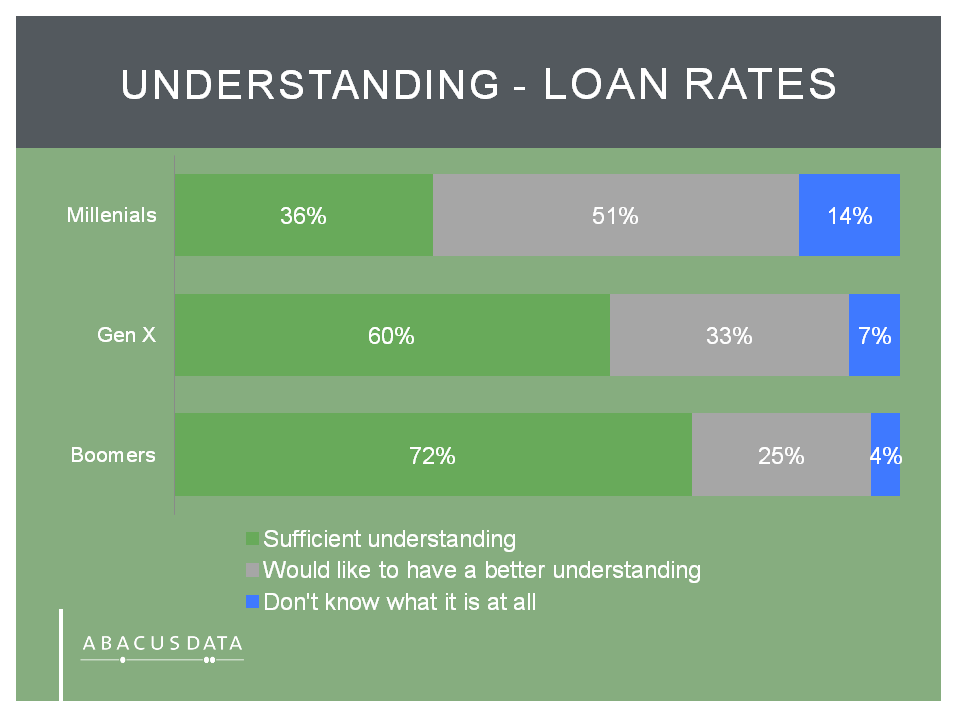

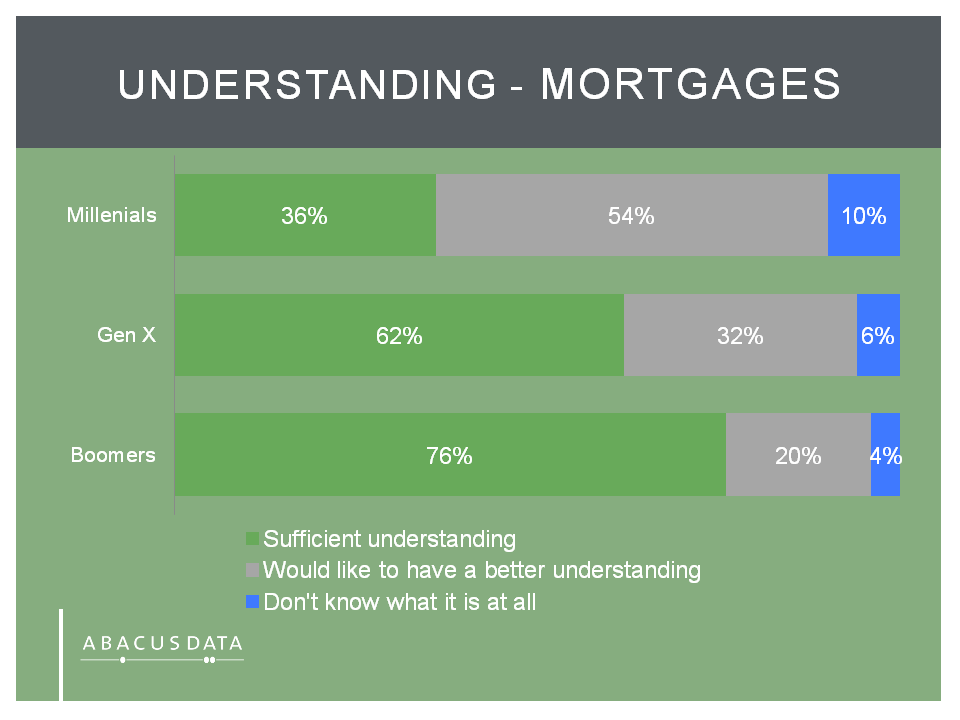

• Between 40% and 50% indicate they could usefully know more about a wide range of financial topics from interest rates, lines of credit, mortgages, RRSPs, TFSAs and many others.

• Finally, when it comes to mutual funds, bonds, stocks, and stock markets, upwards of two thirds indicate that they have a need to know more.

Are Generations Different?

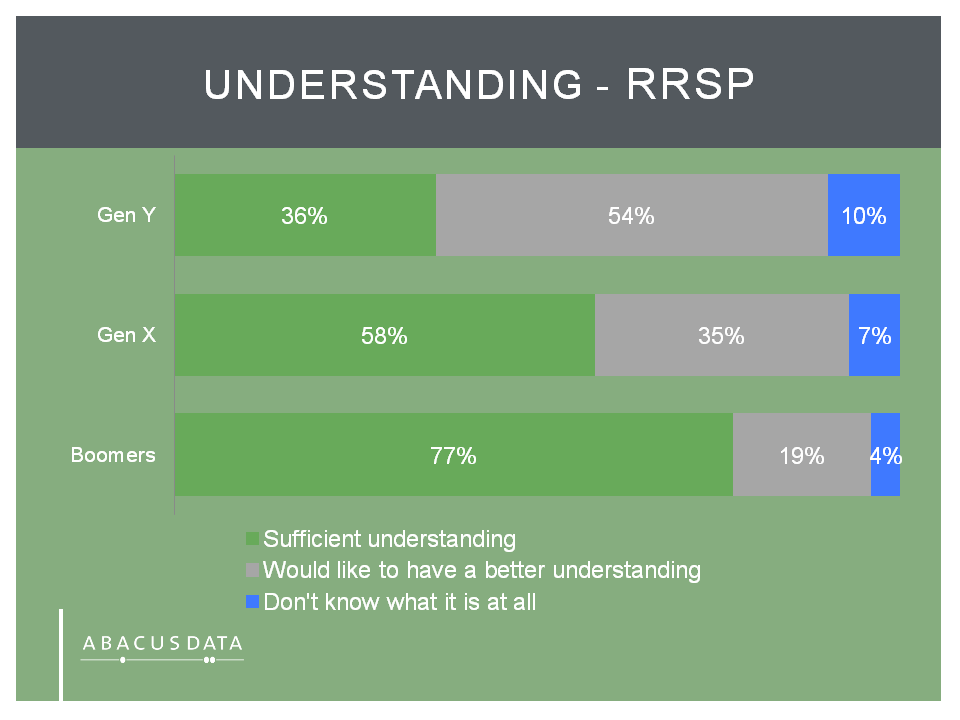

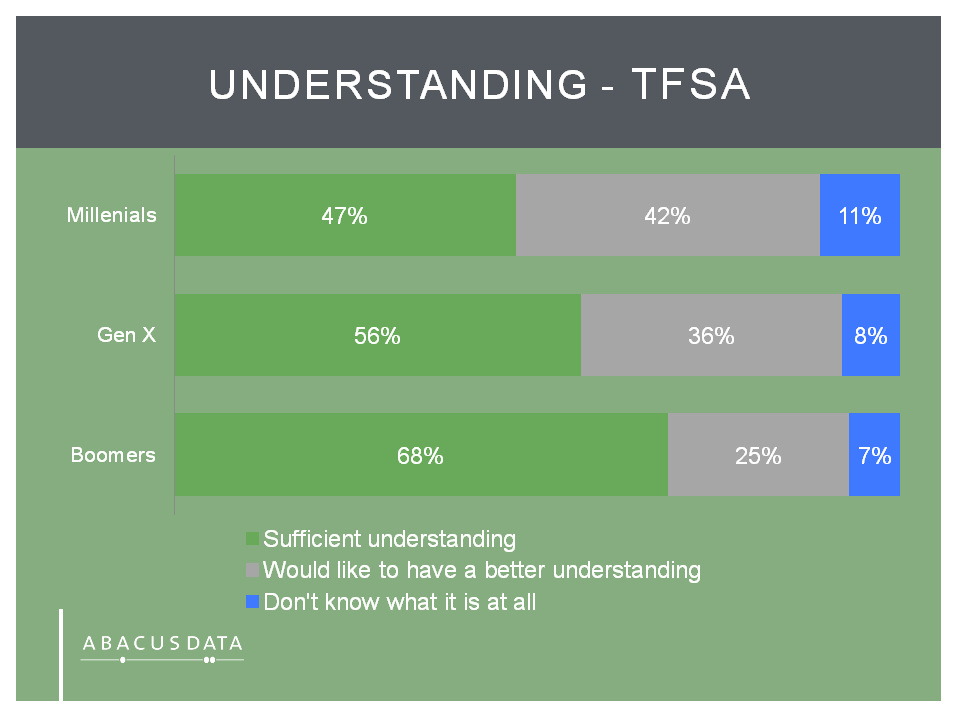

An analysis of responses by generations shows that there are substantial differences in levels of confidence and knowledge about these topics. Millennials and Gen X respondents are far more likely than Baby Boomers to say they could stand to know more about the most common products like savings accounts as well as loans and other savings products such as TFSAs or RRSPs.

The results show that most people feel that they have some knowledge about financial management but that there are areas where they could stand to learn more, in order to achieve their financial aspirations. The level of know how varies significantly by generation, with younger people indicating that there are more gaps in their knowledge than they would like.

It’s also clear in the data that there is a segment of society (roughly 20%) which feels that it lacks sufficient know how about even the most common financial matters such savings and chequing accounts.

Methodology

The survey, commissioned by the Canadian Bankers Association, was conducted online with 1,978 Canadians aged 18 to 70 from April 10 to 21, 2015.A random sample of panelists was invited to complete the survey from a large representative panel of over 500,000 Canadians, recruited and managed by Research Now, one of the world’s leading provider of online research samples.

The Marketing Research and Intelligence Association policy limits statements about margins of sampling error for most online surveys. The margin of error for a comparable probability-based random sample of the same size is +/- 2.2%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.

Abacus Data Inc.

We offer global research capacity with a strong focus on customer service, attention to detail and value added insight. Our team combines the experience of our Chairman Bruce Anderson, one of Canada’s leading research executives for two decades, with the energy, creativity and research expertise of CEO David Coletto, PhD.