Canadian Perspectives on Pharmacare

September 13, 2018

AFFORDABILITY OF MEDICINE AND GROUP/PRIVATE INSURANCE PLANS

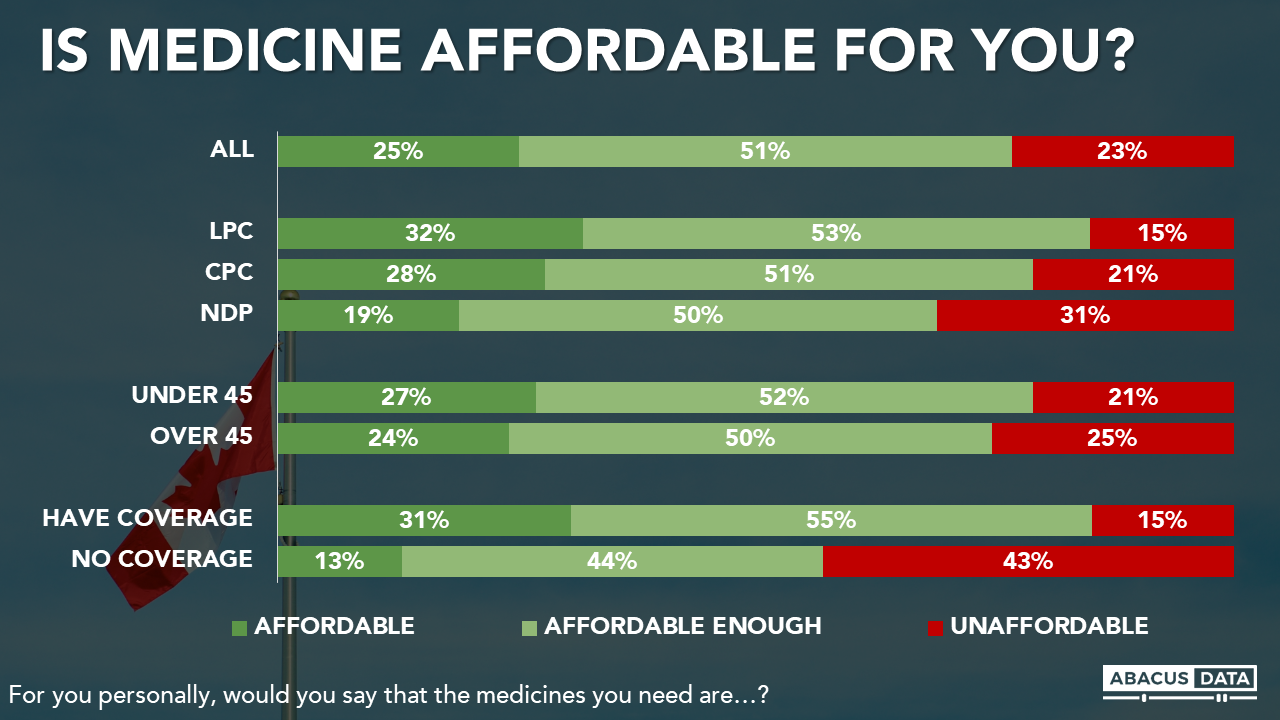

Today, 77% say that the medicines they need are affordable or “affordable enough” while 23% say they are unaffordable. Those who do not have private or group health insurance coverage are about three times more likely to say the medicines they need are unaffordable.

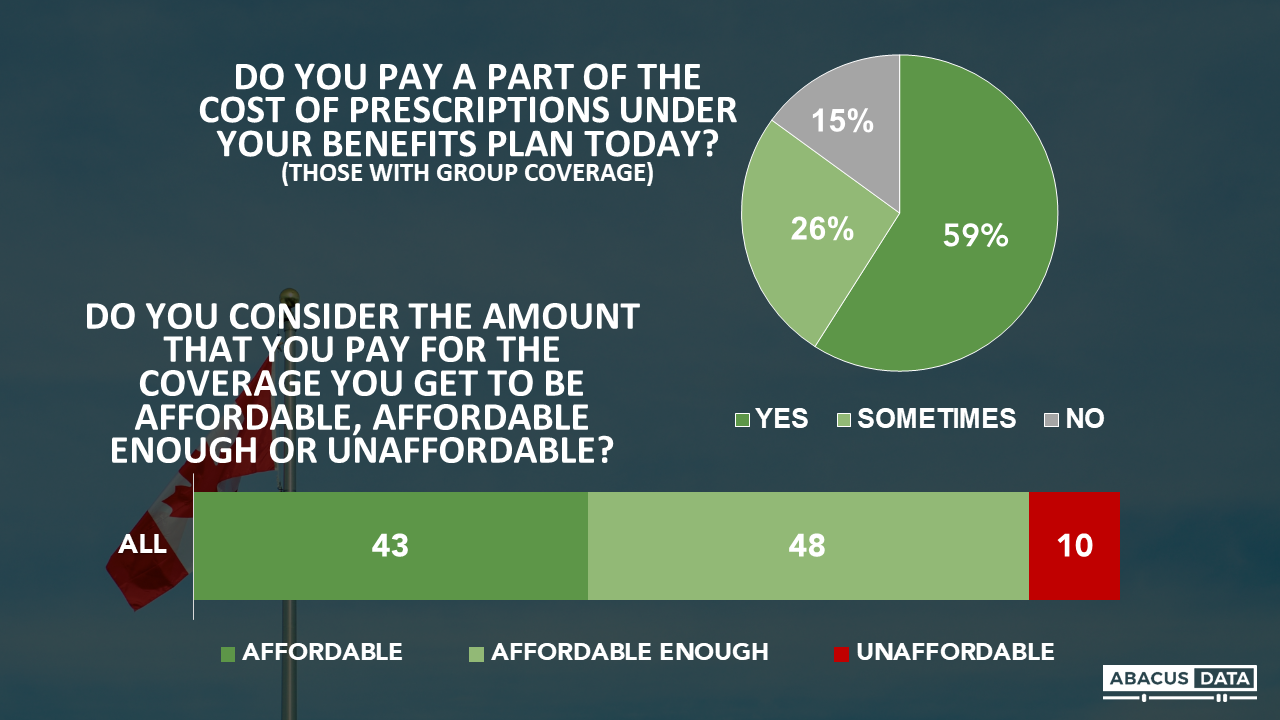

In our survey, 70% have some form of private or group health insurance that provides coverage over and above the health services provided to all Canadians.

Among this group, 85% have a co-pay requirement when they are filling a prescription, all or some of the time. Those who have a co-pay requirement are almost unanimously of the view that the co-pay amount is affordable or affordable enough.

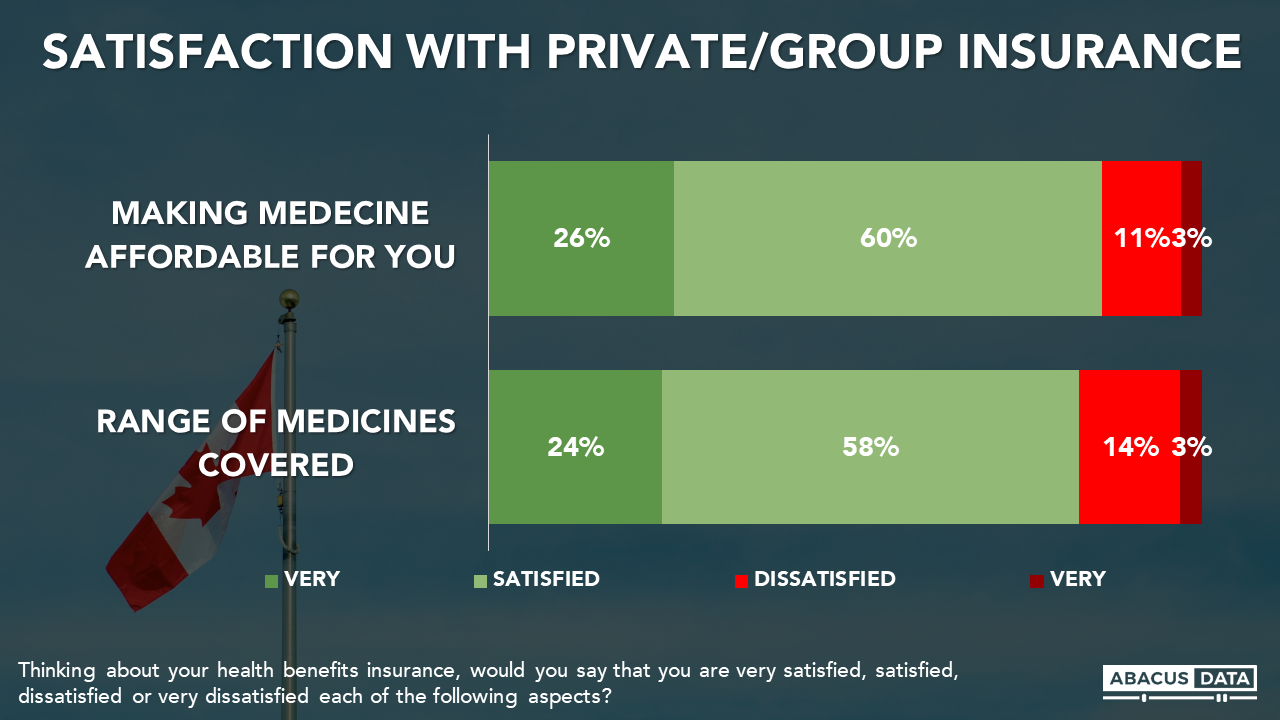

The large majority of those with private/group health insurance are satisfied with the role their plan plays in making medicine affordable and in terms of the range of medicines covered.

SUPPORT FOR FEDERAL TASK FORCE

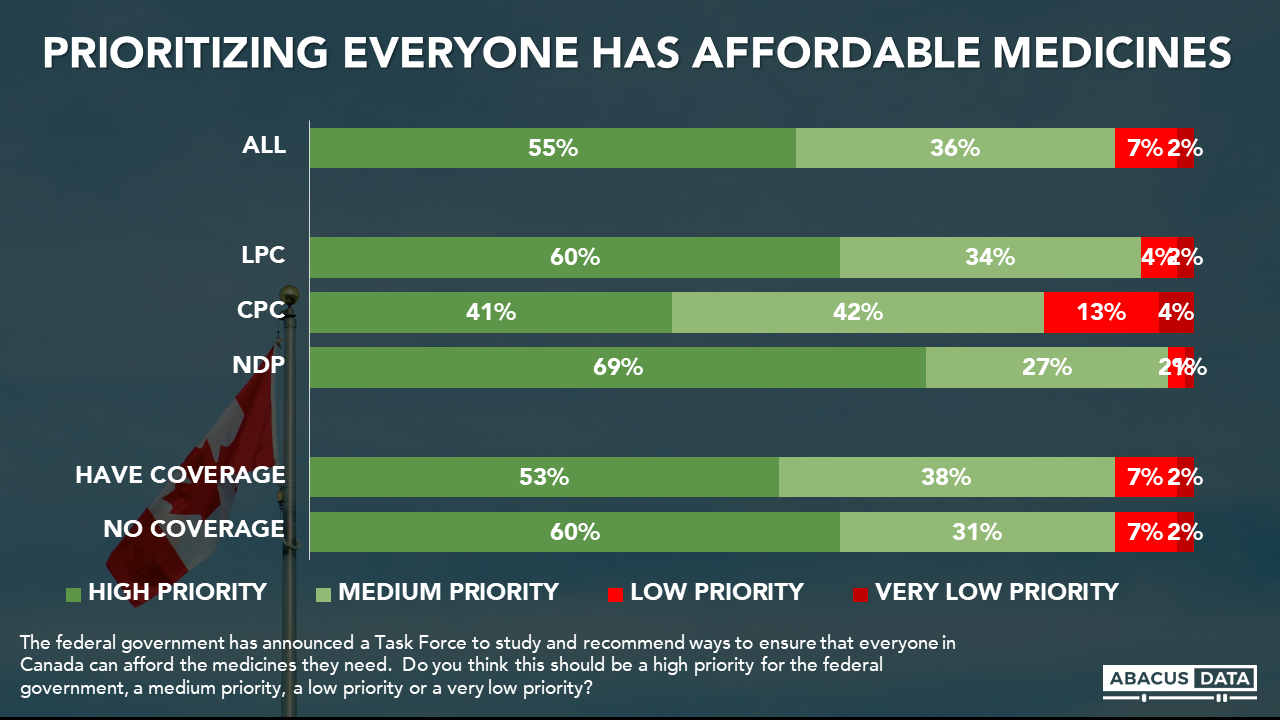

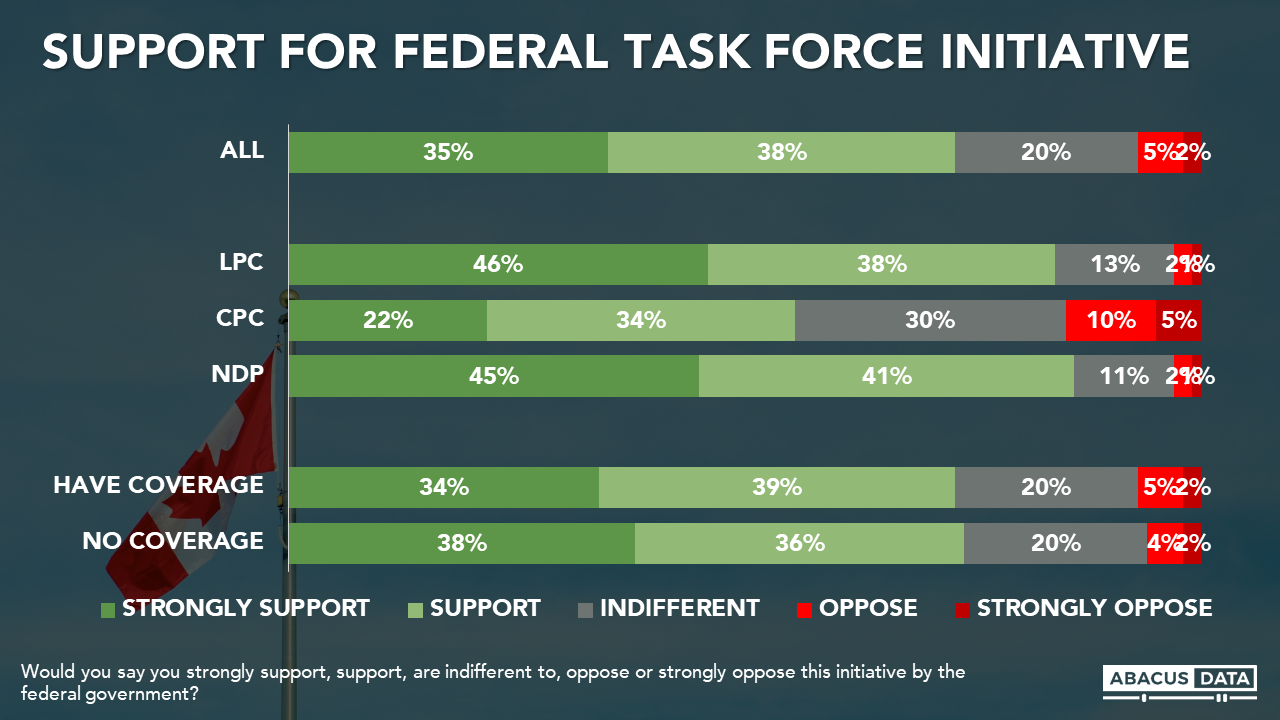

Most Canadians (55%) believe that the work of the Task Force appointed to find ways to “ensure that everyone in Canada can afford the medicines they need” should be a high priority, and 10 people support the idea of the Task Force for every 1 who is opposed.

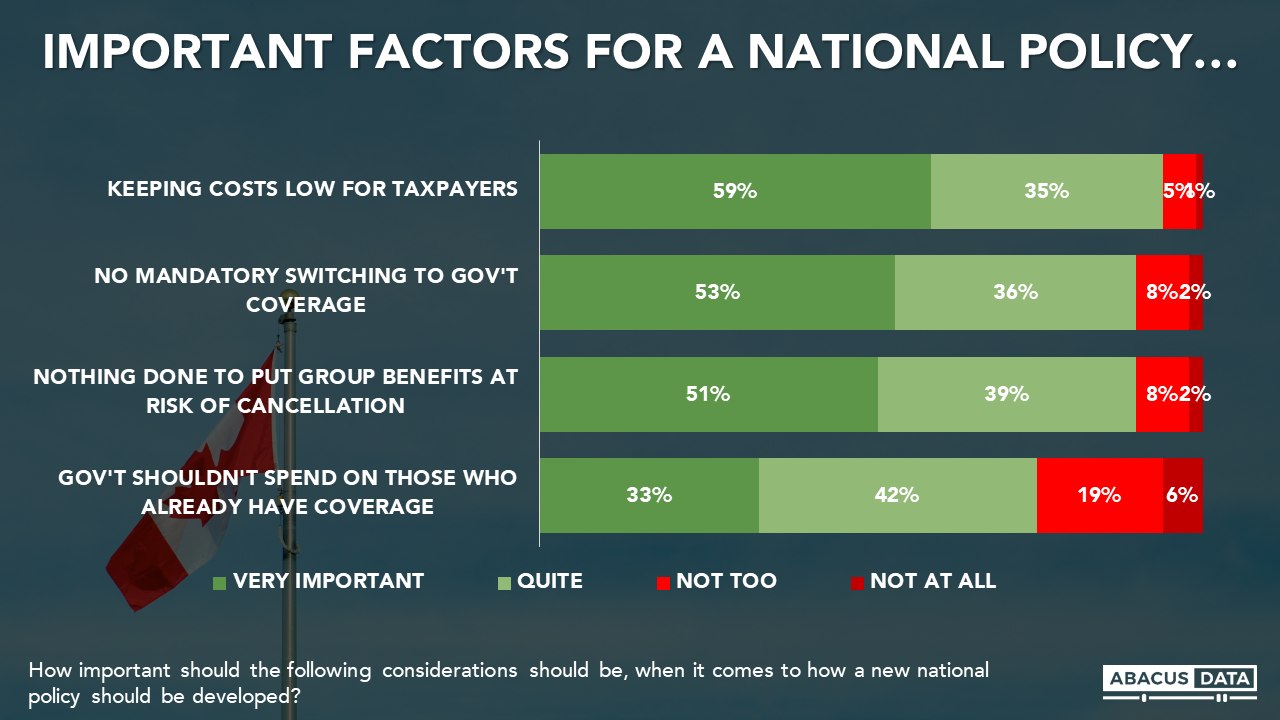

When considering the outcomes from the work of the Task Force and any government initiatives to flow from it, Canadians are broadly hoping that costs for taxpayers will be contained, that no one will be required to switch from their insurance plan to a government plan, that nothing should be done to put group benefits at risk of cancellation by employers. Seventy-five percent believe it is quite or very important that “government shouldn’t spend on those who already have prescription drug coverage.”

CONCLUSIONS

A broad majority of Canadians support the government’s decision to examine ways to help make medicines affordable for all Canadians. The majority of those who currently have private or group health insurance say that they find medicine affordable enough today – which explains why they would expect government to focus on those who lack such coverage.

At this juncture, those with health benefits insurance do not appear to be looking for government to provide them with more support and hope that government will not do anything to put their benefits at risk, or cost more in tax dollars than needed.

METHODOLOGY

On behalf of the Canadian Life and Health Insurance Association, Abacus Data conducted a nationwide online public opinion study among 2000 adult Canadians from July 18 to 22, 2018.

A random sample of panelists was invited to complete the survey from randomly selected Canadian adults who are members of the Maru Voice Canada online panel.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.2%, 19 times out of 20. The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, educational attainment, and region. Totals may not add up to 100 due to rounding.